Boeing 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

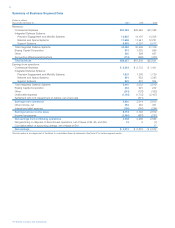

Notes to Consolidated Financial Statements

associated with tax positions, accounting for income taxes in

interim periods and income tax disclosures. The cumulative

effects of applying this interpretation have been recorded as a

decrease of $11 to Retained earnings, an increase of $125 to

Deferred income taxes and an increase of $136 to Income

taxes payable as of January 1, 2007.

In conjunction with adoption of FIN 48, we classified uncertain

tax positions as non-current income tax liabilities unless

expected to be paid in one year. We also began reporting

income tax-related interest income in Income tax expense in

our Consolidated Statement of Operations. In prior periods,

such interest income was reported in Other income. Within the

Consolidated Statements of Operations, Other income includ-

ed interest of $16 in 2006 and $100 in 2005 related to federal

income tax settlements for prior years. Penalties and tax-related

interest expense are reported as a component of Income

tax expense. As of December 31 and January 1, 2007, the

amount of accrued income tax-related interest and penalties

included in the Consolidated Statement of Financial Position

was as follows: interest of $143 and $63, and penalties of

$17 and $1. The amounts of interest and penalties accrued

during 2007 are $108 and $17 respectively.

We are subject to examination in the U.S. federal tax jurisdic-

tion for the 1998-2007 tax years. We are also subject to exam-

ination in major state and foreign jurisdictions for the

2001–2007 tax years, for which no individually material unrec-

ognized tax benefits exist. During the third quarter of 2007 we

received an Internal Revenue Service (IRS) audit report for the

2002-2003 tax years and have filed an appeal. We have also

filed appeals with the IRS for the 1998-2001 tax years. We

believe appropriate provisions for all outstanding issues have

been made for all jurisdictions and all open years.

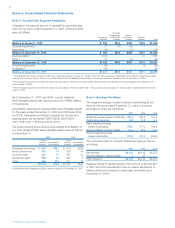

A reconciliation of the beginning and ending amount of un-

recognized tax benefits is as follows:

Unrecognized Tax Benefits – January 1, 2007 $1,097

Gross increases – tax positions in prior periods 181

Gross decreases – tax positions in prior periods (85)

Gross increases – current-period tax positions 89

Lapse of statute of limitations (10)

Unrecognized Tax Benefits – December 31, 2007 $1,272

As of December 31 and January 1, 2007, the total amount of

unrecognized tax benefits was $1,272 and $1,097, of which

$1,032 and $905 would affect the effective tax rate, if recog-

nized. These amounts are primarily associated with U.S. feder-

al tax issues such as the tax benefits from the Foreign Sales

Corporation/Extraterritorial Income (FSC/ETI) tax rules, the

amount of research and development tax credits claimed,

U.S. taxation of foreign earnings, and valuation issues regard-

ing charitable contributions claimed. Also included in these

amounts are accruals for domestic state tax issues such as

the allocation of income among various state tax jurisdictions

and the amount of state tax credits claimed.

It is reasonably possible that within the next 12 months we

and the IRS will resolve some of the matters presently under

consideration at appeals for 1998-2003 which may increase

or decrease unrecognized tax benefits for all open tax years.

Settlement could increase earnings in an amount ranging from

$0 to $130 based on current estimates. Audit outcomes and the

timing of audit settlements are subject to significant uncertainty.

The Research and Development credit expired on December

31, 2007. The credit provided a 2.4% and a 0.7% reduction in

the 2007 and 2006 effective tax rate. Congress is currently

considering bills that will extend the credit. If the Research and

Development credit is not legislatively enacted there could be

an unfavorable impact on our 2008 effective income tax rate.

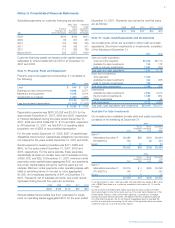

Note 5 – Accounts Receivable

Accounts receivable at December 31 consisted of

the following:

2007 2006

U.S. government contracts $2,838 $2,667

Commercial customers 1,232 1,423

Other1 1,742 1,278

Less valuation allowance (72) (83)

$5,740 $5,285

1 Included $498 and $538 of reinsurance receivables held by Astro Ltd., a

wholly owned subsidiary, which operates as a captive insurance company and

$683 and $308 related to non-U.S. military contracts at December 31, 2007

and 2006.

The following table summarizes our accounts receivable

under long-term contracts that were not billable or related to

outstanding claims as of December 31:

2007 2006

Unbillable

Current $«««825 $«««830

Expected to be collected after one year 520 705

$1,345 $1,535

Claims

Current $÷÷«18 $÷÷«10

Expected to be collected after one year 128 84

$÷«146 $÷÷«94

Unbillable receivables on long-term contracts arise when the

sales or revenues based on performance attainment, though

appropriately recognized, cannot be billed yet under terms of

the contract as of the balance sheet date. Accounts receivable

related to claims are items that we believe are earned, but

are subject to uncertainty concerning their determination or

ultimate realization. Accounts receivable, other than those

described above, expected to be collected after one year

are not material.

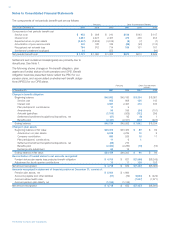

Note 6 – Inventories

Inventories at December 31 consisted of the following:

2007 2006

Long-term contracts in progress $«13,159 $«12,329

Commercial aircraft programs 11,710 8,743

Commercial spare parts, used aircraft,

general stock materials and other 3,401 2,888

28,270 23,960

Less advances and progress billings (18,707) (15,855)

$«««9,563 $«««8,105

The Boeing Company and Subsidiaries