Boeing 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Management’s Discussion and Analysis

In the second quarter of 2006 we increased our ownership

interest in Alsalam, which operates as a Maintenance, Repair

and Overhaul facility for various military and commercial air-

craft. As a result, we began consolidating Alsalam’s financial

statements, which generated revenues of $207 million during

2007 and $137 million during the last three quarters of 2006.

Operating Earnings Support Systems operating earnings

increased by 5% in 2007 and increased by 9% in 2006 driven

by the revenue increases mentioned above in addition to a

different contract mix.

Research and Development Support Systems continues to

focus investment strategies on its core businesses including IL,

MM&U, TS&S and Advanced Logistics Support Systems, as

well as on moving into the innovative Network Centric Logistics

areas. Investments have been made to continue the develop-

ment and implementation of innovative and disciplined tools,

processes and systems as market discriminators in the delivery

of integrated customer solutions. Examples of successful pro-

grams stemming from these investment strategies include the

C-17 Globemaster Sustainment Partnership, the F/A-18

Integrated Readiness Support Teaming program, and the F-15

Singapore Performance Based Logistics contract.

Backlog Support Systems total backlog increased by 3% in

2007 compared with 2006 due to increases in TS&S programs

and International Support programs which were partially offset

by decreases in MM&U and IL programs. Total backlog

increased by 6% in 2006 compared with 2005 driven by a

large IL order for Chinook support.

Boeing Capital Corporation Segment

Business Environment and Trends

BCC’s customer financing and investment portfolio at

December 31, 2007 totaled $6,532 million, which was sub-

stantially collateralized by Boeing produced commercial air-

craft. While worldwide traffic levels are well above those in the

past, the effects of higher fuel prices continue to impact the

airline industry. At the same time, the credit ratings of some

airlines, particularly in the United States, have remained at low

levels. A substantial portion of BCC’s portfolio is concentrated

among U.S. commercial airline customers.

Certain aircraft models in BCC’s portfolio have recently experi-

enced a lower rate of decline in market value and some mod-

els have experienced increases in market value. This market

value condition had been due to certain positive factors includ-

ing passenger load at record high levels, a limited supply of

economically viable used aircraft, increasing lease rates and

increased demand from used aircraft buyers.

Aircraft values and lease rates are impacted by the number

and type of aircraft that are currently out of service. Approxi-

mately 1,600 commercial jet aircraft (8.2% of current world

fleet) continue to be parked, including both in-production and

out-of-production aircraft types, of which over 60% are not

expected to return to service. Aircraft valuations could decline

if significant numbers of aircraft, particularly types with relatively

few operators, are placed out of service.

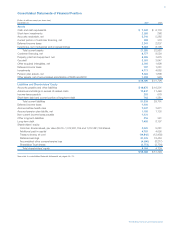

Summary Financial Information

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Revenues

Earnings from operations

Operating margins

$815

$234

29%

$1,025

$÷«291

28%

$966

$232

24%

Revenues BCC segment revenues consist principally of lease

income from equipment under operating lease and interest

from financing receivables and notes. BCC’s revenues

decreased $210 million in 2007, resulting from lower interest

income on notes receivable of $75 million, lower investment

income of $50 million primarily due to the sale or repayment at

maturity of certain investments in 2006 and lower net gain on

disposal of assets of $47 million. BCC’s revenues increased

$59 million in 2006, primarily due to an increase of investment

income and higher gain on the sale of aircraft and certain

investments in notes receivable.

Operating Earnings BCC’s operating earnings are presented

net of interest expense, provision for (recovery of) losses, asset

impairment expense, depreciation on leased equipment and

other operating expenses. Operating earnings decreased by

$57 million in 2007 primarily due to lower revenues partially off-

set by lower interest expense, lower asset impairment expense

and lower depreciation expense and a recovery of losses. The

increase in operating earnings in 2006 compared with 2005

was primarily due to higher revenues.

Financial Position The following table presents selected

financial data for BCC:

(Dollars in millions) 2007 2006

BCC Customer Financing and

Investment Portfolio $6,532 $8,034

Valuation Allowance as a % of

Total Receivables 2.5% 2.4%

Debt $4,327 $5,590

Debt-to-Equity Ratio 5.0-to-1 5.0-to-1

BCC’s customer financing and investment portfolio at

December 31, 2007 decreased from December 31, 2006 due

to prepayment of certain notes receivable, normal portfolio run-

off and sale of certain portfolio assets. At December 31, 2007

and 2006, BCC had $86 million and $259 million of assets that

were held for sale or re-lease of which $86 million and $253

million had firm contracts to be sold or placed on lease.

Additionally, aircraft subject to leases with a carrying value of

approximately $292 million are scheduled to be returned off

lease in the next 12 months. These aircraft are being remarket-

ed or the leases are being extended and $132 million were

committed at December 31, 2007.

BCC enters into certain transactions with the Other segment in

the form of intercompany guarantees and other subsidies.

Finance Restructurings From time to time, certain BCC cus-

tomers have requested a restructuring of their transactions

with BCC. As of December 31, 2007, BCC has not reached

agreement on any restructuring requests that would have a

material adverse effect on its earnings, cash flows and/or

financial position.

The Boeing Company and Subsidiaries