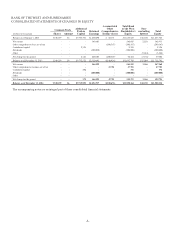

Bank of the West 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Organization and Summary of Significant Accounting Policies

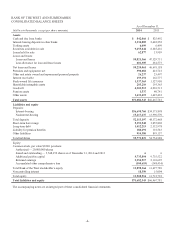

Bank of the West (“BOW”), a State of California chartered bank, has 585 retail branch banking locations (568 full

service retail branches and 17 limited service retail offices) and other commercial banking offices, as of December 31,

2014, located in Arizona, California, Colorado, Idaho, Iowa, Kansas, Minnesota, Missouri, Nebraska, Nevada, New

Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin and Wyoming providing a

wide range of financial services to both consumers and businesses. BOW also has branches serving Pacific Rim

customers, specializing in domestic and international products and services in predominantly Asian American

communities. In addition, the Bank has a commercial banking office in New York and an offshore office in the Cayman

Islands. The terms “the Bank,” “we,” “our,” “us” and similar terms used in this report refer to Bank of the West and its

subsidiaries.

BancWest Corporation (“BancWest”), a financial holding company, as of December 31, 2014 and 2013, owned all

of the outstanding common stock of BOW. BOW also had authorized 1,000,000 shares of preferred stock, none of which

were issued or outstanding as of December 31, 2014 and 2013.

BancWest is a wholly owned subsidiary of BNP Paribas (“BNPP”), a financial institution based in France.

BancWest’s other bank subsidiary (wholly owned) is First Hawaiian Bank.

Regulation

The Bank’s primary regulators are the Federal Deposit Insurance Corporation (“FDIC”) and the California

Department of Financial Institutions. The Bank is a member of the Federal Home Loan Bank System and is required to

maintain an investment in the capital stock of the Federal Home Loan Bank (“FHLB”). The Bank maintains insurance on

its customer deposit accounts with the FDIC, which requires quarterly assessments.

Basis of presentation

The accounting and reporting policies of the Bank and its subsidiaries conform to accounting principles generally

accepted in the United States (“GAAP”). The accompanying consolidated financial statements include the accounts of

the Bank and its subsidiaries in which the Bank has controlling financial interests as well as variable interest entities

(“VIEs”) in which the Bank determines it is the primary beneficiary. The Bank is the primary beneficiary of a VIE if we

have: (1) a variable interest in the entity; (2) the power to direct key activities of the VIE that most significantly impact

it’s economic performance; and (3) the obligation to absorb losses or the right to receive benefits from the VIE that

could potentially be significant to the VIE. All material intercompany transactions among the Bank and its consolidated

entities have been eliminated.

For consolidated entities where it holds less than a 100% interest, the Bank reports income or loss attributable to

noncontrolling stockholders in the consolidated statements of income, and the equity interest attributable to

noncontrolling stockholders in the equity section of the consolidated balance sheets.

All other investments in entities that are not consolidated are accounted for either under the equity method, cost

method or effective yield method where applicable.

Use of estimates

The preparation of the consolidated financial statements and related notes thereto in accordance with GAAP

requires management to make judgments using estimates and assumptions that affect the reported amounts of assets and

liabilities, revenue and expense, and disclosures of contingent assets and liabilities. While management makes its best

judgment, actual amounts or results could differ from those estimates.

Reclassifications

Certain amounts in the consolidated financial statements and notes thereto for the prior year have been reclassified

to conform to the current financial statement presentation. Material reclassifications are otherwise disclosed.

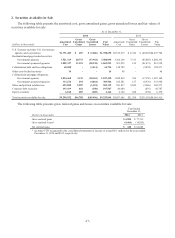

Cash and due from banks

Cash and due from banks include noninterest-bearing amounts due from other financial institutions as well as in-

transit clearings. For purposes of the consolidated statements of cash flows, the Bank includes as cash and cash

equivalents, cash and due from banks, interest-bearing deposits in other banks, federal funds sold and securities

purchased under agreements to resell (with original maturities of less than three months).

-7-