Boeing 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

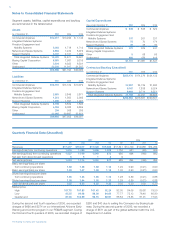

Notes to Consolidated Financial Statements

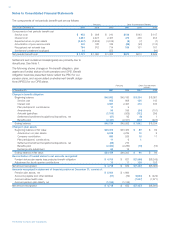

Note 20 – Disclosures About Fair Value

of Financial Instruments

The carrying values and estimated fair values of our financial

instruments were as follows at December 31:

2007 2006

Carrying Fair Carrying Fair

Amount Value Amount Value

Accounts receivable $5,740 $5,629 $5,285 $4,876

Accounts payable 5,714 5,714 5,643 5,356

Debt, excluding capital

lease obligations 8,129 8,865 9,395 10,297

Notes receivable 885 937 1,823 1,823

Residual value and

credit guarantees 207 72 210 113

Contingent repurchase

commitments 7 46 7 91

The fair values of the Accounts receivable and Accounts

payable is based on current market rates for loans of the same

risk and maturities. The fair value of our debt is based on

current market rates for debt of the same risk and maturities.

The estimated fair value of our Other liabilities balance at

December 31, 2007 and 2006 approximates its carrying value.

Items not included in the above disclosures are cash, cash

equivalents and investments. The estimated fair value of those

items approximate their carrying value at December 31, 2007

and 2006 as reflected in Note 10. The estimated fair value of

our Investments at December 31, 2007 and 2006 approximate

the carrying value. With regard to financial instruments with

off-balance sheet risk, it is not practicable to estimate the fair

value of future financing commitments because there is not a

market for such future commitments.

Note 21 – Legal Proceedings

Various legal proceedings, claims and investigations related to

products, contracts and other matters are pending against us.

Many potentially significant legal proceedings are related to

matters covered by our insurance. Potential material contin-

gencies are discussed below.

We are subject to various U.S. government investigations,

from which civil, criminal or administrative proceedings could

result or have resulted. Such proceedings involve, or could

involve claims by the government for fines, penalties, com-

pensatory and treble damages, restitution and/or forfeitures.

Under government regulations, a company, or one or more

of its operating divisions or subdivisions, can also be suspend-

ed or debarred from government contracts, or lose its export

privileges, based on the results of investigations. We believe,

based upon current information, that the outcome of any

such government disputes and investigations will not have

a material adverse effect on our financial position, except as

set forth below.

A-12 Litigation

In 1991, the U.S. Navy notified McDonnell Douglas

Corporation (now one of our subsidiaries) and General

Dynamics Corporation (together, the Team) that it was termi-

nating for default the Team’s contract for development and

initial production of the A-12 aircraft. The Team filed a legal

action to contest the U.S. Navy’s default termination, to assert

its rights to convert the termination to one “for the convenience

of the government,” and to obtain payment for work done

and costs incurred on the A-12 contract but not paid to date.

As of December 31, 2007, inventories included approximately

$584 of recorded costs on the A-12 contract, against which

we have established a loss provision of $350. The amount

of the provision, which was established in 1990, was based

on McDonnell Douglas Corporation’s belief, supported by an

opinion of outside counsel, that the termination for default

would be converted to a termination for convenience, and

that the best estimate of possible loss on termination for

convenience was $350.

On August 31, 2001, the U.S. Court of Federal Claims issued

a decision after trial upholding the government’s default termi-

nation of the A-12 contract. In 2003, the Court of Appeals for

the Federal Circuit, finding that the trial court had applied the

wrong legal standard, vacated the trial court’s 2001 decision

and ordered the case sent back to that court for further pro-

ceedings. On May 3, 2007, the U.S. Court of Federal Claims

issued a decision upholding the government’s default termina-

tion of the A-12 contract. We believe that the ruling raises seri-

ous issues for appeal, and on May 4, 2007 we filed a Notice of

Appeal which we are now pursuing in the Court of Appeals for

the Federal Circuit. This follows an earlier trial court decision in

favor of the Team and reversal of that initial decision on appeal.

If, after all judicial proceedings have ended, the courts deter-

mine, contrary to our belief, that a termination for default was

appropriate, we would incur an additional loss of approximately

$275, consisting principally of remaining inventory costs and

adjustments, and, if the courts further hold that a money judg-

ment should be entered against the Team, we would be

required to pay the U.S. government one-half of the unliquidat-

ed progress payments of $1,350 plus statutory interest from

February 1991 (currently totaling approximately $1,350). In that

event, our loss would total approximately $1,621 in pre-tax

charges. Should, however, the March 31, 1998 judgment of

the U.S. Court of Federal Claims in favor of the Team be rein-

stated, we would be entitled to receive payment of approxi-

mately $1,087, including interest.

We believe that the termination for default is contrary to law

and fact and that the loss provision established by McDonnell

Douglas Corporation in 1990, which was supported by an

opinion from outside counsel, continues to provide adequately

for the reasonably possible reduction in value of A-12 net con-

tracts in process as of December 31, 2007. Final resolution of

the A-12 litigation will depend on the outcome of further pro-

ceedings or possible negotiations with the U.S. government.

Employment and Benefits Litigation

We are a defendant in two employment discrimination class

actions. In the Williams class action, which was filed on June

8, 1998 in the U.S. District Court for the Western District of

Washington (alleging race discrimination), we prevailed in a jury

trial in December 2005, but plaintiffs appealed the pre-trial dis-

missal of compensation claims in November 2005. In the

Calender class action, which was filed January 25, 2005 in the

The Boeing Company and Subsidiaries