Boeing 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Notes to Consolidated Financial Statements

Basic earnings per share is calculated by the sum of (1) net

income less declared dividends divided by the basic weighted

average shares outstanding and (2) declared dividends divided

by the weighted average shares outstanding.

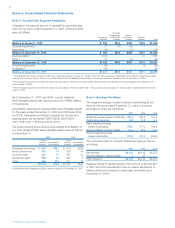

The weighted-average number of shares outstanding for the

year ended December 31 (in millions), included in the table

below, is excluded from the computation of diluted earnings

per share because the average market price did not exceed

the exercise/threshold price. However, these shares may be

dilutive potential common shares in the future.

2007 2006 2005

Stock options 0.2

Stock units 0.1

Performance Shares 0.7 4.0 24.9

Performance Awards 3.0 1.4

ShareValue Trust 25.8 24.6 33.9

Note 4 – Income Taxes

The components of earnings before income taxes were:

Years ended December 31, 2007 2006 2005

U.S. $5,901 $3,067 $2,605

Non-U.S. 217 127 214

$6,118 $3,194 $2,819

Income tax expense/(benefit) consisted of the following:

Years ended December 31, 2007 2006 2005

Current tax expense

U.S. federal $1,260 $193 $(276)

Non-U.S. 139 35 58

U.S. state 164 (58) (86)

1,563 170 (304)

Deferred tax expense

U.S. federal 487 750 547

Non-U.S. (6) (6) (120)

U.S. state 16 74 134

497 818 561

Total income tax expense $2,060 $988 $257

The following is a reconciliation of the U.S. federal statutory tax

rate of 35% to our recorded income tax expense/(benefit):

Years ended December 31, 2007 2006 2005

U.S. federal statutory tax 35.0% 35.0% 35.0%

Global Settlement with

U.S. Department of Justice 6.7

Foreign Sales Corporation/

Extraterritorial Income tax benefit (5.8) (5.6)

Research benefit (2.4) (0.7) (1.2)

Federal audit settlement (1.5) (13.1)

State income tax provision,

net of effect on U.S. federal tax 1.6 0.4 1.1

Change in valuation allowances 0.3 (3.2)

Other provision adjustments (0.8) (3.2) (3.9)

Income tax expense 33.7% 30.9% 9.1%

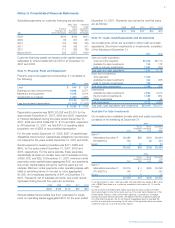

Significant components of our deferred tax assets, net of

deferred tax liabilities, at December 31 were as follows:

2007 2006

Retiree health care accruals $«2,581 $«3,257

Inventory and long-term contract

methods of income recognition 209 640

Other employee benefits accruals 1,476 1,473

In-process research and development

related to acquisitions 108 124

Net operating loss, credit, and charitable

contribution carryovers (net of valuation

allowance of $20 and $2) 275 319

Pension asset (1,648) (397)

Customer and commercial financing (1,587) (1,517)

Unremitted earnings of non-U.S. subsidiaries (48) (48)

Other net unrealized losses (18) 37

Net deferred tax assets1 $«1,348 $«3,888

1 Of the deferred tax asset for net operating loss and credit carryovers, $151

expires in years ending from December 31, 2008 through December 31, 2027

and $125 may be carried over indefinitely.

Net deferred tax assets at December 31 were as follows:

2007 2006

Deferred tax assets $«9,640 $12,174

Deferred tax liabilities (8,272) (8,284)

Valuation allowance (20) (2)

Net deferred tax assets $«1,348 $÷3,888

We recorded net deferred tax liabilities of $11 and $171 in

2007 and 2006, which were primarily due to acquisitions.

As required under SFAS 123R, deferred tax liabilities of $79 and

$306 were reclassified to Additional paid in capital in 2007 and

2006. This represents the tax effect of the net excess tax pool

created during 2007 and 2006 due to share awards paid with a

fair market value in excess of the book accrual for those awards.

Included in the net deferred tax assets at December 31, 2007

and 2006 are deferred tax assets in the amounts of $3,169

and $5,240 related to other comprehensive income.

Net income tax payments/(refunds) were $711, $28 and ($344)

in 2007, 2006 and 2005, respectively.

We have provided for U.S. deferred income taxes and foreign

withholding tax in the amount of $48 on undistributed earnings

not considered permanently reinvested in our non-U.S. sub-

sidiaries. We have not provided for U.S. deferred income taxes

or foreign withholding tax on the remainder of undistributed

earnings from our non-U.S. subsidiaries because such earn-

ings are considered to be permanently reinvested and it is not

practicable to estimate the amount of tax that may be payable

upon distribution.

FASB Interpretation No. 48

Effective January 1, 2007, we adopted FIN 48 which pre-

scribes a more-likely-than-not threshold for financial statement

recognition and measurement of a tax position taken or

expected to be taken in a tax return. This interpretation also

provides guidance on derecognition of income tax assets and

liabilities, classification of current and deferred income tax

assets and liabilities, accounting for interest and penalties

The Boeing Company and Subsidiaries