Boeing 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

Notes to Consolidated Financial Statements

Asset Retirement Obligations

On December 31, 2005, we adopted FIN No. 47, Accounting

for Conditional Asset Retirement Obligations– an interpretation

of FASB Statement No. 143 (FIN 47). In accordance with

FIN 47, we record all known asset retirement obligations for

which the liability’s fair value can be reasonably estimated,

including certain asbestos removal, asset decommissioning

and contractual lease restoration obligations. Recorded

amounts are not material.

We also have known conditional asset retirement obligations,

such as certain asbestos remediation and asset decommis-

sioning activities to be performed in the future, that are not rea-

sonably estimable due to insufficient information about the

timing and method of settlement of the obligation. Accordingly,

these obligations have not been recorded in the Consolidated

Financial Statements. A liability for these obligations will be

recorded in the period when sufficient information regarding

timing and method of settlement becomes available to make a

reasonable estimate of the liability’s fair value. In addition, there

may be conditional asset retirement obligations that we have

not yet discovered (e.g. asbestos may exist in certain buildings

but we have not become aware of it through the normal

course of business), and therefore, these obligations also have

not been included in the Consolidated Financial Statements.

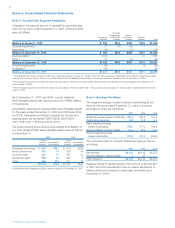

Goodwill and Other Acquired Intangibles

Goodwill and other acquired intangible assets with indefinite

lives are not amortized, but are tested for impairment annually

and when an event occurs or circumstances change such that

it is reasonably possible that impairment may exist. Our annual

testing date is April 1.

We test goodwill for impairment by first comparing the carrying

value of net assets to the fair value of the related operations. If

the fair value is determined to be less than carrying value, a

second step is performed to compute the amount of the im-

pairment. In this process, a fair value for goodwill is estimated,

based in part on the fair value of the operations, and is com-

pared to its carrying value. The shortfall of the fair value below

carrying value represents the amount of goodwill impairment.

Indefinite-lived intangibles consist of brand and trade names

acquired in business combinations. We test these intangibles

for impairment by comparing their carrying value to current

projections of discounted cash flows attributable to the brand

and trade names. Any excess carrying value over the amount of

discounted cash flows represents the amount of the impairment.

Our finite-lived acquired intangible assets are amortized on a

straight-line basis over their estimated useful lives as follows:

developed technology, 5 to 12 years; product know-how, 30

years; customer base, 12 to 15 years; distribution rights, 6 to

30 years; and other, 2 to 17 years. In accordance with SFAS

No. 144, we evaluate the potential impairment of finite-lived

acquired intangible assets when appropriate. If the carrying

value is no longer recoverable based upon the undiscounted

future cash flows of the asset, the amount of the impairment is

the difference between the carrying amount and the fair value

of the asset.

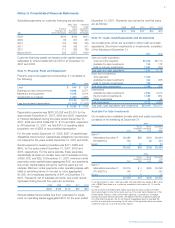

Investments

We classify investment securities as either held-to-maturity or

available-for-sale. Held-to-maturity securities include commer-

cial paper and are carried at amortized cost.

Available-for-sale securities include marketable debt and equity

securities and Enhanced Equipment Trust Certificates (EETCs)

and are recorded at their fair values, with unrealized gains and

losses reported as part of Accumulated other comprehensive

loss on the Consolidated Statements of Financial Position.

Realized gains and losses on marketable securities are recog-

nized based on the cost of securities using the first-in, first-out

method. Realized gains and losses on all other available-for-

sale securities are recognized based on specific identification.

The fair value of marketable securities is based on quoted

market prices. The fair value of non-publicly traded securities,

including certain EETCs, is based on discounted cash flows at

market yield. In cases when we determine that it is probable

that recovery of our investment will come from recovery of col-

lateral, the fair value is based on the underlying collateral.

Available-for-sale and held-to-maturity securities are assessed

for impairment quarterly. To determine if an impairment is

other-than-temporary, we consider the duration and severity of

the loss position, the strength of the underlying collateral, the

term to maturity, and credit rating. For investments that are

deemed other-than-temporarily impaired, losses are recorded in

Cost of products or Cost of services and payments received on

these investments are recorded using the cost recovery method.

The equity method of accounting is used to account for invest-

ments for which we have the ability to exercise significant influ-

ence, but not control, over an investee. Significant influence is

generally deemed to exist if we have an ownership interest in

the voting stock of an investee of between 20% and 50%.

We classify investment income and loss on our Consolidated

Statements of Operations based on whether the investment is

operating or non-operating in nature. Operating investments

align strategically and are integrated with our operations.

Earnings from operating investments, including our share of

income or loss from equity method investments, dividend

income from certain cost method investments, and any

gain/loss on the disposition of these investments, are recorded

in Income from operating investments, net. Non-operating

investments are those we hold for non-strategic purposes.

Earnings from non-operating investments, including interest

and dividends on marketable securities, are recorded in

Other income, net.

The Boeing Company and Subsidiaries