Boeing 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Notes to Consolidated Financial Statements

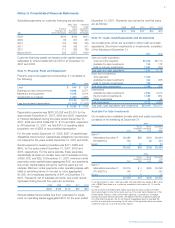

As part of our estimating process, we develop a range of rea-

sonably possible alternate scenarios which include highest

cost estimates for all remediation sites based on our experi-

ence and existing laws and regulations. At December 31, 2007

and 2006 our reasonably possible highest cost estimate for all

remediation sites exceeded our recorded liabilities by $1,191

and $939, excluding the impacts of any potential recoveries.

Discontinued Operations

As part of the 2004 purchase and sale agreement with General

Electric Capital Corporation related to the sale of BCC’s

Commercial Financial Services business, BCC is involved in a

loss sharing arrangement for losses that may exist at the end

of the initial and subsequent financing periods of transferred

portfolio assets, or, in some instances, prior to the end of the

financing term, such as certain events of default and reposses-

sion. As of December 31, 2007, our maximum exposure to

loss associated with the loss sharing arrangement was $224.

As of December 31, 2007 and 2006, the accrued liability under

the loss sharing arrangement was $59 and $78.

Future Lease Commitments

As of December 31, 2007 and 2006, future lease commit-

ments on aircraft and other commitments not recorded on the

Consolidated Statements of Financial Position totaled $240

and $323. These lease commitments extend through 2020,

and our intent is to recover these lease commitments through

sublease arrangements. As of December 31, 2007, the future

lease commitments on aircraft for each of the next five years

were as follows: $43 in 2008, $20 in 2009, $18 in 2010, $19

in 2011, and $19 in 2012. As of December 31, 2007 and

2006, Accounts payable and other liabilities included $42 and

$65 attributable to adverse commitments under these lease

arrangements.

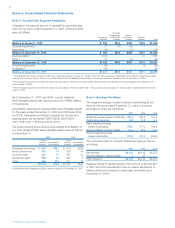

Termination Liability

Due to lack of demand for the 717 and 757 airplanes, we have

concluded production of these airplanes. The last 717 and 757

airplanes were delivered in the second quarter of 2006 and

2005 respectively. The following table summarizes the termina-

tion liability remaining in Accounts payable and other liabilities.

Purchase Obligations

As of December 31, 2007 and 2006 we had $104,023 and

$86,254 of production related purchase obligations not record-

ed on the Consolidated Statement of Financial Position. Such

obligations include agreements for production goods, tooling

costs, electricity and natural gas contracts, property, plant and

equipment, inventory procurement contracts, and other miscel-

laneous production related obligations. As of December 31,

2007, the amounts of production related purchase obligations

for each of the next five years were as follows: $37,922 in

2008, $23,704 in 2009, $17,081 in 2010, $10,976 in 2011,

and $7,305 in 2012.

Commercial Aircraft Commitments

In conjunction with signing a definitive agreement for the sale

of new aircraft, we have entered into specified-price trade-in

commitments with certain customers that give them the right

to trade in their used aircraft for the purchase of Sale Aircraft.

The total contractual trade-in value was $924 and $1,162 as of

December 31, 2007 and 2006. We anticipate that a significant

portion of these commitments will not be exercised by cus-

tomers. There were no probable contractual trade-in commit-

ments as of December 31, 2007. These trade-in commitment

agreements have expiration dates from 2008 through 2015.

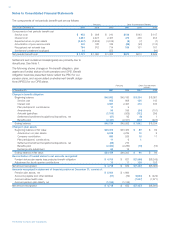

Potential C-17 Shut-Down

As of December 31, 2007, we delivered 171 of the 190 C-17

aircraft ordered by the U.S. Air Force, with final deliveries

scheduled for 2009. In June 2007, based upon continued

bipartisan congressional support, including the House Armed

Services Committee addition of $2.4 billion for 10 C-17s in

their mark of the 2008 budget, and U.S. Air Force testimony to

Congress reflecting interest in additional C-17 aircraft, we

directed key suppliers to begin work on 10 aircraft beyond the

190 currently on order. As of December 31, 2007, inventory

expenditures and potential termination liabilities to suppliers

for work performed related to anticipated orders for 10 C-17

aircraft to the U.S. Air Force and anticipated international

orders for 3 additional aircraft totaled approximately $215. It

2006 2007

Termination Liability

January 1,

2006 Other*

Change in

estimate Payments

December 31,

2006

Change in

estimate

December 31,

Payments 2007

Supplier termination

Production disruption

and shutdown related

Pension/postretirement related

Severance

$239

3

43

19

$(47)

$(4)

4

1

$(190)

(11)

$45

3

9

$(15) $««(18)

(1)

$12

3

8

Total $304 $(47) $«1 $(201) $57 $(15) $(19) $23

*Represents transfer to prepaid pension expense

The above liability was determined based on available infor-

mation and we make revisions to our estimates accordingly

as new information becomes available.

The Boeing Company and Subsidiaries