Boeing 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Management’s Discussion and Analysis

the $17– $18 billion range in the near future. NASA is continu-

ing to pursue elements of the Vision for Space Exploration,

which will provide additional opportunities.

Commercial Satellite Environment The commercial satellite

market has strengthened since the downturn earlier in the

decade and is expected to stabilize with replacement demand

through the end of the decade. The market remains extremely

competitive with overcapacity across the overall industry and

strong pressure on pricing. We will continue to pursue prof-

itable commercial satellite opportunities where the customer

values our technical expertise and unique solutions.

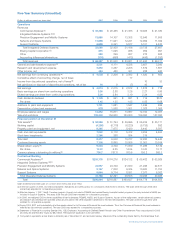

Integrated Defense Systems Operating Results

IDS Realignment Effective January 1, 2007, the B-1 bomber

program (formerly included in PE&MS) and certain Boeing

Australia Limited programs (formerly included in N&SS) are

included in Support Systems. Business segment data for all

periods presented have been adjusted to reflect the realign-

ment. See Note 22.

Operating Results

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Revenues $32,080 $32,439 $31,106

% of Total company revenues 48% 53% 58%

Earnings from operations $««3,440 $««3,032 $««3,919

Operating margins 10.7% 9.3% 12.6%

Research and development $«««««851 $«««««791 $«««««855

Contractual backlog $41,788 $42,291 $36,505

Unobligated backlog $29,922 $33,424 $44,008

Since our operating cycle is long-term and involves many dif-

ferent types of development and production contracts with

varying delivery and milestone schedules, the operating results

of a particular year, or year-to-year comparisons of revenues

and earnings, may not be indicative of future operating results.

In addition, depending on the customer and their funding

sources, our orders might be structured as annual follow-on

contracts, or as one large multi-year order or long-term award.

As a result, period-to-period comparisons of backlog are not

necessarily indicative of future workloads. The following discus-

sions of comparative results among periods should be viewed

in this context.

Revenues IDS revenues decreased 1% in 2007 primarily due

to the exclusion of the government Delta volume from N&SS

revenues, now a revenue component for our joint venture ULA.

Decreased revenue from this exclusion and lower revenues in

the PE&MS segment were partially offset by increased volume

in other N&SS programs and growth in the Support Systems

segment. IDS revenues increased 4% in 2006 as growth in

PE&MS and Support Systems was partially offset by lower vol-

ume in N&SS.

Operating Earnings IDS operating earnings increased by $408

million in 2007 compared with 2006 primarily due to $770 mil-

lion of charges on the AEW&C development program in 2006.

The 2007 increase was partially offset by lower earnings in the

PE&MS and N&SS segments. Operating earnings decreased

by $887 million in 2006 compared with 2005 reflecting a

$569 million net gain on the sale of Rocketdyne in 2005 and

$770 million of charges on the AEW&C development program

in 2006 partially offset by improved margins on other programs.

Backlog Total backlog is comprised of contractual backlog,

which represents work we are on contract to perform for which

we have received funding, and unobligated backlog, which

represents work we are on contract to perform for which fund-

ing has not yet been authorized and appropriated. IDS total

backlog decreased 5% in 2007, from $75,715 million to

$71,710 million, primarily due to current year deliveries and

sales on multi-year contracts awarded in prior years with the

largest decreases in FCS, C-17, and P-8A programs.

For further details on the changes between periods, refer to

the discussions of the individual segments below.

Additional Considerations Our business includes a variety of

development programs which have complex design and tech-

nical challenges. Many of these programs have cost-type con-

tracting arrangements. In these cases the associated financial

risks are primarily in lower profit rates or program cancellation if

milestones and technical progress are not accomplished.

Examples of these programs include Airborne Laser, E/A-18G,

Family of Beyond Line-of-Sight Terminals (JTRS), FCS,

Ground-based Midcourse Defense (GMD), Joint Tactical Radio

System, P-8A and Proprietary programs.

Some of our development programs are contracted on a fixed-

price basis. Many of these programs have highly complex

designs. As technical or quality issues arise, we may experi-

ence schedule delays and cost impacts, which could increase

our estimated cost to perform the work or reduce our estimat-

ed price, either of which could result in a material charge.

These programs are ongoing, and while we believe the cost

and fee estimates incorporated in the financial statements are

appropriate, the technical complexity of these programs cre-

ates financial risk as additional completion costs may become

necessary or scheduled delivery dates could be missed, which

could trigger termination-for-default provisions, the loss of

satellite in-orbit incentive payments, or other financially signifi-

cant exposure. These programs have risk for reach-forward

losses if our estimated costs exceed our estimated contract

revenues. Examples of these programs include AEW&C, inter-

national KC-767 Tanker, commercial and military satellites,

SBInet, Vigilare and High Frequency Modernisation.

Precision Engagement and Mobility Systems

Operating Results

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Revenues $13,685 $14,107 $13,308

% of Total company revenues 21% 23% 25%

Earnings from operations $««1,629 $««1,208 $««1,720

Operating margins 11.9% 8.6% 12.9%

Research and development $÷÷«447 $÷÷«392 $÷÷«432

Contractual backlog $22,957 $24,739 $21,630

Unobligated backlog $÷8,564 $÷8,962 $15,054

The Boeing Company and Subsidiaries