Boeing 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Management’s Discussion and Analysis

Other Segment

Other segment operating losses were $243 million during 2007

as compared to losses of $738 million in 2006. The reduction

of $495 million was primarily due to the absence of losses

related to Connexion by Boeing, which we exited in 2006. As

part of our exit from this business, we recognized a charge of

$320 million in 2006, in addition to losses of $237 million for

the year ended December 31, 2006. We have not reached final

settlements with all customers or suppliers. We do not believe

the final settlements will have a material adverse effect on our

earnings, cash flows and/or financial position.

Other segment operating losses were $738 million during 2006

as compared to losses of $363 million in 2005. The increase of

$375 million was primarily due to the $320 million charge from

the exit of the Connexion by Boeing business and the $68 mil-

lion environmental expense recognized in 2006. The Other

segment recorded $74 million of lower valuation allowances for

customer financing in 2006 compared to 2005. Additionally,

during 2005, the Other segment recognized earnings of $63

million associated with the buyout of several operating lease

aircraft by a customer.

Liquidity and Capital Resources

Cash Flow Summary

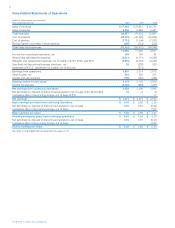

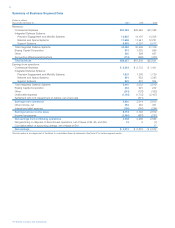

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Net earnings $«4,074 $«2,215 $«2,572

Non-cash items 2,835 3,097 3,494

Changes in working capital 2,675 2,187 934

Net cash provided by

operating activities 9,584 7,499 7,000

Net cash used by investing activities (3,822) (3,186) (98)

Net cash used by financing activities (4,884) (3,645) (4,657)

Effect of exchange rate changes

on cash and cash equivalents 46 38 (37)

Net increase in cash and

cash equivalents

Cash and cash equivalents

at beginning of year

Cash and cash equivalents

at end of year

924

6,118

$«7,042

706

5,412

$«6,118

2,208

3,204

$«5,412

Operating Activities

Net cash provided by operating activities increased by $2,085

million to $9,584 million in 2007, primarily due to an increase

in Net earnings. In addition, working capital improved in 2007,

reflecting higher advances driven by commercial airplane

orders and decreases in customer financing assets due to

pre-payment of certain notes receivable and normal portfolio

run-off, which were partially offset by an increase in inventories

driven by the continued ramp-up of the 787 program.

Net cash provided by operating activities increased by $499

million to $7,499 million in 2006. The increase was primarily

due to working capital improvements which were partially off-

set by lower Net earnings. The working capital improvements

in 2006 compared with 2005 reflect $1,340 million of lower

pension contributions in 2006. Working capital reductions in

2006 also reflect higher advances driven by commercial air-

plane orders, decreased investment in customer financing, and

lower income tax payments which were partially offset by a

decrease in accounts payable and other liability.

Investing Activities

Cash used for investing activities increased to $3,822 million in

2007 from $3,186 million in 2006, largely due to increases in

short-term investments, primarily time deposits and commer-

cial paper, partially offset by our investment in the acquisition

of Aviall in 2006. At December 31, 2007 the recorded balances

of time deposits and commercial paper classified as short-term

investments were $1,025 million and $799 million.

As of December 31, 2007, our externally managed portfolio of

investment grade fixed income instruments had an average

duration of 1.5 years. The balance, at December 31, 2007 and

2006, was $3,269 million and $3,180 million, of which $306

million and $257 million was classified as short-term. The

investments are held as available for sale.

Cash used for investing activities increased to $3,186 million in

2006 from $98 million in 2005. The increase is primarily due to

our investment of $1,738 million in the 2006 acquisition of

Aviall, net of $42 million of cash acquired, and $458 million of

assumed debt, in an all-cash merger. The assumed debt was

repaid on the acquisition closing date. In 2005, we received

proceeds of $1,676 million, primarily from the disposition of our

Commercial Airplanes operations in Wichita, Kansas and Tulsa

and McAlester, Oklahoma, and the sale of Rocketdyne.

Financing Activities

Cash used by financing activities increased to $4,884 million in

2007 from $3,645 million in 2006 primarily due to increased

common share repurchases. Cash used by financing activities

decreased to $3,645 million in 2006 from $4,657 million in

2005 primarily due to lower common share repurchases.

During 2007, we repurchased 28,995,599 shares at an aver-

age price of $95.68 in our open market share repurchase pro-

gram and 28,432 shares in stock swaps. During 2006, we

repurchased 21,184,202 shares at an average price of $80.18

in our open market share repurchase program, 3,749,377

shares at an average price of $80.28 as part of the ShareValue

Trust distribution, and 49,288 shares in stock swaps. During

2005, we repurchased 45,217,300 shares at an average price

of $63.60 in our open market share repurchase program and

33,660 shares in stock swaps.

In 2007, we repaid $1,406 million of debt, including $1,309 mil-

lion of debt held at BCC. In 2006, we repaid $1,681 million of

debt, including $713 million of debt held at BCC and $458 mil-

lion of debt assumed in the Aviall acquisition. In 2005, we repaid

$1,378 million of debt. There were no debt issuances during

2007, 2006, or 2005. At December 31, 2007 and 2006, the

recorded balance of debt was $8,217 million and $9,538 million,

of which $4,327 million and $5,590 million was recorded at BCC.

The Boeing Company and Subsidiaries