Boeing 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

Notes to Consolidated Financial Statements

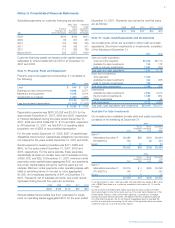

Inventories

Inventoried costs on commercial aircraft programs and long-

term contracts include direct engineering, production and tool-

ing costs, and applicable overhead, which includes fringe

benefits, production related indirect and plant management

salaries and plant services, not in excess of estimated net real-

izable value. To the extent a material amount of such costs are

related to an abnormal event or are fixed costs not appropri-

ately attributable to our programs or contracts, they are

expensed in the current period rather than inventoried.

Inventoried costs include amounts relating to programs and

contracts with long-term production cycles, a portion of which

is not expected to be realized within one year. Included in

inventory for federal government contracts is an allocation of

allowable costs related to manufacturing process reengineer-

ing. We net advances and progress billings on long-term con-

tracts against costs incurred to date for each contract in the

Consolidated Statements of Financial Position. Contracts

where costs incurred to date exceed advances and progress

billings are reported in Inventories, net of advances and

progress billings. Contracts where advances and progress

billings exceed costs incurred to date are reported in Advances

and billings in excess of related costs.

Because of the higher unit production costs experienced at the

beginning of a new or derivative commercial airplane program

(known as the learning curve effect), the actual costs incurred

for production of the early units in the program may exceed

the amount reported as cost of sales for those units. In addi-

tion, the use of a total program gross profit rate to delivered

units may result in costs assigned to delivered units in a report-

ing period being less than the actual cost of those units. The

excess actual costs incurred over the amount reported as cost

of sales is disclosed as deferred production costs, which are

included in inventory along with unamortized tooling costs.

The determination of net realizable value of long-term contract

costs is based upon quarterly contract reviews that determine

an estimate of costs to be incurred to complete all contract

requirements. When actual contract costs and the estimate to

complete exceed total estimated contract revenues, a loss

provision is recorded. The determination of net realizable value

of commercial aircraft program costs is based upon quarterly

program reviews that determine an estimate of revenue and

cost to be incurred to complete the program accounting quan-

tity. When estimated costs to complete exceed estimated pro-

gram revenues to go, a loss provision is recorded.

Used aircraft purchased by the Commercial Airplanes segment

and general stock materials are stated at cost not in excess of

net realizable value. See ‘Aircraft valuation’ within this Note for

our valuation of used aircraft purchased by the Commercial

Airplanes segment. Spare parts inventory is stated at lower of

average unit cost or market. We review our commercial spare

parts and general stock materials each quarter to identify

impaired inventory, including excess or obsolete inventory,

based on historical sales trends, expected production usage,

and the size and age of the aircraft fleet using the part.

Impaired inventories are charged to Cost of products in the

period the impairment occurs.

Included in inventory for commercial aircraft programs are

amounts paid or credited in cash, or other consideration to

certain airline customers, that are referred to as early issue

sales consideration. Early issue sales consideration is recog-

nized as a reduction to revenue when the delivery of the air-

craft under contract occurs. In the unlikely situation that an

airline customer was not able to perform and take delivery of

the contracted aircraft, we believe that we would have the abil-

ity to recover amounts paid through retaining amounts secured

by advances received on aircraft to be delivered. However, to

the extent early issue sales consideration exceeds advances

and is not considered to be recoverable, it would be recog-

nized as a current period expense.

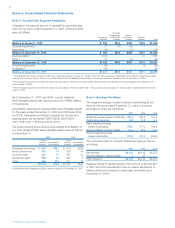

Precontract Costs

We may, from time to time, incur costs to begin fulfilling the

statement of work under a specific anticipated contract that

we are still negotiating with a customer. If we determine it is

probable that we will be awarded the specific anticipated con-

tract, then we capitalize the precontract costs we incur,

excluding any start-up costs which are expensed as incurred.

Capitalized precontract costs of $27 and $40 at December 31,

2007 and 2006, are included in Inventories, net of advances

and progress billings, in the accompanying Consolidated

Statements of Financial Position.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost, including

applicable construction-period interest, less accumulated

depreciation and are depreciated principally over the following

estimated useful lives: new buildings and land improvements,

from 10 to 40 years; and new machinery and equipment, from

3 to 20 years. The principal methods of depreciation are as fol-

lows: buildings and land improvements, 150% declining bal-

ance; and machinery and equipment, sum-of-the-years’ digits.

Capitalized internal use software is included in Other assets

and amortized using the straight line method over five years.

We periodically evaluate the appropriateness of remaining

depreciable lives assigned to long-lived assets, including assets

that may be subject to a management plan for disposition.

We review long-lived assets, which includes property, plant and

equipment, for impairment in accordance with SFAS No. 144,

Accounting for the Impairment or Disposal of Long-Lived

Assets (SFAS No. 144). Long-lived assets held for sale are

stated at the lower of cost or fair value less cost to sell.

Long-lived assets held for use are subject to an impairment

assessment whenever events or changes in circumstances

indicate that the carrying amount may not be recoverable. If

the carrying value is no longer recoverable based upon the

undiscounted future cash flows of the asset, the amount of

the impairment is the difference between the carrying amount

and the fair value of the asset.

The Boeing Company and Subsidiaries