Boeing 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

Notes to Consolidated Financial Statements

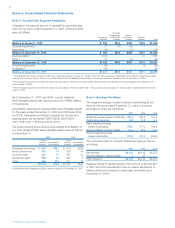

Differences between carrying values and fair values of finance

leases and notes and other receivables, as determined by col-

lateral value, are considered in determining the allowance for

losses on receivables.

We use a median calculated from published collateral values

from multiple third-party aircraft value publications based on

the type and age of the aircraft to determine the fair value of

aircraft. Under certain circumstances, we apply judgment

based on the attributes of the specific aircraft or equipment,

usually when the features or use of the aircraft vary significantly

from the more generic aircraft attributes covered by outside

publications.

Impairment Review for Assets Under Operating Leases and

Held for Sale or Re-lease We evaluate assets under operating

lease or assets held for sale or re-lease for impairment when

the expected undiscounted cash flow from the asset is less

than the carrying value. We use various assumptions when

determining the expected undiscounted cash flow including

our intentions for how long we will hold an asset subject to

operating lease before it is sold, the expected future lease

rates, lease terms, residual value of the asset, periods in which

the asset may be held in preparation for a follow-on lease,

maintenance costs, remarketing costs and the remaining eco-

nomic life of the asset. We state assets held for sale at the

lower of carrying value or fair value less costs to sell.

When we determine that impairment is indicated for an asset,

the amount of impairment expense recorded is the excess of

the carrying value over the fair value of the asset.

Allowance for Losses on Receivables We record the potential

impairment of receivables in our portfolio in a valuation account,

the balance of which is an accounting estimate of probable but

unconfirmed losses in the receivables portfolio. The allowance

for losses on receivables relates to two components of receiv-

ables: (a) specifically identified receivables that are evaluated

individually for impairment and (b) all other receivables.

We determine a receivable is impaired when, based on current

information and events, it is probable that we will be unable to

collect amounts due according to the original contractual

terms of the receivable agreement, without regard to any sub-

sequent restructurings. Factors considered in assessing col-

lectibility include, but are not limited to, a customer’s extended

delinquency, requests for restructuring and filings for bank-

ruptcy. We determine a specific impairment allowance based

on the difference between the carrying value of the receivable

and the estimated fair value of the related collateral.

We review the adequacy of the allowance attributable to the

remaining receivables (after excluding receivables subject to a

specific impairment allowance) by assessing both the collateral

exposure and the applicable cumulative default rate. Collateral

exposure for a particular receivable is the excess of the carry-

ing value of the receivable over the fair value of the related col-

lateral. A receivable with an estimated fair value in excess of

the carrying value is considered to have no collateral exposure.

The applicable cumulative default rate is determined using two

components: customer credit ratings and weighted average

remaining contract term. Credit ratings are determined for each

customer in the portfolio. Those ratings are updated based

upon public information and information obtained directly from

our customers.

We have entered into agreements with certain customers that

would entitle us to look beyond the specific collateral underly-

ing the receivable for purposes of determining the collateral

exposure as described above. Should the proceeds from the

sale of the underlying collateral asset resulting from a default

condition be insufficient to cover the carrying value of our

receivable (creating a shortfall condition), these agreements

would, for example, permit us to take the actions necessary to

sell or retain certain other assets in which the customer has an

equity interest and use the proceeds to cover the shortfall.

Each quarter we review customer credit ratings, published his-

torical credit default rates for different rating categories, and

multiple third party aircraft value publications as a basis to vali-

date the reasonableness of the allowance for losses on receiv-

ables. There can be no assurance that actual results will not

differ from estimates or that the consideration of these factors

in the future will not result in an increase or decrease to the

allowance for losses on receivables.

Supplier Penalties

We record an accrual for supplier penalties when an event

occurs that makes it probable that a supplier penalty will be

incurred and the amount is reasonably estimable. Until an

event occurs, we fully anticipate accepting all products pro-

cured under production-related contracts.

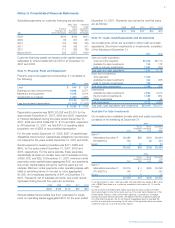

Guarantees

We account for guarantees in accordance with FASB

Interpretation No. 45, Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Others. We record a liability for the fair value

of guarantees in Accounts Payable and other liabilities that are

issued or modified after December 31, 2002. For a residual

value guarantee where we received a cash premium, the liabili-

ty is equal to the cash premium received at the guarantee’s

inception. For credit and performance guarantees, the liability

is equal to the present value of the expected loss. We deter-

mine the expected loss by multiplying the creditor’s default rate

by the guarantee amount reduced by the expected recovery, if

applicable, for each future period the credit or performance

guarantee will be outstanding. If at inception of a guarantee,

we determine there is a probable related contingent loss, we

will recognize a liability for the greater of (a) the fair value of the

guarantee as described above or (b) the probable contingent

loss amount.

The Boeing Company and Subsidiaries