Boeing 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Notes to Consolidated Financial Statements

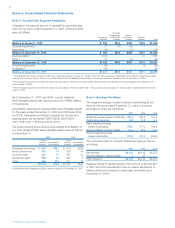

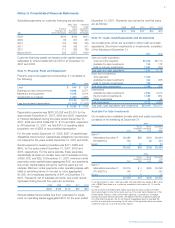

Note 2 – Goodwill and Acquired Intangibles

Changes in the carrying amount of goodwill by reportable seg-

ment for the years ended December 31, 2007, 2006 and 2005

were as follows:

Commercial

Airplanes

Precision

Engagement

and Mobility

Systems

Network

and Space

Systems

Support

Systems Total

Balance at January 1, 2005

Goodwill Adjustments

Divestitures

Balance at December 31, 2005

Aviall acquisition 1

Other 2

Balance at December 31, 2006

Goodwill Adjustments

Acquisition 3

Balance at December 31, 2007

$÷«282

21

(23)

$÷«280

1,014

71

$1,365

(25)

60

$1,400

$616

(13)

$603

$603

$603

$924

(18)

(2)

$904

(3)

$901

$901

$126

11

$137

41

$178

(1)

$177

$1,948

1

(25

$1,924

1,055

68

$3,047

(26

60

$3,081

)

)

1 On September 20, 2006, we acquired all of the outstanding shares of Aviall, Inc. (Aviall) for $1,780. The acquisition of Aviall was accounted for under the purchase

method of accounting. The purchase price was allocated to the net assets acquired based on their fair values and finalized in the fourth quarter of 2006.

2 The increase in goodwill is primarily the result of an acquisition in the second quarter 2006. The purchase price allocation for this acquisition was finalized in the

fourth quarter of 2006.

3 The increase in goodwill is primarily the result of an acquisition in the first quarter 2007. The purchase price allocation for this acquisition was finalized in the fourth

quarter of 2007.

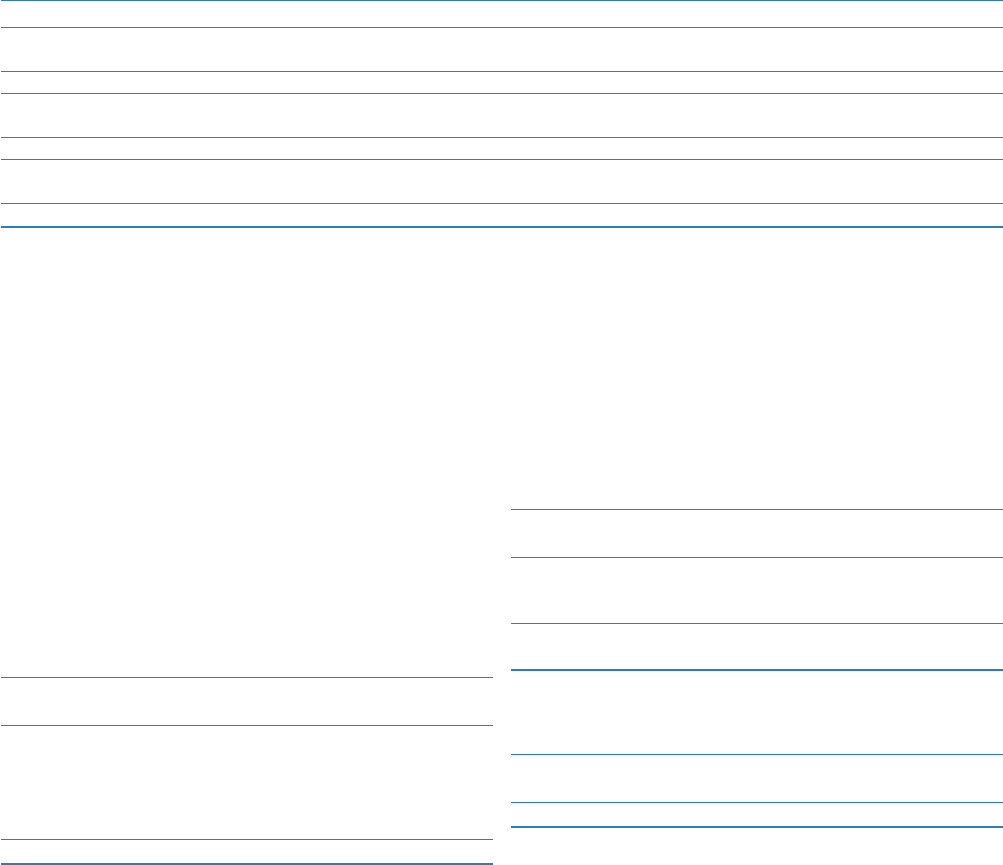

As of December 31, 2007 and 2006, we had indefinite- Note 3 – Earnings Per Share

lived intangible assets with carrying amounts of $499 relating The weighted-average number of shares outstanding (in mil-

to tradenames. lions) for the years ended December 31, used to compute

Amortization expense for acquired finite-lived intangible assets earnings per share are as follows:

for the years ended December 31, 2007 and 2006 was $152 2007 2006 2005

and $100. Estimated amortization expense for the five suc- Weighted-average shares outstanding 750.5 760.5 779.4

ceeding years are as follows: 2008–$209; 2009– $207; Participating securities 8.8 10.5 9.1

2010– $183; 2011 –$134 and 2012– $124. Basic weighted-average

The gross carrying amounts and accumulated amortization of shares outstanding 759.3 771.0 788.5

our other acquired finite-lived intangible assets were as follows Diluted potential common shares 13.2 16.6 14.4

at December 31: Diluted weighted-average

shares outstanding 772.5 787.6 802.9

2007 2006

Gross Gross

The numerator used to compute diluted earnings per share is

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization as follows:

Developed technology $«÷640 $432 $«÷615 $369 2007 2006 2005

Product know-how 308 74 308 64

Net earnings $4,074 $2,215 $2,572

Customer base 325 77 307 51

Expense related to diluted shares 2 27

Distribution rights 796 40 295 8

Total numerator $4,076 $2,242 $2,572

Other 249 101 241 75

$2,318 $724 $1,766 $567

Expense related to diluted shares in the amount of $2 and $27

in 2007 and 2006 represented mark-to-market adjustment of

Acquired finite-lived intangibles of $342 remain unpaid as of December 31, 2007. vested performance shares to employees terminated as of

December 31, 2005.

The Boeing Company and Subsidiaries