Boeing 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

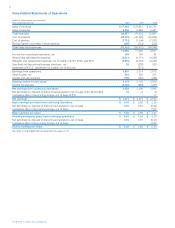

43

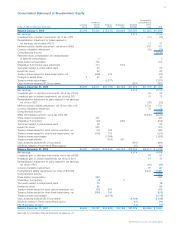

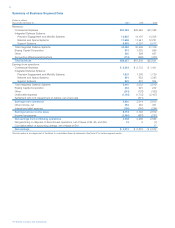

Consolidated Statement of Shareholders’ Equity

(Dollars in millions except per share data)

Common

Stock

Additional

Paid-In

Capital

Treasury

Stock

ShareValue

Trust

Accumulated

Comprehensive

Retained Other

Earnings Loss Total

Balance January 1, 2005 $5,059 $3,420 $««(8,810) $(2,023) $15,565 $(1,925) $11,286

Net earnings 2,572 2,572

Unrealized loss of certain investments, net of tax of $8 (12) (12)

Reclassification adjustment for losses realized in

net earnings, net of taxes of $(15) 21 21

Minimum pension liability adjustment, net of tax of $(45) 167 167

Currency translation adjustment (29) (29)

Comprehensive income 2,719

Restricted stock compensation and reclassification

of deferred compensation 3 3

Share-based compensation 720 720

ShareValue Trust market value adjustment 773 (773)

Tax benefit related to share-based plans 35 35

Excess tax pools 63 63

Treasury shares issued for share-based plans, net (666) 612 (54)

Changes in capital stock 2 23 25

Treasury shares repurchased (2,877) (2,877)

Cash dividends declared ($1.05 per share) (861) (861)

Balance December 31, 2005 $5,061 $4,371 $(11,075) $(2,796) $17,276 $(1,778) $11,059

Net earnings 2,215 2,215

Unrealized gain on derivative instruments, net of tax of $(16) 23 23

Unrealized gain on certain investments, net of tax of $(7) 13 13

Reclassification adjustment for gains realized in net earnings,

net of tax of $23 (39) (39)

Minimum pension liability adjustment, net of tax of $(1,116) 1,733 1,733

Currency translation adjustment 73 73

Comprehensive income 4,018

SFAS 158 transition amount, net of tax of $5,195 (8,242) (8,242)

Share-based compensation 487 487

ShareValue Trust activity (20) (259) (279)

Tax benefit related to share-based plans 36 36

Excess tax pools 325 325

Treasury shares issued for stock options exercised, net (51) 345 294

Treasury shares issued for other share-based plans, net (493) 270 (223)

Treasury shares repurchased (1,698) (1,698)

Treasury shares transfer (301) 301

Cash dividends declared ($1.25 per share) (991) (991)

Dividends related to Performance Share payout (47) (47)

Balance December 31, 2006 $5,061 $4,655 $(12,459) $(2,754) $18,453 $(8,217) $««4,739

Net earnings 4,074 4,074

Unrealized gain on derivative instruments, net of tax of $(58) 97 97

Unrealized gain on certain investments, net of tax of $(11) 17 17

Reclassification adjustment for gains realized in net earnings,

net of tax of $13 (21) (21)

Currency translation adjustment 87 87

Postretirement liability adjustment, net of tax of $(1,948) 3,441 3,441

Comprehensive income 7,695

Share-based compensation 287 287

ShareValue Trust activity (2) 2

Tax benefit related to share-based plans 18 18

Excess tax pools 85 85

Treasury shares issued for stock options exercised, net (32) 241 209

Treasury shares issued for other share-based plans, net (254) 151 (103)

Treasury shares repurchased (2,775) (2,775)

Cash dividends declared ($1.45 per share) (1,129) (1,129)

Dividends related to Performance Share payout (11) (11)

FIN 48 transition amount (11) (11)

Balance December 31, 2007 $5,061 $4,757 $(14,842) $(2,752) $21,376 $(4,596) $««9,004

See notes to consolidated financial statements on pages 44–76.

The Boeing Company and Subsidiaries