Boeing 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Management’s Discussion and Analysis

airplanes. Additionally, other competitors from Russia, China,

and Japan are likely to enter the 70 to 130 seat aircraft market

over the next few years. This market environment has resulted

in intense pressures on pricing and other competitive factors.

Worldwide, airplane sales are generally conducted in U.S. dol-

lars. Fluctuating exchange rates affect the profit potential of our

major competitors, all of whom have significant costs in other

currencies. A decline of the U.S. dollar relative to their local

currencies as experienced in 2007 puts pressure on competi-

tors’ revenues and profits. Competitors often respond by

aggressively reducing costs and increasing productivity, there-

by improving their longer-term competitive posture. Airbus has

recently announced such initiatives targeting a two-year reduc-

tion in its development cycle and a significant increase in over-

all productivity by 2010. If the U.S. dollar strengthens, Airbus

can use the extra efficiency to develop new products and gain

market share.

We are focused on improving our processes and continuing

cost-reduction efforts. We continue to leverage our extensive

customer support services network which includes aviation

support, spares, training, maintenance documents and tech-

nical advice for airlines throughout the world. This enables

us to provide a higher level of customer satisfaction and pro-

ductivity. These efforts enhance our ability to pursue pricing

strategies that enable us to price competitively and maintain

satisfactory margins.

717

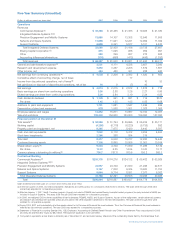

Operating Results

(Dollars in millions)

Years ended December 31, 2007 2006 2005

Revenues $÷33,386 $÷28,465 $÷21,365

% of Total company revenues 50% 46% 40%

Earnings from operations $÷÷3,584 $÷÷2,733 $÷÷1,431

Operating margins 10.7% 9.6% 6.7%

Research and development $÷÷2,962 $÷÷2,390 $÷÷1,302

Contractual backlog $255,176 $174,276 $124,132

Revenues The increase in revenue of $4,921 million in 2007

from 2006 was primarily attributable to higher new airplane

deliveries, including model mix changes, of $3,369 million,

increased commercial aviation support business of $1,432 mil-

lion and $120 million primarily attributable to revenue from

aircraft trading.

The increase in revenue of $7,100 million in 2006 from 2005

was primarily attributable to higher new airplane deliveries,

including model mix changes, of $6,820 million, increased

commercial aviation support business of $873 million offset

by $593 million primarily attributable to lower revenue from

aircraft trading. In 2005 we delivered 29 fewer than expected

airplanes due to the International Association of Machinists

and Aerospace Workers (IAM) strike during the month of

September 2005. This resulted in approximately $2,000 million

lower revenue than anticipated for 2005.

Commercial jet aircraft deliveries as of December 31, including

deliveries under operating lease, which are identified by paren-

theses, were as follows:

737 NG 747 757 767 777 Total

2007

Cumulative Deliveries 155 2,466 1,396 1,049 959 687

Deliveries 330* 16 12* 83 441

2006

Cumulative Deliveries 155 2,136 1,380 1,049 947 604

Deliveries 5(3) 302* 14 12* 65 398

2005

Cumulative Deliveries 150 1,834 1,366 1,049 935 539

Deliveries 13(5) 212* 13 2 10* 40 290

*Intracompany deliveries were one 767 aircraft and one 737 Next Generation aircraft in 2007, two 767 aircraft and eight 737 Next Generation aircraft in 2006 and

two 767 aircraft and two 737 Next Generation aircraft in 2005.

Earnings from Operations The $851 million increase in

earnings from operations in 2007 over the comparable period

of 2006 was primarily attributable to earnings of $950 million

on increased new aircraft deliveries and $304 million in

increased earnings primarily attributable to commercial aviation

support business. In addition cost performance improved by

$169 million. These were offset by an increase in research

and development costs of $572 million.

The $1,302 million increase in earnings from operations in

2006 over the comparable period of 2005 was primarily attrib-

utable to earnings of $1,781 million on increased new aircraft

deliveries and $315 million in increased earnings primarily

attributable to commercial aviation support business. In addi-

tion cost performance improved by $226 million. Such items

were offset by increased research and development costs of

$1,088 million. In 2005 we had a loss on the sale of Wichita,

Kansas and Tulsa and McAlester, Oklahoma operations of

$68 million. The IAM strike resulted in lower operating earnings

in 2005 due to 29 fewer than expected airplane deliveries.

Backlog The backlog increase in 2007 related to orders in

excess of deliveries for all programs, while the increase in 2006

related to orders in excess of deliveries for 737NG, 747 and 787.

Accounting Quantity The accounting quantity is our estimate

of the quantity of airplanes that will be produced for delivery

under existing and anticipated contracts. Its determination is

limited by the ability to make reasonably dependable estimates

of the revenue and costs of these contracts. It is a key deter-

minant of gross margins we recognize on sales of individual

airplanes throughout a program’s life. Estimation of each pro-

gram’s accounting quantity takes into account several factors

that are indicative of the demand for that program, including

The Boeing Company and Subsidiaries