Boeing 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Management’s Discussion and Analysis

In connection with the formation of ULA, we and Lockheed

each committed to provide up to $25 million in additional capi-

tal contributions, and we each have agreed to extend a line of

credit to ULA of up to $200 million to support its working capi-

tal requirements. We and Lockheed transferred performance

responsibility for certain U.S. government contracts to ULA as

of the closing date. We and Lockheed agreed to jointly guaran-

tee the performance of those contracts to the extent required

by the U.S. government.

In December 2006, we agreed to indemnify ULA through

December 31, 2020 against potential non-recoverability of

$1,375 million of Boeing Delta inventories included in con-

tributed assets plus $1,860 million of inventory subject to the

inventory supply agreement which ends on March 31, 2021.

Since inception, ULA sold $443 million of inventories that were

contributed by us. During 2007, ULA determined that certain

Delta II inventory is not fully recoverable. As a result we record-

ed charges of $31 million for non-recoverable Delta II inventory

and $39 million for our share of the loss recorded by ULA relat-

ed to Delta II. Future decisions regarding the Delta II program

could reduce our earnings by up to $100 million.

We also agreed to indemnify ULA in the event ULA is unable to

obtain re-pricing of certain contracts which we contributed to

ULA and to which we believe ULA is entitled. We will be

responsible for any shortfall and may record up to $332 million

in pre-tax losses related to these contracts.

Sea Launch

The Sea Launch venture, in which we are a 40%

partner, provides ocean-based launch services to commercial

satellite customers.

We have issued credit guarantees to creditors of the Sea

Launch venture to assist it in obtaining financing. In the event

we are required to perform on these guarantees, we believe

we can recover a portion of the cost (estimated at $486 mil-

lion) through guarantees from the other venture partners. The

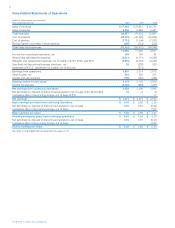

components of this exposure are as follows:

Estimated

Estimated Proceeds Estimated

Maximum Established from Net

(Dollars in millions) Exposure Reserves Recourse Exposure

Credit guarantees $«÷457 $183 $274

Partner Loans

(principal and interest) 479 287 192

Trade receivable from

Sea Launch 337 334 3

Performance guarantees 33 20 13

Subcontract termination 8 8

Other receivables and

Inventory 47 39 8

$1,361 $843 $486 $32

We made no additional capital contributions to the Sea Launch

venture during the year ended December 31, 2007.

The venture conducted zero, five and four successful launches

for the years ended December 31, 2007, 2006, and 2005,

respectively. A Sea Launch Zenit-3SL vehicle, carrying a

Boeing-built NSS-8 satellite, experienced an anomaly during

launch on January 30, 2007. The launch platform has been

repaired and resumed flight operations on January 15, 2008,

successfully launching a Boeing-built satellite. The venture

incurred losses in 2007 due to a delay in its 2007 launch mani-

fest that was caused by the launch anomaly and unusually

strong ocean currents at the launch site during November and

December. The venture incurred losses in 2006 and 2005 due

to the relatively low price and volume of launches, driven by a

depressed commercial satellite market and oversupply of

launch vehicles as well as a high level of debt and debt servic-

ing requirements.

We suspended recording equity losses after writing our invest-

ment in and direct loans to Sea Launch down to zero in 2001

and accruing our obligation for third-party guarantees on Sea

Launch indebtedness. We are not obligated to provide any fur-

ther financial support to the Sea Launch venture. However, in

the event that we do extend additional financial support to

Sea Launch in the future, we will recognize suspended losses

as appropriate. In addition, we continue to look at alternative

capital structures for the venture.

Satellites

The Boeing-built NSS-8 satellite was declared a total

loss due to an anomaly during launch on January 30, 2007.

The NSS-8 satellite was insured for $200 million which was

collected during the second and third quarter of 2007. New

Skies Satellites B.V. (New Skies) declined to exercise its option

to purchase a replacement spacecraft due to its assertion that

we anticipatorily breached the contract. We believe that had

New Skies exercised its option, we would have fulfilled our

contractual responsibilities. We do not expect New Skies’

assertion to materially impact our consolidated results of oper-

ations, financial position, or cash flows.

See the discussions of Boeing Satellite Systems International,

Inc. (BSSI) litigation/arbitration with ICO Global Communications

(Operations), Ltd., Thuraya Satellite Telecommunications,

Telesat Canada, and Space Communications Corporation in

Note 21.

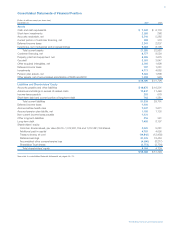

Support Systems Operating Results

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Revenues $6,699 $6,391 $5,577

% of Total company revenues 10% 10% 10%

Earnings from operations $÷«920 $÷«872 $÷«804

Operating margins 13.7% 13.6% 14.4%

Research and development $÷«104 $÷÷«98 $÷÷«89

Contractual backlog $9,664 $9,714 $8,551

Unobligated backlog $1,148 $÷«739 $1,320

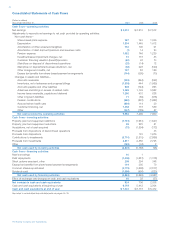

Revenues Support Systems revenues increased $308 million in

2007 and $814 million in 2006, an increase of 5% and 15%.

The increases were due to higher Integrated Logistics (IL) pro-

gram volume resulting from the 2006 acquisition of Aviall, Inc.

(Aviall) and increased revenue on the C-17 support program.

Higher international program volume in 2007 was the result of

our increased ownership in Alsalam Aircraft Company (Alsalam)

which occurred during the second quarter of 2006. Lower

volume on several Maintenance, Modification and Upgrades

(MM&U) and Training Systems and Services (TS&S) programs

partially offset the 2007 increases. Higher volume on several

MM&U programs also contributed to the significant growth in

2006 revenues.

The Boeing Company and Subsidiaries