Boeing 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

Management’s Discussion and Analysis

Credit Ratings

Our credit ratings are summarized below:

Standard &

Fitch Moody’s Poor’s

Long-term:

Boeing/BCC A+ A2 A+

Short-term:

Boeing/BCC F1 P-1 A-1

On September 12, 2007, Fitch Ratings revised its ratings out-

look to positive from stable, citing continuation of strong orders

and production ramp-up of large commercial aircraft, in addi-

tion to an over-funded status of our pension plans, debt reduc-

tion and stronger than expected cash flows. The ratings were

reaffirmed at A+ for long-term borrowings and F1 for short-

term borrowings. On January 16, 2008, Fitch Ratings changed

their outlook on the A+ rating to stable from positive, citing the

impact of delays in the 787 program.

Capital Resources

We and BCC have commercial paper programs that continue

to serve as significant potential sources of short-term liquidity.

Throughout 2007 and at December 31, 2007, neither we nor

BCC had any commercial paper borrowings outstanding.

We believe we have substantial borrowing capacity. Currently,

we have $3,000 million ($1,500 million exclusively available for

BCC) of unused borrowing on revolving credit line agreements.

In 2007, we renewed the 364-day revolving credit facility and

the 5-year credit facility, of which $500 million and $1,000 mil-

lion is allocated to BCC. BCC has an aggregate of $3,421 mil-

lion available for issuance from shelf registrations filed with the

SEC, which are due to expire in November 2008. We believe

our internally generated liquidity, together with access to

external capital resources, will be sufficient to satisfy existing

commitments and plans, and also to provide adequate finan-

cial flexibility to take advantage of potential strategic business

opportunities should they arise within the next year.

We and Lockheed have agreed to make available to ULA a line

of credit in the amount of up to $200 million each as may be

necessary from time to time to support ULA’s Expendable

Launch Vehicle business during the five year period following

December 1, 2006. ULA did not request any funds under the

line of credit as of December 31, 2007.

In accordance with Statement of Financial Accounting

Standards No. 158,

Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans—an amendment of

FASB Statements No. 87, 88, 106 and 132(R)

(SFAS 158), we

recognize the funded status of our defined benefit pension and

other postretirement plans, with a corresponding after-tax

adjustment to Accumulated other comprehensive loss. The

2007 annual remeasurement of our pension and other post-

retirement plans resulted in a net $3,441 million increase in

Shareholders’ equity.

As of December 31, 2007, we were in compliance with the

covenants for our debt and credit facilities.

Disclosures about Contractual Obligations and

Commercial Commitments

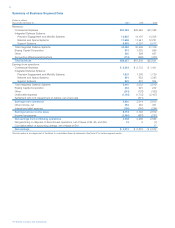

The following table summarizes our known obligations to make

future payments pursuant to certain contracts as of December

31, 2007, and the estimated timing thereof.

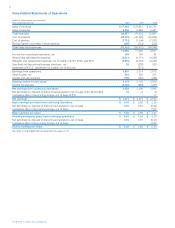

Contractual Obligations

Less than 1–3 3–5 After 5

(Dollars in millions) Total 1 year years years years

Long-term debt

(including current

portion) $««««8,114 $«««««746 $««1,197 $««2,090 $««4,081

Interest on debt* 5,607 507 910 684 3,506

Pension and other

post retirement

cash requirements 7,403 675 1,441 1,549 3,738

Capital lease obligations 103 19 22 22 40

Operating lease

obligations 1,086 221 297 158 410

Purchase obligations

not recorded on

statement of

financial position 104,023 37,922 40,785 18,281 7,035

Purchase obligations

recorded on statement

of financial position 10,827 9,829 598 396 4

Total contractual

obligations $137,163 $49,919 $45,250 $23,180 $18,814

*Includes interest on variable rate debt calculated based on interest rates at

December 31, 2007. Variable rate debt was approximately 3% of our total debt

at December 31, 2007.

Income Tax Obligations

As of December 31, 2007, our total liability for income taxes

payable, including uncertain tax positions, was $1,374 million,

of which $253 million we expect to pay in the next twelve

months. We are not able to reasonably estimate the timing

of future cash flows related to the remaining $1,121 million.

Our income tax obligations are excluded from the table above.

See Note 4.

Pension and Other Postretirement Benefits

Pension cash requirements are based on an estimate of our

minimum funding requirements, pursuant to ERISA regulations,

although we may make additional discretionary contributions.

Estimates of other postretirement benefits are based on both

our estimated future benefit payments and the estimated con-

tributions to a single plan that is funded through a trust.

Purchase Obligations

Purchase obligations represent contractual agreements to

purchase goods or services that are legally binding; specify a

fixed, minimum or range of quantities; specify a fixed, minimum,

variable, or indexed price provision; and specify approximate

timing of the transaction. In addition, the agreements are not

cancelable without substantial penalty. Purchase obligations

include amounts recorded as well as amounts that are not

recorded on the statements of financial position. Approximately

11% of the purchase obligations disclosed above are reim-

bursable to us pursuant to cost-type government contracts.

The Boeing Company and Subsidiaries