Bank of the West 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

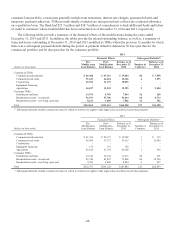

estimates and perform impairment evaluations, actual results in the future could differ significantly. Impairment tests in

future periods may result in impairment charges, which could materially impact our future reported results.

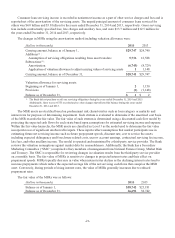

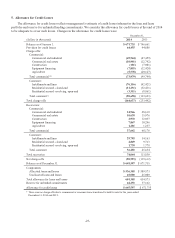

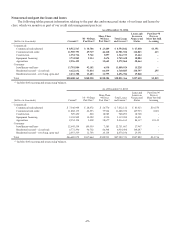

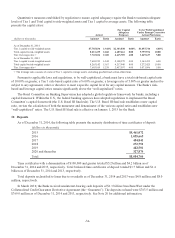

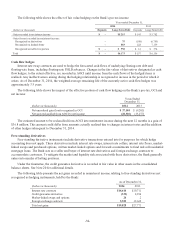

The following table presents our finite-lived intangible assets:

(dollars in thousands)

Gross

Carrying

Amount

Less

Accumulated

Amortization

Net

Book

Value

Balance as of December 31, 2014:

Core deposits (1) $195,059 $163,532 $ 31,527

Software(2) 330,200 194,533 135,667

MSRs and other 85,539 49,523 36,016

Total 610,798 407,588 203,210

Balance as of December 31, 2013:

Core deposits (1) 195,059 150,996 44,063

Software(2) 281,088 170,224 110,864

MSRs and other 79,811 41,375 38,436

Total $555,958 $362,595 $193,363

(1) Does not include fully amortized assets.

(2) Includes in process software not subject to amortization of $57.6 million and $43.2 million as of December 31, 2014 and

2013, respectively.

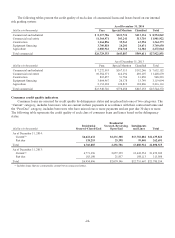

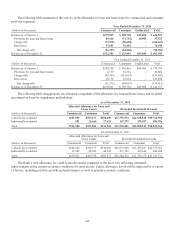

Intangible amortization expense included in noninterest expense was $42.1 million and $36.7 million for the years

ended December 31, 2014 and 2013, respectively. For the years ended December 31, 2014 and 2013, the Bank’s review

did not result in any material impairment. See Note 3 for valuation allowance related to MSRs.

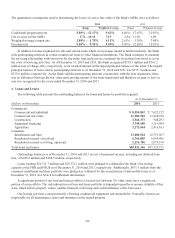

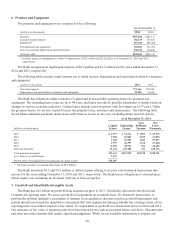

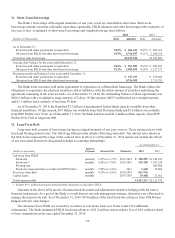

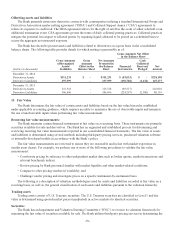

The table below presents the estimated future annual amortization expense for finite-lived intangible assets for the

years ending December 31:

(dollars in thousands) Core Deposits Software

MSRs and

Other Total

2015 $12,517 $26,178 $5,797 $44,492

2016 12,498 22,355 4,991 39,844

2017 6,392 17,022 4,551 27,965

2018 58 10,009 4,059 14,126

2019 39 2,272 3,533 5,844

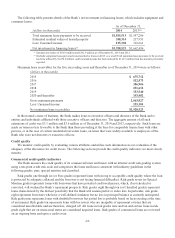

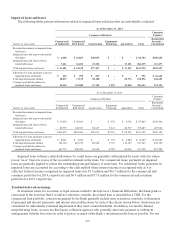

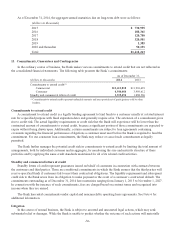

8. Variable Interest Entities

A VIE is an entity that has either a total equity investment that is insufficient to finance its activities without

additional subordinated financial support or whose equity investors lack the ability to control the entity’s activities.

Under existing accounting guidance, a VIE is consolidated by its primary beneficiary, the party that has both the power

to direct the activities that most significantly impact the VIE and a variable interest that could potentially be significant

to the VIE.

The Bank evaluates whether an entity is a VIE upon its creation and upon the occurrence of significant events; such

as a change in an entity’s assets or activities. The determination of whether the Bank is the primary beneficiary involves

performing a qualitative analysis of the VIE. The analysis includes its capital structure, contractual terms including the

rights of each variable interest holder, the activities of the VIE that most significantly impact its economic performance,

whether the Bank has the power to direct those activities and our obligation to absorb losses or the right to receive

benefits significant to the VIE.

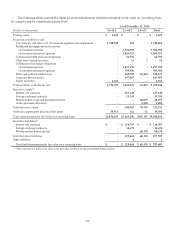

Limited liability companies

The Bank has formed CLAAS Financial Services, LLC with the purpose of providing lease and loan financing to

commercial entities acquiring agricultural equipment. The Bank owns 51% interest in the LLC and has the obligation to

-31-