Boeing 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

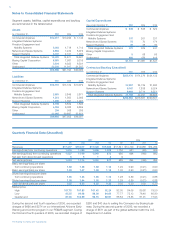

Notes to Consolidated Financial Statements

participants. A distribution is proportionally distributed in the

ratio each participant’s number of months of participation

which relates to the total number of months earned by all

participants in the investment period. At December 31, 2007,

the Trust held 31,362,850 shares of our common stock in the

two funds.

Based on the average stock price of $82.285 as of June 30,

2006, the market value of fund 1 exceeded the threshold of

$1,004 by $758. This excess was paid in Boeing common

stock, except for partial shares and distributions to non-U.S.

employees and beneficiaries of deceased participants, which

were paid in cash. After employee withholding taxes of $265,

which were recorded as a liability in the second quarter of

2006 and were paid in the third quarter of 2006, 5.6 million

shares of common stock were distributed to participants dur-

ing the third quarter of 2006. These distributions were record-

ed as a deduction to Additional paid-in capital. In addition,

related employer payroll taxes of $59 were expensed in the

second quarter of 2006.

If on June 30, 2008, the market value of fund 2 exceeds

$1,028, the amount in excess of the threshold will be distrib-

uted to employees in shares of common stock. Similarly, if on

June 30, 2010, the market value of fund 1 exceeds $1,130,

the amount in excess of the threshold will be distributed to

employees in shares of common stock. As of December 31,

2007 the market values of Fund 1 and 2 were $1,094

and $1,658.

The ShareValue Trust is accounted for as a contra-equity

account and stated at market value. Market value adjustments

are offset to Additional paid-in capital. At December 31, 2007,

there was $180 of total unrecognized compensation cost relat-

ed to the ShareValue Trust which is expected to be recognized

over a period of 2.5 years.

Other Compensation Arrangements

Performance Awards Performance Awards are cash units that

payout based on the achievement of long-term financial goals

at the end of a three-year period. Each unit has an initial value

of $100 dollars. The amount payable at the end of the three-

year performance period may be anywhere from zero to $200

dollars per unit, depending on the Company’s performance

against plan for a three-year period. The Compensation

Committee has the discretion to pay these awards in cash,

stock, or a combination of both after the three-year perform-

ance period. Compensation expense, based on the estimated

performance payout, is recognized ratably over the perform-

ance period.

During the first quarter of 2006, we granted Performance

Awards to our executives with the payout based on the

achievement of financial goals for the three-year period ending

December 31, 2008. The minimum amount is zero and the

maximum amount we could be required to payout for the

2006 Performance Awards is $252.

During the first quarter of 2007, we granted Performance

Awards to our executives with the payout based on the

achievement of financial goals for the three-year period ending

December 31, 2009. The minimum amount is zero and the

maximum amount we could be required to payout for the

2007 Performance Awards is $282.

Deferred Stock Compensation The Company has a deferred

compensation plan which permits executives to defer receipt

of a portion of their salary, bonus, and certain other incentive

awards. Prior to May 1, 2006, employees who participated in

the deferred compensation plan could choose to defer in either

an interest earning account or a Boeing stock unit account.

Effective May 1, 2006, participants can diversify deferred com-

pensation among 19 investment funds including the interest

earning account and the Boeing stock unit account.

Total expense related to deferred stock compensation was

$51, $210 and $149 in 2007, 2006, and 2005, respectively.

Additionally, for employees who elected to defer their compen-

sation in stock units prior to January 1, 2006, the Company

matched 25% of the deferral with additional stock units. Upon

retirement, the 25% match is settled in cash or stock; however,

effective January 1, 2006 all matching contributions are settled

in stock. This modification resulted in no incremental compen-

sation. As of December 31, 2007 and 2006, the deferred

compensation liability which is being marked to market was

$1,415 and $1,505.

Note 17 – Shareholders’ Equity

On August 28, 2006, our Board of Directors approved the

repurchase of $3,000 of common stock (the 2006 Program).

On October 29, 2007, the Board approved a new repurchase

plan (the 2007 Program) for up to $7,000 of common stock

that commenced following the completion of the 2006

Program. Unless terminated earlier by a Board resolution, the

2007 Program will expire when we have used all authorized

funds for repurchase. At December 31, 2007 $6,597 in shares

may still be purchased under the 2007 Program.

As of December 31, 2007 and 2006, there were

1,200,000,000 common shared authorized. Twenty million

shares of authorized preferred stock remain unissued.

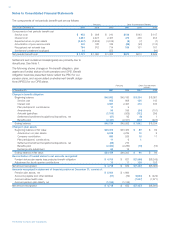

Changes in Share Balances

The following table shows changes in each class of shares:

Common Treasury ShareValue

Stock Stock Trust

Balance January 1, 2005 1,011,870,159 179,686,231 38,982,205

Issued 391,000 (12,812,111)

Acquired 45,217,300 611,258

Payout

Balance December 31, 2005 1,012,261,159 212,091,420 39,593,463

Issued (13,502,823)

Acquired 24,933,579 524,563

Payout (9,215,000)

Balance December 31, 2006 1,012,261,159 223,522,176 30,903,026

Issued (8,300,606)

Acquired 28,995,600 459,824

Payout

Balance December 31, 2007 1,012,261,159 244,217,170 31,362,850

The Boeing Company and Subsidiaries