Boeing 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Notes to Consolidated Financial Statements

Stock Options

Options have been granted with an exercise price equal to the

fair market value of our stock on the date of grant and expire

ten years after the date of grant. For stock options issued prior

to 2006, vesting is generally over a five-year service period

with portions of a grant becoming exercisable at one year,

three years and five years after the date of grant. In the event

an employee has a termination of employment due to retire-

ment, layoff, disability or death, the employee (or beneficiary)

immediately vests in grants that have been outstanding for at

least one year.

On February 26, 2007 and February 27, 2006, we granted to

our executives 5,334,700 and 6,361,100 options with an exer-

cise price equal to the fair market value of our stock on the

date of grant. The stock options vest over a period of three

years, with 34% vesting after the first year, 33% vesting after

the second year and the remaining 33% vesting after the third

year. The options expire 10 years after the date of grant. If an

executive terminates employment for any reason, the non-vest-

ed portion of the stock option will not vest and all rights to the

non-vested portion will terminate completely. Stock options

granted during 2005 were not material.

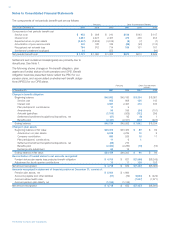

The activity of stock options issued to directors, officers, and

other employees for the year ended December 31, 2007 is

as follows:

(Shares in thousands) Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (years)

Aggregate

Intrinsic

Value

(in millions)

Number of shares

under option:

Outstanding at

beginning of year 15,482 $56.22

Granted 5,342 89.66

Exercised

Forfeited

(4,291)

(663)

49.35

80.25

Expired (30) 53.14

Outstanding at end of year 15,840 $68.36 6.84 $314

Exercisable at end of year 6,700 $52.19 4.34 $236

The total intrinsic value of options exercised was $192, $216

and $170 during the years ended December 31, 2007, 2006

and 2005, respectively. Cash received from options exercised

for the years ended December 31, 2007, 2006 and 2005 was

$209, $294 and $348 with a related tax benefit of $65, $52

and $59, respectively, derived from the compensation deduc-

tions resulting from these option exercises. At December 31,

2007, there was $125 of total unrecognized compensation

cost related to the Stock Option plan which is expected to be

recognized over a weighted average period of 1.8 years. The

total fair value of stock options vested during the year ended

December 31, 2007 was $43.

The fair value of stock-based compensation awards granted

prior to 2006 were estimated using a binomial option-pricing

model and the 2007 and 2006 awards granted were estimated

using the Black-Scholes option-pricing model with the follow-

ing assumptions:

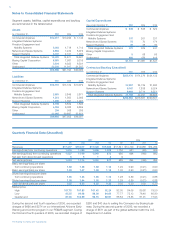

Risk Weighted

Free Average

Grant Grant Expected Expected Dividend Interest Grant Date

Year Date Life Volatility Yield Rate Fair Value

2007 2/26/07 6 years 28.4% 1.7% 4.62% $27.31

2006 2/27/06 6 years 29.5% 1.8% 4.64% 23.00

2005 8/23/05 9 years 29% 1.5% 4.2% 25.01

For the stock option grants issued in 2007 and 2006, the

expected volatility is based on a combination of our historical

stock volatility and the volatility levels implied on the grant date

by actively traded option contracts on our common stock. We

determined the expected term of the 2007 and 2006 stock

option grants to be 6 years, calculated using the “simplified”

method in accordance with the SEC Staff Accounting Bulletin

107, Valuation of Share-Based Payment Arrangements for

Public Companies. We used the “simplified” method since we

changed the vesting terms, tax treatment and the recipients of

our stock options beginning in 2006 such that we believe our

historical data no longer provides a reasonable basis upon

which to estimate expected term.

Other Stock Unit Awards

The total number of other stock unit awards that are convert-

ible either to common stock or cash equivalents and are not

contingent upon stock price were 1,997,763, 1,871,559 and

2,037,438 at December 31, 2007, 2006 and 2005, respectively.

Liability award payments relating to Boeing Stock Units totaled

$40, $57 and $32 for the years ended December 31, 2007,

2006 and 2005, respectively.

ShareValue Trust

The ShareValue Trust, established effective July 1, 1996, is a

14-year irrevocable trust that holds our common stock,

receives dividends, and distributes to employees the apprecia-

tion in value above a 3% per annum threshold rate of return at

the end of each period. The total compensation expense to be

recognized over the life of the trust was determined using a

binomial option-pricing model and was not affected by adop-

tion of SFAS No.123R.

The Trust was split between two funds, “fund 1” and “fund 2”,

upon its initial funding. Each fund consists of investment peri-

ods which result in overlapping periods as follows:

Period 1 (fund 1): July 1, 1996 to June 30, 1998

Period 2 (fund 2): July 1, 1996 to June 30, 2000

Period 3 (fund 1): July 1, 1998 to June 30, 2002

Period 4 (fund 2): July 1, 2000 to June 30, 2004

Period 5 (fund 1): July 1, 2002 to June 30, 2006

Period 6 (fund 2): July 1, 2004 to June 30, 2008

Period 7 (fund 1): July 1, 2006 to June 30, 2010

An initial investment value is established for each investment

period based on the lesser of either (1) fair market value of the

fund or (2) the prior ending balance of that fund. This amount

is then compounded by the 3% per annum to determine the

threshold amount that must be met for that investment period.

At the end of the investment period, the value of the investment

in excess of the threshold amount will result in a distribution to

The Boeing Company and Subsidiaries