Boeing 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Notes to Consolidated Financial Statements

On June 6, 2002, BCC established a Euro medium-term note

program in the amount of $1,500. At December 31, 2007 and

2006, BCC had zero debt outstanding under the program

such that $1,500 would normally be available for potential debt

issuance. However, debt issuance under this program requires

that documentation, information, and other procedures relating

to BCC and the program be updated within the prior twelve

months. In view of BCC’s cash position and other available

funding sources, BCC determined during 2004 that it was

unlikely they would need to use this program in the foreseeable

future. The program is thus inactive but available subject to

updated documentation and procedures. The availability of

funding under this program would be dependent on investor

demand and market conditions.

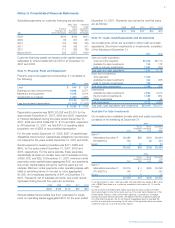

Short-term debt and current portion of long-term debt, con-

sisted of the following:

At December 31, 2007 At December 31, 2006

Consolidated BCC Consolidated BCC

Total Only Total Only

Unsecured debt

securities $685 $685 $1,256 $1,256

Capital lease obligations 17 16 55 47

Non-recourse debt

and notes 31 5 42 4

Other notes 29 28

$762 $706 $1,381 $1,307

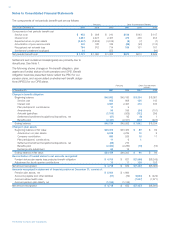

Debt consisted of the following:

December 31, December 31,

2007 2006

Boeing Capital Corporation debt:

Unsecured debt securities

3.600% – 7.580% due through 2023 $4,170 $5,382

Non-recourse debt and notes

4.840% – 7.690% notes due through 2013 71 76

Capital lease obligations

4.070% – 8.250% due through 2015 86 132

Subtotal Boeing Capital Corporation debt $4,327 $5,590

Other Boeing debt:

Non-recourse debt and notes

Enhanced equipment trust $«««405 $«««442

Unsecured debentures and notes

350, 9.750% due Apr. 1, 2012 349 349

600, 5.125% due Feb. 15, 2013 598 598

400, 8.750% due Aug. 15, 2021 398 398

300, 7.950% due Aug. 15, 2024

(puttable at holder’s option on

Aug. 15, 2012) 300 300

250, 7.250% due Jun. 15, 2025 248 247

250, 8.750% due Sep. 15, 2031 249 248

175, 8.625% due Nov. 15, 2031 173 173

400, 6.125% due Feb. 15, 2033 393 393

300, 6.625% due Feb. 15, 2038 300 300

100, 7.500% due Aug. 15, 2042 100 100

175, 7.875% due Apr. 15, 2043 173 173

125, 6.875% due Oct. 15, 2043 125 125

Capital lease obligations due through 2010 2 11

Other notes 77 91

Subtotal other Boeing debt $3,890 $3,948

Total debt $8,217 $9,538

At December 31, 2007, $150 of BCC debt was collateralized

by portfolio assets and underlying equipment totaling $247. The

debt consists of the 4.07% to 8.25% notes due through 2015.

Maturities of long-term debt for the next five years are as follows:

2008 2009 2010 2011 2012

BCC $710 $528 $645 $798 $«««878

Other Boeing 52 23 22 73 363

$762 $551 $667 $871 $1,241

Note 15 – Postretirement Plans

We have various pension plans covering substantially all

employees. We fund all our major pension plans through

trusts. Pension assets are placed in trust solely for the benefit

of the plans’ participants, and are structured to maintain liquid-

ity that is sufficient to pay benefit obligations as well as to keep

pace over the long term with the growth of obligations for

future benefit payments.

We also have postretirement benefits other than pensions

which consist principally of health care coverage for eligible

retirees and qualifying dependents, and to a lesser extent, life

insurance to certain groups of retirees. Retiree health care is

provided principally until age 65 for approximately half those

retirees who are eligible for health care coverage. Certain

employee groups, including employees covered by most

United Auto Workers bargaining agreements, are provided life-

time health care coverage. We use a measurement date of

September 30 for our pension and other postretirement benefit

(OPB) plans.

Effective December 31, 2006, we adopted SFAS No. 158,

which requires that the Consolidated Statements of Financial

Position reflect the funded status of the pension and postretire-

ment plans. The funded status of the plans is measured as the

difference between the plan assets at fair value and the pro-

jected benefit obligation (PBO). We have recognized the aggre-

gate of all overfunded plans in Pension plan assets, net and

the aggregate of all underfunded plans in either Accrued retiree

health care or Accrued pension plan liability, net. The portion of

the amount by which the actuarial present value of benefits

included in the PBO exceeds the fair value of plan assets,

payable in the next 12 months, is reflected in Accounts

payable and other liabilities.

Effective December 31, 2008, SFAS No. 158 will require us to

measure plan assets and benefit obligations at fiscal year end.

We currently perform this measurement at September 30 of

each year. Beginning in fourth quarter of 2007 in accordance

with this Standard, we eliminated the use of a three-month lag

period when recognizing the impact of curtailments or settle-

ments and, instead, recognize these amounts in the period

in which they occur. The provisions of SFAS No. 158 do not

permit retrospective application.

The Boeing Company and Subsidiaries