Boeing 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Management’s Discussion and Analysis

for three additional aircraft totaled approximately $215 million.

It is reasonably possible that we will decide in 2008 to com-

plete production of the C-17 if further orders are not received.

We are still evaluating the full financial impact of a potential

production shut-down, including any recovery that would be

available from the government. Such recovery from the gov-

ernment would not include the costs incurred by us resulting

from the second-quarter direction to key suppliers to begin

working on the additional 10 aircraft.

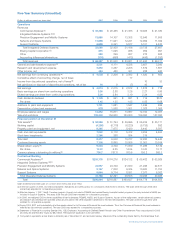

Network and Space Systems Operating Results

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Revenues $11,696 $11,941 $12,221

% of Total company revenues 18% 19% 23%

Earnings from operations $÷÷«891 $÷÷«952 $÷1,395

Operating margins 7.6% 8.0% 11.4%

Research and development $«««««300 $÷÷«301 $÷÷«334

Contractual backlog $÷9,167 $÷7,838 $÷6,324

Unobligated backlog $20,210 $23,723 $27,634

Revenues N&SS revenues decreased 2% in both 2007 and

2006. The decrease of $245 million in 2007 was primarily due

to the exclusion of government Delta volume, now a compo-

nent of our equity investment in ULA and lower FCS volume,

partially offset by increased volume on SBInet and several

satellite programs. The decrease of $280 million in 2006 was

primarily due to lower volume in Proprietary and GMD as well

as the divestiture of our Rocketdyne business, which were

partly offset by significant growth in FCS and higher Delta IV

volume. Additional impacts resulted from fewer milestone com-

pletions in our commercial satellite business in 2006 and the

completion of a Homeland Security contract in 2005.

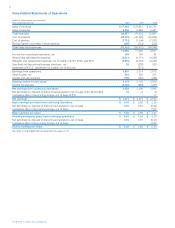

Delta launch and new-build satellite deliveries were as follows:

2007 2006 2005

Delta II Commercial 3

Delta II Government 2 2

Delta IV Government 3

Satellites 4 4 3

Delta government launches are excluded from our deliveries

after December 1, 2006 due to the formation of ULA.

Operating Earnings N&SS operating earnings decreased by

$61 million in 2007 and decreased by $443 million in 2006.

The decrease in 2007 was due to lower earnings on FCS and

several satellite programs. These decreases were partially off-

set by higher award fees on GMD and a $44 million gain on

sale of Anaheim property. The decrease in 2006 was primarily

due to the $569 million net gain on the Rocketdyne sale and

higher contract values for Delta IV launch contracts in 2005,

partially offset by increased earnings in the FCS program in

2006. N&SS operating earnings include equity earnings of

$85 million, $71 million and $72 million from the United Space

Alliance joint venture in 2007, 2006, and 2005, respectively

and equity loss of $11 million and equity earnings of $5 million

from the ULA joint venture in 2007 and 2006. The ULA

equity earnings and loss amounts are net of the basis differ-

ence amortization.

Divestitures On February 28, 2005, we completed the stock

sale of Electronic Dynamic Devices Inc. to L-3 Communications.

On August 2, 2005 we completed the sale of our Rocketdyne

business to United Technologies Corporation. See Note 7 Exit

Activity and Divestitures.

Research and Development The N&SS research and develop-

ment funding remains focused on the development of intelli-

gence and surveillance systems; communications and

command and control capabilities that support a network-

enabled architecture approach for our various government

customers. We are investing in the communications market to

enable connectivity between existing air/ground platforms,

increase communications availability and bandwidth through

more robust space systems, and leverage innovative commu-

nications concepts. Key programs in this area include Joint

Tactical Radio System, FCS, Global Positioning System, and

Transformational Satellite Communications System. Invest-

ments were also made to support concepts that will lead to

the development of next-generation space intelligence sys-

tems. Along with increased funding to support these areas of

architecture and network-enabled capabilities development, we

also maintained our investment levels in global missile defense

and advanced missile defense concepts and technologies.

Backlog N&SS total backlog decreased by 7% in 2007 com-

pared with 2006 due to revenues recognized on multi-year

orders received in prior years on FCS and Proprietary pro-

grams, partially offset by an increase in our Space Exploration

programs. Total backlog decreased by 7% in 2006 compared

with 2005 primarily due to revenues recognized on multi-year

orders received in prior years on the FCS program.

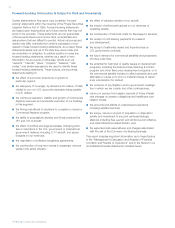

Additional Considerations Items which could have a future

impact on N&SS operations include the following:

United Launch Alliance

On December 1, 2006, we completed

the transaction with Lockheed Martin Corporation (Lockheed)

to create a 50/50 joint venture named United Launch Alliance

L.L.C. (ULA). ULA combines the production, engineering, test

and launch operations associated with U.S. government

launches of Boeing Delta and Lockheed Atlas rockets. In con-

nection with the transaction, we initially contributed net assets

of $914 million at December 1, 2006. On July 24, 2007 we

and Lockheed reached agreement with respect to resolution of

the final working capital and the value of the launch vehicle

support contracts that each party contributed to form ULA.

Effective August 15, 2007 the parties received all necessary

approvals pursuant to the terms of the Consent Order and the

terms of the agreement which resulted in additional contribu-

tions from both parties with Boeing agreeing to contribute an

additional $97 million which did not result in a cash outflow as

it will be offset against future payments due to us from ULA

associated with an inventory supply agreement. Additionally,

conformed accounting adjustments made by ULA resulted in

adjustments to ULA’s balance sheet. The book value of our

investment exceeds our proportionate share of ULA’s net

assets. This difference will be expensed ratably in future years.

Based on the adjusted contributions and the conformed

accounting policies established by ULA, this amortization is

expected to be approximately $14 million annually for the

next 17 years.

The Boeing Company and Subsidiaries