Boeing 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

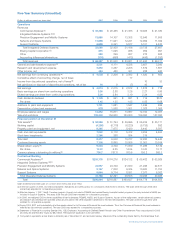

Management’s Discussion and Analysis

Backlog

Contractual backlog of unfilled orders excludes purchase

options, announced orders for which definitive contracts have

not been executed, and unobligated U.S. and non-U.S. gov-

ernment contract funding. Contractual backlog increased by

$80,397 million in 2007 compared to 2006 as a result of

increases at Commercial Airplanes of $80,900 million, which

were due to new orders in excess of deliveries for all programs

offset by decreases at IDS of $503 million.

Unobligated backlog includes U.S. and non-U.S. government

definitive contracts for which funding has not been authorized.

Funding that is subsequently received is moved to contractual

backlog. The decrease in IDS unobligated backlog of $3,502

million during 2007 compared with 2006 is primarily due to

funding released from existing contracts on Future Combat

Systems (FCS), Proprietary, C-17, P-8A and F-18, partially off-

set by increases in the F-22 program and Support Systems.

Segment Results of Operations and Financial Condition

Commercial Airplanes

Business Environment and Trends

Airline Industry Environment The fundamental drivers of air

travel growth are a combination of economic growth and the

increasing propensity to travel due to increased trade, global-

ization and improved airline services driven by liberalization of

air traffic rights between countries. Air traffic growth continues

to exceed its long-term trend due to strong performance of

these key drivers. Global economic growth, the primary driver

of air traffic growth, remained above long-term trend for the

fourth straight year in 2007. The world economy has grown at

an average 3.8% annual rate since 2004 compared to the

long-term trend rate of 3.1%. The increasingly diversified world

economy is forecast to continue above-trend growth through

the end of the decade although there is increased uncertainty

in the near-term outlook due to a slowdown in the United

States economy.

Increasingly liberalized and competitive air travel markets are

also supporting strong traffic growth. Many bilateral air service

agreements governing air traffic rights between countries are

liberalizing air travel around the world particularly in high

growth markets such as China and India which have signed

multiple new agreements over the last several years. In addi-

tion, open skies agreements, in which all traffic rights restric-

tions are eliminated, continue to emerge with United States—

European Union open skies negotiations being the most

prominent recent example. Airline ownership is also becoming

more commercially driven— governments are reducing owner-

ship and control stakes, moving away from national carriers.

All of these facets of liberalization are increasing competition

between airlines and further stimulating demand for air travel.

In this increasingly liberalized environment, airlines are offering

improved service levels increasing flight frequency and airport

pairs served by 5% per year since 2004.

The combination of these two fundamental drivers has led to

a 9% annual average increase in the number of passengers

since 2003. In addition, high fuel prices are spurring strong

demand to replace older, less fuel efficient airplanes. Together,

these two factors have led to strong demand for new aircraft—

over 7,000 orders for large commercial jet aircraft over the last

four years, increasing industry backlog levels to seven years of

deliveries at current production rates.

Fuel prices are also playing a key role in increasing the current

demand for new aircraft. Strong economic growth has also led

to sustained high oil and fuel prices. Between 2003 and 2007,

jet fuel expense grew from 15 percent to more than 30 percent

of airline operating costs. Airlines are responding by improving

the fuel efficiency of their aircraft operations and reducing cost

in many other areas. They are implementing more efficient

(internet based) distribution systems, reducing commission

payments, and drawing on their employees for participation in

labor cost reduction. These initiatives, combined with strong

demand, are enabling industry-wide profitability despite high

fuel prices. Worldwide airlines achieved a $5.6 billion net profit

in 2007 and are forecast to earn $5.0 billion in 2008.

Looking forward, our 20-year forecast is for a long-term aver-

age growth rate of 5% per year for passenger traffic, and 6%

per year for cargo traffic based on projected average annual

worldwide real economic growth rate of 3%. Based on long-

term global economic growth projections, and factoring in

increased utilization of the worldwide airplane fleet and require-

ments to replace older airplanes, we project a $2.8 trillion mar-

ket for 28,600 new airplanes over the next 20 years.

The industry remains vulnerable to near-term exogenous devel-

opments including disease outbreaks (such as avian flu), terror-

ism, global economic cycles, increased global environmental

regulations and fuel prices. Fuel prices are forecast to remain

elevated and volatile in the near-term due to strong demand

driven by economic growth and historically low surplus capacity

to cushion against supply shocks.

Industry Competitiveness The commercial jet aircraft market

and the airline industry remain extremely competitive. We

expect the existing long-term downward trend in passenger

revenue yields worldwide (measured in real terms) to continue

into the foreseeable future. Market liberalization in Europe and

Asia has continued to enable low-cost airlines to gain market

share. These airlines have increased the downward pressure

on airfares. This results in continued cost pressures for all air-

lines and price pressure on our products. Major productivity

gains are essential to ensure a favorable market position at

acceptable profit margins.

Continued access to global markets remains vital to our ability

to fully realize our sales potential and long-term investment

returns. Approximately two-thirds of Commercial Airplanes’

sales and contractual backlog are directly from customers

based outside the United States.

We face aggressive international competitors who are intent on

increasing their market share. They offer competitive products

and have access to most of the same customers and suppli-

ers. Airbus has historically invested heavily to create a family of

products to compete with ours. Regional jet makers Embraer

and Bombardier, coming from the less than 100-seat commer-

cial jet market, continue to develop larger and more capable

The Boeing Company and Subsidiaries