Bank of the West 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

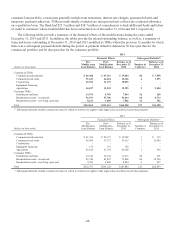

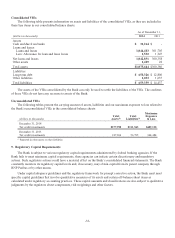

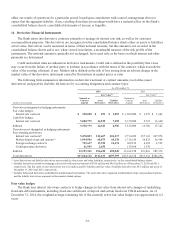

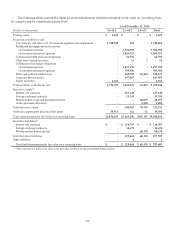

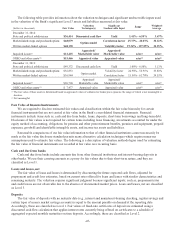

The following table shows the effect of fair value hedging on the Bank’s pre-tax income:

Years ended December 31,

2014 2013

(dollars in thousands) Deposits Long-Term Debt Deposits Long-Term Debt

Gains recorded in net interest income $ - $5,215 $ 143 $ 5,782

Gains (losses) recorded in noninterest income:

Recognized on derivatives -75(108) (6,785)

Recognized on hedged items - 883 122 7,159

Recognized as ineffective portion $ - $ 958 $ 14 $ 374

Total $ - $6,173 $ 157 $ 6,156

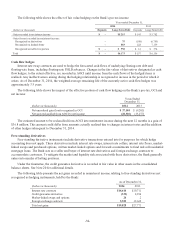

Cash flow hedges

Interest rate swap contracts are used to hedge the forecasted cash flows of underlying floating-rate debt and

floating-rate loans, including floating-rate FHLB advances. Changes in the fair values of derivatives designated as cash

flow hedges, to the extent effective, are recorded in AOCI until income from the cash flows of the hedged items is

realized. Any ineffectiveness arising during the hedging relationship is recognized in income in the period in which it

arises. As of December 31, 2014, the weighted-average remaining life of the currently active cash flow hedges was

approximately 3.5 years.

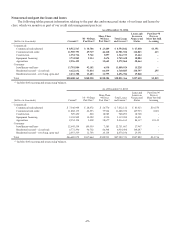

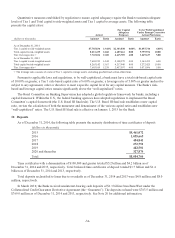

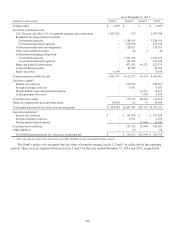

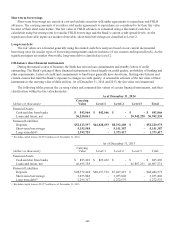

The following table shows the impact of the effective portion of cash flow hedging on the Bank’s pre-tax, OCI and

net income:

Years Ended

December 31,

(dollars in thousands) 2014 2013

Net unrealized gain (loss) recognized in OCI $ 37,105 $ (9,205)

Net gain reclassified from AOCI to net income (28,320) (13,277)

The estimated amount to be reclassified from AOCI into noninterest income during the next 12 months is a gain of

$36.8 million. This amount could differ from amounts actually realized due to changes in interest rates and the addition

of other hedges subsequent to December 31, 2014.

Free-standing derivatives

Free-standing derivative instruments include derivative transactions entered into for purposes for which hedge

accounting does not apply. These derivatives include interest rate swaps, interest rate collars, interest rate floors, market-

linked swaps and purchased options, written market-linked options and forward commitments to fund and sell residential

mortgage loans. The Bank acts as a seller and buyer of interest rate derivatives and foreign exchange contracts to

accommodate customers. To mitigate the market and liquidity risk associated with these derivatives, the Bank generally

enters into similar offsetting positions.

Under the Guarantee, the credit guarantee derivative is recorded at fair value in other assets in the consolidated

balance sheets. See Note 20 for additional details.

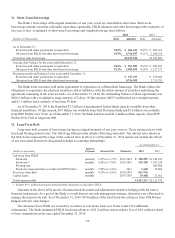

The following table presents the net gains recorded in noninterest income relating to free-standing derivatives not

recognized as hedging instruments, held by the Bank:

As of December 31,

(dollars in thousands) 2014 2013

Interest rate contracts $14,614 $10,711

Credit guarantee derivative (333) 4,396

Market-linked swaps and options 24 2

Foreign exchange contracts 5,523 12,662

Total net gains $19,828 $27,771

-38-