Boeing 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

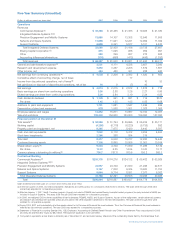

Management’s Discussion and Analysis

Revenues PE&MS revenues decreased 3% in 2007 compared

with an increase of 6% in 2006. The decrease of $422 million

in 2007 was due to reduced deliveries of the Apache and T-45

aircraft and Joint Direct Attack Munitions, partially offset by

higher deliveries of Chinook and F-18 aircraft and higher vol-

ume on the P-8A program. The revenue growth of $799 million

in 2006 was driven by higher deliveries of F-15 and Apache

aircraft and higher volume on P-8A, F-22, and Chinook, partially

offset by reduced revenues on AEW&C.

Deliveries of new-build production aircraft, excluding remanu-

factures and modifications, were as follows:

2007 2006 2005

F/A-18 Models 44 42 42

T-45TS Goshawk 9 13 10

F-15E Eagle 12 12 6

C-17 Globemaster 16 16 16

CH-47 Chinook 10 2

AH-64 Apache 17 31 12

C-40A Clipper 3 1 2

Total New-Build Production Aircraft 111 117 88

Operating Earnings PE&MS operating earnings increased by

$421 million in 2007 primarily due to the 2006 charges of

$770 million on the AEW&C development program, which were

partially offset by lower 2007 earnings due to revised cost

estimates on the international KC-767 Tanker program, lower

prices on the C-17 program and revised cost and revenue esti-

mates on the AEW&C program. Operating earnings decreased

by $512 million in 2006 due to the above mentioned AEW&C

charge, which was partially offset by earnings from revenue

growth, favorable contract mix, and reduced Company-

Sponsored Research & Development expenditures on the

767 Tanker program.

Research and Development The PE&MS segment continues to

focus its research and development resources where it can

use its customer knowledge, technical strength and large-scale

integration capabilities to provide innovative solutions to meet

the war fighter’s enduring needs. Research and development

has remained consistent over the past several years. Research

and development activities leverage our capabilities in architec-

tures, system-of-systems integration and weapon systems

technologies to develop solutions which are designed to

enhance our customers’ capabilities in the areas of mobility,

precision effects, situational awareness and survivability. These

efforts focus on increasing mission effectiveness and interoper-

ability, and improving affordability, reliability and economic own-

ership. Continued research and development investments in

unmanned technology and systems have enabled the demon-

stration of multi-vehicle coordinated flight and distributed con-

trol of high-performance unmanned combat air vehicles.

Research and development in advanced weapons technolo-

gies emphasizes, among other things, precision guidance and

multi-mode targeting. Research and development investments

in the Global Tanker Aircraft program represent a significant

opportunity to provide state-of-the-art refueling capabilities to

domestic and non-U.S. customers. Investments were also

made to support various intelligence, surveillance, and recon-

naissance business opportunities including P-8A and AEW&C

aircraft. Other research and development efforts include

upgrade and technology insertions to network-enable and

enhance the capability and competitiveness of current product

lines such as the F/A-18E/F Super Hornet, F-15E Eagle, AH-

64 Apache, CH-47 Chinook and C-17 Globemaster.

Backlog PE&MS total backlog decreased by 6% in 2007 com-

pared with 2006 primarily due to deliveries and sales on C-17,

F/A-18, P-8A and F-15. These decreases were partially offset

by a multi-year contract for F-22 aircraft and international

orders for AEW&C and F/A-18 aircraft. Total backlog

decreased by 8% in 2006 compared with 2005 primarily due

to deliveries and sales on F/A-18 and F-15 from multi-year

contracts awarded in prior years.

Additional Considerations Items which could have a future

impact on PE&MS operations include the following:

AEW&C

During 2006 we recorded charges of $770 million on

our international Airborne Early Warning & Control program.

This development program, also known as Wedgetail in

Australia and Peace Eagle in Turkey, consists of a 737-700 air-

craft outfitted with a variety of command and control and

advanced radar systems, some of which have never been

installed on an airplane before. Wedgetail includes six aircraft

and Peace Eagle includes four aircraft. This is an advanced

and complex fixed-price development program involving tech-

nical challenges at the individual subsystem level and in the

overall integration of these subsystems into a reliable and

effective operational capability. We believe that the cost esti-

mates incorporated in the financial statements are appropriate;

however, the technical complexity of the programs creates

financial risk as additional completion costs may be necessary

or scheduled delivery dates could be missed.

International KC-767 Tanker Program

During 2007, the PE&MS

segment recorded charges of $152 million which were partially

offset at the consolidated level. Currently the international KC-

767 Tanker program includes four aircraft for the Italian Air

Force and four aircraft for the Japanese Air Self Defense Force.

These charges are associated with additional estimated costs

for mitigating both the risks on the flight test program and the

delivery risk associated with the Italy and Japan contracts.

These programs are ongoing, and while we believe the cost

estimates incorporated in the financial statements are appropri-

ate, the technical complexity of the programs creates financial

risk as additional completion and development costs may be

necessary or scheduled delivery dates could be missed.

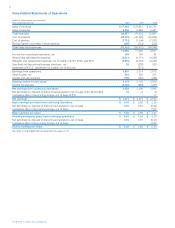

C-17

As of December 31, 2007 we delivered 171 of the 190

C-17 aircraft ordered by the U.S. Air Force, with final deliveries

scheduled for 2009. In June 2007, based upon continued

bipartisan congressional support, including the House Armed

Services Committee addition of $2.4 billion for 10 C-17s in

their mark of the 2008 budget, and U.S. Air Force testimony to

Congress reflecting interest in additional C-17 aircraft, we

directed key suppliers to begin work on 10 aircraft beyond the

190 currently on order. As of December 31, 2007, inventory

expenditures and potential termination liabilities to suppliers for

work performed related to anticipated orders for 10 C-17 air-

craft to the U.S. Air Force and anticipated international orders

The Boeing Company and Subsidiaries