Boeing 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Notes to Consolidated Financial Statements

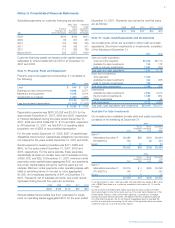

The components of net periodic benefit cost are as follows:

Pensions Other Postretirement Benefits

Years ended December 31, 2007 2006 2005 2007 2006 2005

Components of net periodic benefit cost

Service cost $÷÷953 $÷««908 $÷««910 $136 $143 $«147

Interest cost 2,681 2,497 2,457 473 436 454

Expected return on plan assets (3,507) (3,455) (3,515) (8) (7) (7)

Amortization of prior service costs 200 188 185 (88) (90) (110)

Recognized net actuarial loss 764 912 714 159 131 161

Settlement/curtailment loss/(gain) 10 552 (96)

Net periodic benefit cost $«1,101 $«1,050 $«1,303 $672 $613 $«549

Settlement and curtailment losses/(gains) are primarily due to

divestitures. See Note 7.

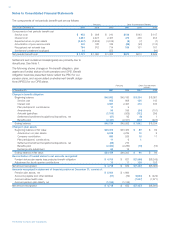

The following shows changes in the benefit obligation, plan

assets and funded status of both pensions and OPB. Benefit

obligation balances presented below reflect the PBO for our

pension plans, and accumulated postretirement benefit obliga-

tions (APBO) for our OPB plans.

Pensions Other Postretirement

Benefits

At September 30, 2007 2006 2007 2006

Change in benefit obligation

Beginning balance $45,582 $45,183 $«8,334 $«8,057

Service cost 953 908 136 143

Interest cost 2,681 2,497 473 436

Plan participants’ contributions 11 9

Amendments 95 156 (34) (101)

Actuarial (gain)/loss (1,100) (925) (732) 295

Settlement/curtailment/acquisitions/dispositions, net (57) 85 (8) 1

Benefits paid (2,431) (2,331) (507) (497)

Ending balance $45,734 $45,582 $«7,662 $«8,334

Change in plan assets

Beginning balance at fair value $46,203 $43,484 $÷÷÷89 $÷÷÷82

Actual return on plan assets 6,029 4,239 10 6

Company contribution 580 526 15 17

Plan participants’ contributions 11 9 1

Settlement/curtailment/acquisitions/dispositions, net (65) 216

Benefits paid (2,382) (2,286) (19) (16)

Exchange rate adjustment 63 15

Ending balance at fair value $50,439 $46,203 $÷÷÷96 $÷÷÷89

Reconciliation of funded status to net amounts recognized

Funded status-plan assets less projected benefit obligation $÷4,705 $÷÷«621 $(7,566) $(8,245)

Adjustment for fourth quarter contributions 13 11 129 152

Net amount recognized $÷4,718 $÷÷«632 $(7,437) $(8,093)

Amounts recognized in statement of financial position at December 31, consist of:

Pension plan assets, net $÷5,924 $÷1,806

Accounts payable and other liabilities (51) (39) $(430) $÷«(422)

Accrued retiree health care (7,007) (7,671)

Accrued pension plan liability, net (1,155) (1,135)

Net amount recognized $÷4,718 $÷÷«632 $(7,437) $(8,093)

The Boeing Company and Subsidiaries