Boeing 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

Management’s Discussion and Analysis

support costs, engineering services and technical data and

documents. The costs for fleet support are expensed as

incurred and have been historically less than 1.5% of total con-

solidated costs of products and services. This level of expendi-

tures is anticipated to continue in the upcoming years. These

costs do not vary significantly with current production rates.

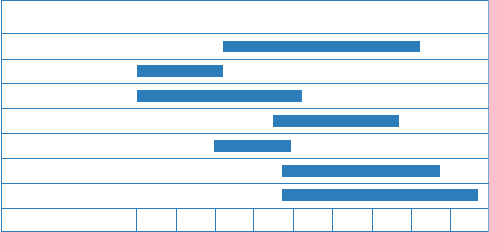

Research and Development The following chart summarizes the

time horizon between go-ahead and certification/initial delivery

for major Commercial Airplanes derivatives and programs.

787-8

777-300ER

777-200LR

777-F

747-400BCF

747-8 Freighter

747-8 Intercontinental

Go-ahead and Certification/Delivery

02 03 04 05 06 07 08 09 10

Our Research and development expense increased $572 mil-

lion and $1,088 million in 2007 and 2006. Research and devel-

opment expense is net of development cost sharing payments

received from suppliers. The increase in 2007 was due to high-

er spending of $542 million, primarily on 787 and 747-8, and

$30 million of lower supplier development cost sharing pay-

ments. We anticipate a decrease in research and development

spending for 2008 primarily due to reduced 787 product devel-

opment activities.

Integrated Defense Systems

Business Environment and Trends

IDS consists of three capabilities-driven businesses: Precision

Engagement and Mobility Systems (PE&MS), Network and

Space Systems (N&SS), and Support Systems.

Defense Environment Overview The U.S. is faced with con-

tinuous force deployments overseas, stability operations in

Afghanistan and Iraq, and uncertainties about near-peer

adversary states with growing sophistication and military

means. At the same time, our defense department faces the

simultaneous requirements to recapitalize important defense

capabilities and to transform the force to take advantage of

available technologies to meet the changing national security

environment as outlined in the latest Quadrennial Defense

Review (QDR). All of this must be carried out against a back-

drop of significant Federal budget deficits and bipartisan

objectives to reduce and ultimately eliminate annual deficit

spending as well as the upcoming 2008 Presidential elections.

We anticipate that the national security environment will

remain challenging for at least the next decade.

Because U.S. DoD spending was about half of worldwide

defense spending and represented approximately 84% of IDS

revenue in 2007, the trends and drivers associated with the

U.S. DoD budget are critical. The U.S. DoD budget has grown

substantially over the past decade, particularly after the terror-

ist attacks of September 11, 2001. Although the growth rate

had moderated in recent years, the 2009 submittal equates to

a 7.5% increase over 2008. The President’s request for fiscal

year 2009 is $515 billion, excluding the additional initial request

of $70 billion to continue the fight in the Global War on Terror

(GWOT). The Procurement account continues to see growth

with a request of $104 billion, a 5% increase over 2008, while

the Research, Development, Test & Evaluation account

increased modestly to $80 billion, a 4% increase from the

2008 level. (All projections and percentage increases are made

without taking inflation into account and without accounting for

Supplemental funding.)

Over the past years, emergency supplemental requests

have been used to cover the on-going costs of the GWOT. In

addition to the fiscal year 2008 discretionary budget request,

the President also submitted supplemental requests totaling

$189 billion to cover operations in the GWOT. It is anticipated

that additional supplemental requests for 2009 will exceed

$100 billion, including the $70 billion initially requested, and

that the trend to use supplemental requests to fund the GWOT

will continue.

Even though we continue to see modest growth in the U.S.

DoD budget, it is unlikely that the U.S. DoD will be able to fully

fund the hardware programs already in development as well as

new initiatives in order to address the capability gaps identified

in the latest QDR. This imbalance between future costs of

hardware programs and expected funding levels is not uncom-

mon in the U.S. DoD and is routinely managed by internally

adjusting priorities and schedules, restructuring programs, and

lengthening production runs to meet the constraints of avail-

able funding and occasionally by cancellation of programs. We

expect the U.S. DoD will respond to future budget constraints

by focusing on affordability strategies that emphasize jointness

and network-enabled operations. These strategies will be

enabled through persistent intelligence, surveillance, and

reconnaissance, long-range strike, special operations, un-

manned systems, precision guided kinetic and non-kinetic

weapons as well as continued privatization of logistics and

support activities to improve overall effectiveness while main-

taining control over costs.

Consolidation of contractor-provided U.S. government launch

capabilities was completed with the formation of the ULA joint

venture in 2006. This consolidation was driven by the limited

schedule of government launches as well as the downturn in

the commercial launch market. Launch contractors had built

business cases around the government market being supple-

mented by a robust commercial market, but as the commercial

market declined these business cases were re-evaluated. The

U.S. government has an assured access to space policy which

requires that two separate vehicles be available for use. The

ULA joint venture is intended to provide this assurance.

Civil Space Transportation and Exploration Environment

NASA has had stable but very little growth in their funding

in this decade. NASA’s fiscal year 2007 appropriation of

$16.6 billion was approximately equal to the fiscal year 2006

funding level. NASA’s budget remains focused on needed

funds for Space Shuttle Operations, International Space

Station, and new initiatives associated with the Vision for

Space Exploration. We anticipate funding levels to remain in

The Boeing Company and Subsidiaries