Boeing 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

Notes to Consolidated Financial Statements

Actual investment allocations vary from target allocations due

to periodic investment strategy changes and the length of time

it takes to complete investments in asset classes such as

private equity, real estate, real assets, and other investments.

Additionally, actual and target allocations vary due to the timing

of benefit payments or contributions made on or near the

measurement date.

Pension investment managers are retained with a specific

investment role and corresponding investment guidelines.

Investment managers have the ability to purchase securities on

behalf of the pension fund and invest in derivatives, such as

equity or bond futures, swaps, options, or currency forwards.

Derivatives generally are used to achieve the desired market

exposure of a security or an index, transfer value-added per-

formance between asset classes, achieve the desired currency

exposure, adjust portfolio duration, or rebalance the total port-

folio to the target asset allocation.

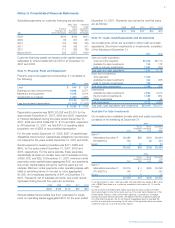

The actual allocations for the pension assets at September 30,

2007 and 2006, and target allocations by asset category, are

as follows:

Percentage of Plan Assets Target

at September 30, Allocations

Asset Category 2007 2006 2007 2006

Equity 38% 55% 28% 28%

Debt 46 37 45 45

Real estate and real assets 4 3 10 10

Private equity 4 3 6 6

Hedge funds 3 2 6 6

Global strategies 55 5

100% 100% 100% 100%

Equity includes domestic and international equity securities,

such as common, preferred or other capital stock, as well as

equity futures, currency forwards and residual cash allocated

to the equity managers. Equity includes our common stock in

the amounts of $0 (0% of plan assets) and $1,260 (2.8% of

plan assets) at September 30, 2007 and 2006. A currency

management strategy was implemented during 2006 which

uses currency forwards and options. Equity and currency

management derivatives based on net notional amounts

totaled 1.9% and 6.6% of plan assets at September 30, 2007

and 2006.

Debt includes domestic and international debt securities, such

as U.S. Treasury securities, U.S. government agency securi-

ties, corporate bonds; cash equivalents; and investments in

bond derivatives such as bond futures, options, swaps and

currency forwards. Bond derivatives based on net notional

amounts totaled 16.6% and 7.0% of plan assets at September

30, 2007 and 2006. Additionally, Debt includes “To-Be-

Announced” mortgage-backed securities (TBA) and treasury

forwards which have delayed, future settlement dates. Debt

included $2,478 and $1,770 related to TBA securities and

treasury forwards at September 30, 2007 and 2006.

Private equity represents private market investments which

are generally limited partnerships. Real estate includes invest-

ments in private and public real estate. Real assets include

investments in natural resources (such as energy and timber)

and infrastructure. Hedge funds include event driven, relative

value, long-short and market neutral strategies. Global strate-

gies seek to identify inefficiencies across various asset classes

and markets, using long-short positions in physical securities

and derivatives.

We held $96 and $89 in trust fund assets for OPB plans at

September 30, 2007 and 2006. Most of these funds are

invested in a balanced index fund which is comprised of

approximately 60% equities and 40% debt securities. The

expected rate of return on these assets does not have a

material effect on the net periodic benefit cost.

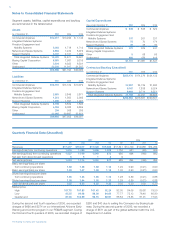

Cash Flows

Contributions Required pension contributions under the

Employee Retirement Income Security Act (ERISA) and the

Pension Protection Act of 2006 are not expected to be

material in 2008. In the first quarter of 2008 we expect to

make a discretionary contribution to our plans of $500 (pre-

tax). We will evaluate additional contributions later in the year.

We expect to contribute approximately $15 to our OPB

plans in 2008.

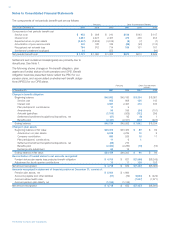

Estimated Future Benefit Payments The table below reflects

the total pension benefits expected to be paid from the plans

or from our assets, including both our share of the benefit cost

and the participants’ share of the cost, which is funded by par-

ticipant contributions. OPB payments reflect our portion only.

Other

Postretirement

Pensions Benefits

2008 $2,576 $524

2009 2,657 553

2010 2,751 582

2011 2,848 609

2012 2,922 622

2013 – 2017 16,571 3,340

Termination Provisions

Certain of the pension plans provide that, in the event there is

a change in control of the Company which is not approved by

the Board of Directors and the plans are terminated within five

years thereafter, the assets in the plan first will be used to pro-

vide the level of retirement benefits required by ERISA, and

then any surplus will be used to fund a trust to continue pres-

ent and future payments under the postretirement medical and

life insurance benefits in our group insurance benefit programs.

We have an agreement with the U.S. government with respect

to certain pension plans. Under the agreement, should we ter-

minate any of the plans under conditions in which the plan’s

assets exceed that plan’s obligations, the U.S. government will

be entitled to a fair allocation of any of the plan’s assets based

on plan contributions that were reimbursed under U.S. govern-

ment contracts.

The Boeing Company and Subsidiaries