Boeing 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

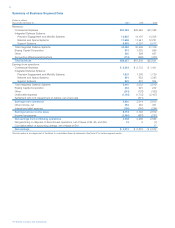

Management’s Discussion and Analysis

As of September 30, 2007 (Dollars in millions)

Change in discount rate

Increase 25 bps Decrease 25 bps

Pension plans

Projected benefit obligation

(pensions) (1,263) 1,436

Net periodic pension cost (145) 155

Other postretirement benefit plans

Accumulated postretirement

benefit obligation (168) 185

Net periodic postretirement benefit cost (14) 13

Pension expense is also sensitive to changes in the expected

long-term rate of asset return. An increase or decrease of

25 basis points in the expected long-term rate of asset return

would have increased or decreased 2007 pension income by

approximately $114 million. Differences between the actual

return on plan assets and the expected long term rate of return

are reflected in Shareholders’ Equity (net of taxes) as of our

annual measurement date.

The assumed medical trend rates have a significant effect

on the following year’s expense recorded liabilities and

Shareholders’ Equity. In the following table, we show the sensi-

tivity of our other postretirement benefit plan liabilities and net

periodic cost to a 100 basis point change.

As of September 30, 2007 (Dollars in millions)

Change in medical trend rate

Increase 100 bps Decrease 100 bps

Other postretirement benefit plans

Accumulated postretirement

benefit obligation 621 (545)

Net periodic postretirement

benefit cost 121 (109)

Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Risk

We have financial instruments that are subject to interest rate

risk, principally investments, fixed-rate debt obligations, and

customer financing assets and liabilities. Historically, we have

not experienced material gains or losses on these instruments

due to interest rate changes. Additionally, BCC uses interest

rate swaps with certain debt obligations to manage exposure

to interest rate changes.

The principal source of BCC’s market risk relates to interest

rate changes. This risk is managed by matching the profile of

BCC’s liabilities with the profile of BCC’s assets. Exposure to

mismatched risk is measured and managed with the use of

interest rate derivatives. We do not use interest rate derivatives

for speculative or trading purposes. Although many of the

assets, liabilities and derivatives affected by a change in inter-

est rates are not traded, if we had an immediate, one-time,

100 basis-point increase in market rates at December 31,

2007, we estimate that the tax-adjusted net fair value of these

items would have decreased by $12 million compared to a

decrease of $9 million at December 31, 2006.

Based on the portfolio of other Boeing existing debt, the

unhedged exposure to interest rate risk is not material. The

investors in the fixed-rate debt obligations that we issue do

not generally have the right to demand we pay off these obli-

gations prior to maturity. Therefore, exposure to interest rate

risk is not believed to be material for our fixed-rate debt.

Foreign Currency Exchange Rate Risk

We are subject to foreign currency exchange rate risk relating

to receipts from customers and payments to suppliers in for-

eign currencies. We use foreign currency forward and option

contracts to hedge the price risk associated with firmly com-

mitted and forecasted foreign denominated payments and

receipts related to our ongoing business. Foreign currency

contracts are sensitive to changes in foreign currency

exchange rates. At December 31, 2007, a 10% unfavorable

exchange rate movement in our portfolio of foreign currency

contracts would have reduced our unrealized gains by $69 mil-

lion. Consistent with the use of these contracts to neutralize

the effect of exchange rate fluctuations, such unrealized losses

or gains would be offset by corresponding gains or losses,

respectively, in the remeasurement of the underlying transac-

tions being hedged. When taken together, these forward

currency contracts and the offsetting underlying commitments

do not create material market risk.

The Boeing Company and Subsidiaries