Boeing 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

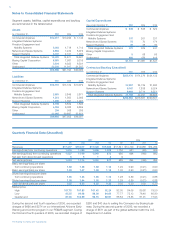

Notes to Consolidated Financial Statements

While our principal operations are in the United States,

Canada, and Australia, some key suppliers and subcontractors

are located in Europe and Japan. Revenues by geographic

area consisted of the following:

Years ended December 31, 2007 2006 2005

Asia, other than China $11,104 $÷8,672 $÷5,077

China 2,853 2,659 3,154

Europe 6,296 5,445 3,312

Middle East 1,891 1,991 477

Oceania 1,057 1,206 1,283

Africa 751 967 961

Canada 1,653 660 748

Latin America, Caribbean and other 1,446 1,431 629

27,051 23,031 15,641

United States 39,336 38,499 37,980

Total revenues $66,387 $61,530 $53,621

Commercial Airplanes segment revenues were approximately

79%, 73% and 76% of total revenues in Europe and approxi-

mately 87%, 80% and 80% of total revenues in Asia, excluding

China, for 2007, 2006 and 2005, respectively. IDS revenues

were approximately 16%, 22% and 20% of total revenues in

Europe and approximately 12%, 20% and 19% of total rev-

enues in Asia, excluding China, for 2007, 2006 and 2005

respectively. IDS revenues from the U.S. government repre-

sented 42%, 46% and 51% of consolidated revenues for

2007, 2006 and 2005. Approximately 13% of operating assets

are located outside the United States.

The information in the following tables is derived directly from

the segments’ internal financial reporting used for corporate

management purposes.

Research and Development Expense

Years ended December 31, 2007 2006 2005

Commercial Airplanes $2,962 $2,390 $1,302

Integrated Defense Systems:

Precision Engagement and

Mobility Systems 447 392 432

Network and Space Systems 300 301 334

Support Systems 104 98 89

Total Integrated Defense Systems* 851 791 855

Other 37 76 48

$3,850 $3,257 $2,205

*Includes bid and proposal costs of $306, $227, and $210, respectively.

Depreciation and Amortization

Years ended December 31, 2007 2006 2005

Commercial Airplanes $÷«318 $÷«263 $÷«396

Integrated Defense Systems:

Precision Engagement and

Mobility Systems 126 141 161

Network and Space Systems 176 231 283

Support Systems 60 38 24

Total Integrated Defense Systems 362 410 468

Boeing Capital Corporation 222 247 257

Other 32 60 40

Unallocated 551 579 365

$1,485 $1,559 $1,526

We recorded earnings from operations associated with our

equity method investments of $100, $50, and $0 in our

Commercial Airplanes segment and $87, $96, and $88 prima-

rily in our N&SS segment for the years ended December 31,

2007, 2006 and 2005, respectively.

For segment reporting purposes, we record Commercial

Airplanes segment revenues and cost of sales for airplanes

transferred to other segments. Such transfers may include air-

planes accounted for as operating leases and considered

transferred to the BCC segment and airplanes transferred to

the IDS segment for further modification prior to delivery to the

customer. The revenues and cost of sales for these transfers

are eliminated in the Accounting differences/eliminations cap-

tion. In the event an airplane accounted for as an operating

lease is subsequently sold, the ‘Accounting differences/elimina-

tions’ caption would reflect the recognition of revenue and cost

of sales on the consolidated financial statements. For segment

reporting purposes, we record IDS revenues and cost of sales

for the modification performed on airplanes received from

Commercial Airplanes when the airplane is delivered to the

customer or at the attainment of performance milestones.

Intersegment revenues, eliminated in Accounting

differences/eliminations are shown in the following table.

Years ended December 31, 2007 2006 2005

Commercial Airplanes $390 $826 $640

Boeing Capital Corporation 103 131 57

Other 2 5 3

Total $495 $962 $700

Unallocated Expense

Unallocated expense includes costs not attributable to busi-

ness segments. Unallocated expense also includes the impact

of cost measurement differences between generally accepted

accounting principles in the United States of America and fed-

eral cost accounting standards as well as intercompany profit

eliminations. The most significant items not allocated to seg-

ments are shown in the following table.

Years ended December 31, 2007 2006 2005

Share-based plans $«««(233) $«««(680) $«««(999)

Deferred compensation (51) (211) (186)

Pension (561) (369) (846)

Post-retirement (125) (103) (5)

Capitalized interest (53) (48) (47)

Other (162) (322) (324)

Total $(1,185) $(1,733) $(2,407)

Unallocated assets primarily consist of cash and investments,

prepaid pension expense, net deferred tax assets, capitalized

interest and assets held by our Shared Services Group as well

as intercompany eliminations. Unallocated liabilities include var-

ious accrued employee compensation and benefit liabilities,

including accrued retiree health care, net deferred tax liabilities

and income taxes payable. Debentures and notes payable are

not allocated to other business segments except for the por-

tion related to BCC. Unallocated capital expenditures relate pri-

marily to Shared Services Group assets and segment assets

managed by Shared Services Group, primarily IDS.

The Boeing Company and Subsidiaries