Bank of the West 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

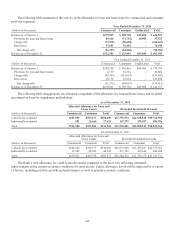

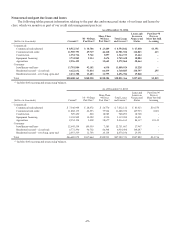

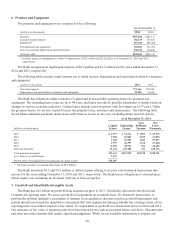

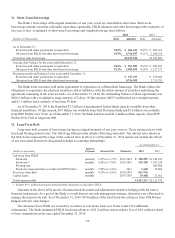

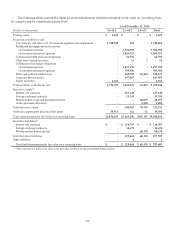

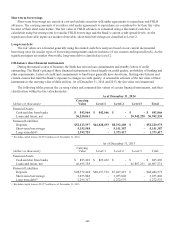

As of December 31, 2014, the aggregate annual maturities due on long-term debt were as follows:

(dollars in thousands)

2015 $ 730,995

2016 188,361

2017 120,780

2018 320,501

2019 1,385

2020 and thereafter 50,191

Total $1,412,213

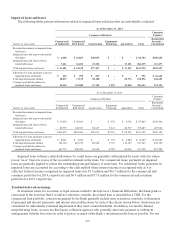

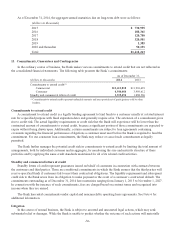

13. Commitments, Guarantees and Contingencies

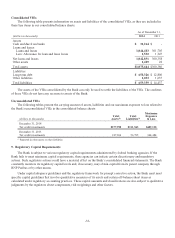

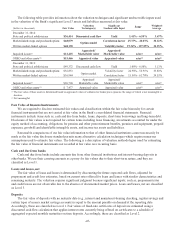

In the ordinary course of business, the Bank makes various commitments to extend credit that are not reflected in

the consolidated financial statements. The following table presents the Bank’s commitments:

As of December 31,

(dollars in thousands) 2014 2013

Commitments to extend credit(1)

Commercial $13,413,818 $11,903,439

Consumer 4,540,084 3,909,612

Standby and commercial letters of credit 1,339,494 1,088,506

(1) Commitments to extend credit represent unfunded amounts and are reported net of participations sold to other

lenders.

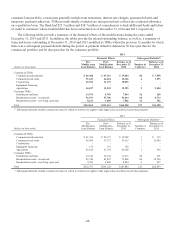

Commitments to extend credit

A commitment to extend credit is a legally binding agreement to lend funds to a customer usually at a stated interest

rate for a specified purpose with fixed expiration dates and generally require a fee. The extension of a commitment gives

rise to credit risk. The actual liquidity requirements or credit risk that the Bank will experience will be lower than the

contractual amount of commitments to extend credit, because a significant portion of those commitments are expected to

expire without being drawn upon. Additionally, certain commitments are subject to loan agreements containing

covenants regarding the financial performance obligations a customer must meet before the Bank is required to fund the

commitment. For our consumer loan commitments, the Bank may reduce or cancel such commitments as legally

permitted.

The Bank further manages the potential credit risk in commitments to extend credit by limiting the total amount of

arrangements, both by individual customer and in aggregate, by monitoring the size and maturity structure of these

portfolios and by applying the same credit standards maintained for all of its related credit activities.

Standby and commercial letters of credit

Standby letters of credit represent guarantees issued on behalf of customers in connection with contracts between

the customers and third parties. These are conditional commitments in which the Bank assures that the third parties will

receive specified funds if customers fail to meet their contractual obligations. The liquidity requirement and subsequent

credit risk to the Bank arises from its obligation to make payment in the event of a customer’s contractual default. The

commitments outstanding as of December 31, 2014 have maturities ranging from January 1, 2015 to November 1, 2027.

In connection with the issuance of such commitments, fees are charged based on contract terms and recognized into

income when they are earned.

The Bank has rental commitments under capital and noncancelable operating lease agreements. See Note 6 for

additional information.

Litigation

In the course of normal business, the Bank is subject to asserted and unasserted legal actions, which may seek

substantial relief or damages. While the Bank is unable to predict whether the outcome of such actions will materially

-36-