Boeing 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

Management’s Discussion and Analysis

expense. Commercial Airplanes’ research and development

expense increased by $572 million to $2,962 million compared

with the same period 2006, primarily due to spending on the

787 and 747-8 programs. IDS earnings increased by $408 mil-

lion compared with 2006. The increase is primarily due to 2006

charges of $770 million in the PE&MS segment related to

Airborne Early Warning & Control (AEW&C), partially offset by

lower 2007 earnings on several programs in the PE&MS and

N&SS segments. BCC operating earnings decreased $57 mil-

lion reflecting lower revenues partially offset by a recovery of

losses and lower expenses. Other segment earnings improved

by $495 million primarily due to the absence of losses related to

Connexion by Boeing, which included a charge of $320 million

to exit this business in 2006. Lower unallocated expense in 2007

contributed $548 million to the 2007 earnings improvement.

Operating earnings increased in 2006 compared with 2005 pri-

marily driven by improved earnings at Commercial Airplanes

resulting from higher revenue from new aircraft deliveries,

increased earnings from commercial aviation support business

and improved cost performance. Lower unallocated expense in

2006 also contributed to the 2006 earnings increase. This was

partially offset by a $571 million charge for global settlement

with U.S. DoJ, lower IDS earnings reflecting a $569 million net

gain on the sale of our Rocketdyne business in 2005 and $770

million of charges on the AEW&C development program in

2006 partially offset by improved margins on other programs

and a $320 million charge related to the exit of the Connexion

by Boeing business recorded in Other segment.

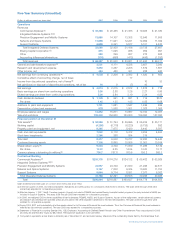

The most significant items included in Unallocated expense are

shown in the following table:

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Pension and other postretirement $÷«(686) $÷«(472) $÷«(851)

Share-based plans (233) (680) (999)

Deferred compensation (51) (211) (186)

Other (215) (370) (371)

Unallocated expense $(1,185) $(1,733) $(2,407)

We recorded net periodic benefit cost related to pensions and

other postretirement benefits of $1,773 million, $1,663 million

and $1,852 million in 2007, 2006 and 2005, respectively. Not

all net periodic benefit cost is recognized in earnings in the

period incurred because it is allocated to production as prod-

uct costs and a portion remains in inventory at the end of the

reporting period. Accordingly, earnings from operations includ-

ed $1,730 million, $1,227 million and $1,893 million in 2007,

2006, and 2005, respectively. A portion of pension and other

postretirement expense is recorded in the business segments

and the remainder is included in unallocated pension and

other postretirement expense.

Unallocated pension and other postretirement expense repre-

sents the difference between costs recognized under GAAP

in the consolidated financial statements and federal cost

accounting standards required to be utilized by our business

segments for U.S. government contracting purposes.

Pension and other postretirement expense increased during

2007 when compared with 2006 primarily due to increased

overall pension costs recognized in inventory as of December

31, 2006, which are subsequently expensed in cost of sales in

2007. Pension and other postretirement expense decreased in

2006 compared with 2005 mainly due to an absence of net

settlement and curtailment charges partially offset by an

increase in the amount of actuarial loss that was amortized.

The reduction in Share-based plans expense is primarily due to

lower Performance Shares outstanding during 2007 and higher

expense acceleration during 2006, resulting from 12 payouts

compared with six payouts in 2007. The decrease in 2006

Share-based plans expense is primarily due to the increase in

our stock price during 2005 which resulted in additional com-

pensation expense due to an increase in the number of per-

formance shares meeting the price growth targets and being

converted to common stock. The year over year changes in

deferred compensation expense are primarily driven by

changes in our stock price. Other expense decreased in 2007

partly due to reduced intercompany profit elimination as a

result of fewer intercompany deliveries during 2007 compared

with 2006.

Other Earnings Items

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Earnings from operations $«5,830 $3,014 $2,812

Other income, net 484 420 301

Interest and debt expense (196) (240) (294)

Earnings before income taxes 6,118 3,194 2,819

Income tax expense (2,060) (988) (257)

Net earnings from

continuing operations $«4,058 $2,206 $2,562

Other income, which primarily consists of interest income, was

higher in 2007 compared with 2006 as a result of increases

in average principal balances and higher average rates of

return on cash and investments. Other income was higher in

2006 compared with 2005 as a result of increases in average

principal balances and higher average rates of return, partially

offset by lower interest income compared with 2005 related to

federal income tax settlements for prior years.

Interest and debt expense decreased in 2007 and in 2006,

primarily due to debt repayments.

The effective income tax rate of 33.7% for 2007 differed from

the 2006 effective income tax rate of 30.9% primarily due to

Foreign Sales Corporation and Extraterritorial Income exclusion

tax benefits that existed in 2006, but did not recur in 2007.

This was partially offset by the non-deduction in 2006 of the

global settlement with the U.S. DoJ and other income tax pro-

vision adjustments. The 2007 tax rate of 33.7% included

enhanced Research and Development credits that exceeded

the credits in 2006. The effective income tax rate of 30.9% for

2006 differed from the 2005 effective income tax rate of 9.1%

primarily due to the favorable 2005 settlement with the Internal

Revenue Service and the non-deduction in 2006 of the global

settlement with the U.S. DoJ. For additional discussion related

to Income Taxes see Note 4.

The Boeing Company and Subsidiaries