Boeing 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Notes to Consolidated Financial Statements

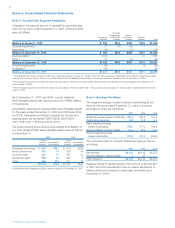

Scheduled payments on customer financing are as follows:

Sales-Type/ Operating

Finance Lease

Principal Lease Equipment

Payments on Payments Payments

Year Notes Receivable Receivable Receivable

2008 $184 $324 $433

2009 95 307 383

2010 104 295 325

2011 156 336 241

2012 111 295 186

Beyond 2012 235 2,257 1,008

Customer financing assets we leased under capital leases and

subleased to others totaled $43 and $137 at December 31,

2007 and 2006.

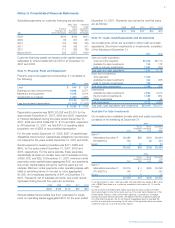

Note 9 – Property, Plant and Equipment

Property, plant and equipment at December 31 consisted of

the following:

2007 2006

Land $÷«÷«544 $÷«÷«524

Buildings and land improvements 8,868 8,571

Machinery and equipment 9,308 8,614

Construction in progress 1,460 1,601

20,180 19,310

Less accumulated depreciation (11,915) (11,635)

$«÷8,265 $«÷7,675

Depreciation expense was $978, $1,058 and $1,001 for the

years ended December 31, 2007, 2006 and 2005, respective-

ly. Interest capitalized during the years ended December 31,

2007, 2006 and 2005 totaled $117, $110 and $84, respective-

ly. At December 31, 2007, we had $314 of operating lease

properties, net of $202 of accumulated depreciation.

For the year ended December 31, 2006, $357 of capital lease

obligations was incurred. Capital lease obligations incurred were

not material for the years ended December 31, 2007 and 2005.

Rental expense for leased properties was $411, $388 and

$400, for the years ended December 31, 2007, 2006 and

2005, respectively. For the same periods, these expenses,

substantially all minimum rentals, were net of sublease income

of $26, $18, and $22. At December 31, 2007, minimum rental

payments under capital leases aggregated $16, and payments

due under capital leases during the next five years are not

material. Minimum rental payments under operating leases with

initial or remaining terms of one year or more aggregated

$1,038, net of sublease payments of $47, at December 31,

2007. Payments, net of sublease amounts, due under operat-

ing leases during the next five years are as follows:

2008 2009 2010 2011 2012

$205 $158 $119 $91 $60

Noncancellable future rentals due from customers for equip-

ment on operating leases aggregated $137 for the year ended

December 31, 2007. Payments due during the next five years

are as follows:

2008 2009 2010 2011 2012

$13 $14 $13 $12 $13

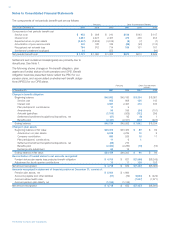

Note 10 – Cash, Cash Equivalents and Investments

Our investments, which are recorded in either Cash and cash

equivalents, Short-term investments or Investments, consisted

of the following at December 31:

2007 2006

Cash and cash equivalents

Cash and time deposits $5,406 $5,710

Available-for-sale investments 134 118

Held-to-maturity investments 1,502 290

Total cash and cash equivalents 7,042 6,118

Short-term investments

Time deposits 1,025

Available-for-sale investments 442 268

Held-to-maturity investments 799

Total short-term investments 2,266 268

Investments

Available-for-sale investments 2,982 3,076

Equity method investments 1,085 964

Other investments 44 45

Total investments 4,111 4,085

Total cash, cash equivalents and investments $13,419 $10,471

Available-For-Sale Investments

Our investments in available-for-sale debt and equity securities

consisted of the following at December 31:

2007

Cost

Gross Gross

Unrealized Unrealized

Gain Loss

Estimated

Fair

Value

Debt: (1)

Marketable Securities (2)

ETCs/EETCs

Equity

$3,385

145

2

$3,532

$29

10

$39

$(11)

(2)

$(13)

$3,403

143

12

$3,558

2006

Cost

Gross Gross

Unrealized Unrealized

Gain Loss

Estimated

Fair

Value

Debt: (1)

Marketable Securities (2)

ETCs/EETCs

Equity

$3,319

145

4

$3,468

$««4

7

8

$19

$(25)

$(25)

$3,298

152

12

$3,462

(1) At December 31, 2007, debt securities with estimated fair values of $574 and

cost of $580 have been in a continuous unrealized loss position for 12 months

or longer.

(2) The portfolio is diversified and highly liquid and primarily consists of invest-

ment grade fixed income instruments such as U.S. dollar debt obligations of the

United States Treasury, other government agencies, corporations, mortgage-

backed and asset-backed securities. We believe that the unrealized losses are

not other-than-temporary. We do not have a foreseeable need to liquidate the

portfolio and anticipate recovering the full value of the securities either as market

conditions improve, or as the securities mature.

The Boeing Company and Subsidiaries