Boeing 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

Notes to Consolidated Financial Statements

is reasonably possible that we will decide in 2008 to complete

production of the C-17 if further orders are not received. We

are still evaluating the full financial impact of a potential pro-

duction shut-down, including any recovery that would be avail-

able from the government. Such recovery from the government

would not include the costs incurred by us resulting from the

second quarter direction to key suppliers to begin working on

the additional 10 aircraft.

Department of Defense Office of the

Inspector General Audit

We have been advised by the Department of Defense Office of

the Inspector General (DoD OIG) that it is conducting an audit

of the application of economic price adjustment (EPA) clauses

included in our multi-year contracts for the C-17, F-18, and

Apache programs. A final audit report has not been issued and

the actions, if any, that our U.S. government customers may

take in response to the audit are unknown at this time, as is

any potential financial impact in the future.

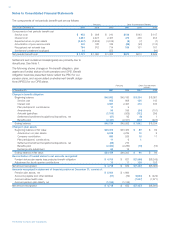

Satellites

The Boeing-built NSS-8 satellite was declared a total loss due

to an anomaly during launch on January 30, 2007. The NSS-8

satellite was insured for $200 which was collected during the

second and third quarter of 2007. New Skies Satellites B.V.

(New Skies) declined to exercise its option to purchase a

replacement spacecraft due to its assertion that we anticipato-

rily breached the contract. We believe that had New Skies

exercised its option, we would have fulfilled our contractual

responsibilities. We do not expect New Skies’ assertion to

materially impact our consolidated results of operations, finan-

cial position, or cash flows.

In certain launch and satellite sales contracts, we include provi-

sions that specify that we bear risk of loss associated with the

launch phase through acceptance in orbit by the customer. We

have historically purchased insurance to cover these exposures

when allowed under the terms of the contract and when eco-

nomically advisable. The current insurance market reflects high

premium rates and also suffers from a lack of capacity to handle

all insurance requirements. We make decisions on the procure-

ment of insurance based on our analysis of risk. There is one

contractual launch scheduled in 2008 for which full insurance

coverage may not be available or, if available, could be prohibi-

tively expensive. We will continue to review this risk. We estimate

that the potential uninsured amount for this launch could

approach $350 depending on the nature of the uninsured event.

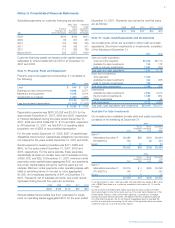

Financing Commitments

Financing commitments totaled $8,350 and $10,164 as of

December 31, 2007 and 2006. We anticipate that a significant

portion of these commitments will not be exercised by the cus-

tomers as we continue to work with third party financiers to

provide alternative financing to customers.

In connection with the formation of ULA, we and Lockheed

each committed to provide up to $25 in additional capital con-

tributions and we each have agreed to extend a line of credit

to ULA of up to $200 to support its working capital require-

ments during the five year period following December 1, 2006.

ULA did not request any funds under the line of credit as of

December 31, 2007.

We have entered into standby letters of credit agreements and

surety bonds with financial institutions primarily relating to the

guarantee of future performance on certain contracts.

Contingent liabilities on outstanding letters of credit agree-

ments and surety bonds aggregated approximately $4,973 as

of December 31, 2007 and approximately $4,368 at

December 31, 2006.

Company Owned Life Insurance

McDonnell Douglas Corporation insured its executives with

Company Owned Life Insurance (COLI), which are life insur-

ance policies with a cash surrender value. Although we do not

use COLI currently, these obligations from the merger with

McDonnell Douglas are still a commitment at this time. We

have loans in place to cover costs paid or incurred to carry the

underlying life insurance policies. As of December 31, 2007

and 2006, the cash surrender value was $310 and $288

and the total loans were $298 and $279. As we have the

right to offset the loans against the cash surrender value of

the policies, we present the net asset in Other assets on the

Consolidated Statements of Financial Position as of

December 31, 2007 and 2006.

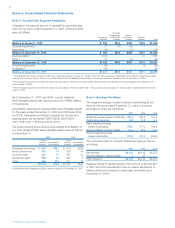

Note 14 – Debt

Total debt interest incurred, including amounts capitalized, was

$591, $657, and $713 for the years ended December 31, 2007,

2006 and 2005, respectively. Interest expense recorded by

BCC is reflected as a separate line item on our Consolidated

Statements of Operations, and is included in earnings from

operations. Total company interest payments were $616,

$657, and $671 for the years ended December 31, 2007,

2006 and 2005, respectively.

We have $3,000 currently available under credit line agree-

ments. We have given BCC exclusive access to $1,500 under

these arrangements. We continue to be in full compliance with

all covenants contained in our debt or credit facility agree-

ments, including those at BCC.

On March 23, 2004, we filed a shelf registration with the

Securities and Exchange Commission (SEC) for $1,000 for

the issuance of debt securities and underlying common stock.

The entire amount remains available for potential debt

issuance. BCC has $3,421 that remains available from shelf

registrations filed with the SEC. Both of BCC’s shelf registra-

tions expire in November 2008. The availability of funding

under these shelf registrations is dependent on investor

demand and market conditions.

The Boeing Company and Subsidiaries