Boeing 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Notes to Consolidated Financial Statements

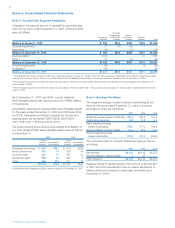

Note 11 – Accounts Payable and Other Liabilities

Accounts payable and other liabilities at December 31 consisted

of the following:

2007 2006

Accounts payable $÷5,714 $÷5,643

Accrued compensation and

employee benefit costs 4,996 4,852

Product warranties (a) 962 761

Environmental (b) 679 582

Forward loss recognition (c) 607 532

Other 3,718 3,831

$16,676 $16,201

(a) See Note 12.

(b) See Note 13.

(c) Forward loss recognition relates primarily to Airborne Early Warning & Control.

Payments associated with these liabilities may occur in periods

significantly beyond the next twelve months. Accounts payable

included $265 and $335 at December 31, 2007 and 2006,

attributable to checks written but not yet cleared by the bank.

Note 12 – Arrangements with Off-Balance Sheet Risk

We enter into arrangements with off-balance sheet risk in the

normal course of business, as discussed below. These

arrangements are primarily in the form of product warranties

and guarantees.

Product Warranties

We provide product warranties in conjunction with certain

product sales. The majority of our warranties are issued by our

Commercial Airplanes segment. Generally, aircraft sales are

accompanied by a three- to four-year standard warranty for

systems, accessories, equipment, parts, and software manu-

factured by us or manufactured to certain standards under our

authorization. These warranties are included in the programs’

estimate at completion (EAC). Additionally, on occasion we

have made commitments beyond the standard warranty obli-

gation to correct fleet wide major warranty issues of a parti-

cular model. These costs are expensed as incurred. These

warranties cover factors such as non-conformance to specifi-

cations and defects in material and design. Warranties issued

by our IDS segments principally relate to sales of military

aircraft and weapons hardware. These sales are generally

accompanied by a six to twelve-month warranty period and

cover systems, accessories, equipment, parts, and software

manufactured by us to certain contractual specifications.

These warranties cover factors such as non-conformance to

specifications and defects in material and workmanship.

Estimated costs related to standard warranties are recorded in

the period in which the related product sales occur. The war-

ranty liability recorded at each balance sheet date reflects the

estimated number of months of warranty coverage outstanding

for products delivered times the average of historical monthly

warranty payments, as well as additional amounts for certain

major warranty issues that exceed a normal claims level.

Estimated costs of these additional warranty issues are con-

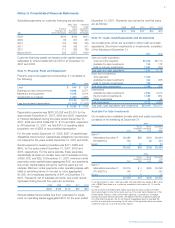

sidered changes to the initial liability estimate. The following

table summarizes product warranty activity recorded during

2007 and 2006.

Product Warranty

Liabilities*

Beginning balance – January 1, 2006 $781

Additions for 2006 deliveries 171

Reductions for payments made (206)

Changes in estimates 15

Ending balance – December 31, 2006 761

Additions for 2007 deliveries 186

Reductions for payments made (220)

Changes in estimates 235

Ending balance – December 31, 2007 $962

*Amounts included in Accounts payable and other liabilities

Third-Party Guarantees

The following tables provide quantitative data regarding our

third-party guarantees. The maximum potential payments rep-

resent a “worst-case scenario,” and do not necessarily reflect

our expected results. Estimated proceeds from collateral and

recourse represent the anticipated values of assets we could

liquidate or receive from other parties to offset our payments

under guarantees. The carrying amount of liabilities recorded

on the Consolidated Statements of Financial Position reflects

our best estimate of future payments we may incur as part of

fulfilling our guarantee obligations.

As of December 31, 2007

Maximum

Potential

Payments

Estimated

Proceeds

from

Collateral/

Recourse

Carrying

Amount of

Liabilities*

Contingent repurchase commitments $4,284 $4,275 $7

Indemnifications to ULA** 1,221 7

Residual value guarantees 103 96 16

Credit guarantees related to

the Sea Launch venture 457 274 183

Other credit guarantees 43 14 1

Performance guarantees 48 20

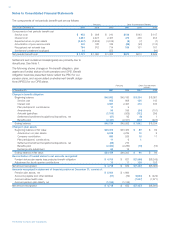

Estimated

Proceeds

Maximum from Carrying

Potential Collateral/ Amount of

As of December 31, 2006 Payments Recourse Liabilities*

Contingent repurchase commitments $4,164 $4,155 $7

Indemnifications to ULA** 1,664 7

Residual value guarantees 252 215 15

Credit guarantees related to

the Sea Launch venture 471 283 188

Other credit guarantees 31 17

Performance guarantees 47 20

*Amounts included in Accounts payable and other liabilities

**Amount includes indemnification payments related to contributed Delta launch

program inventory of $917 and $1,375 plus indemnification payments of $289

related to the pricing of certain contracts at December 31, 2007 and 2006, and

$15 related to miscellaneous Delta vendor contracts at December 31, 2007.

The Boeing Company and Subsidiaries