Bank of the West 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

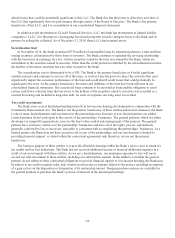

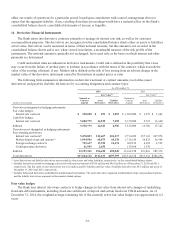

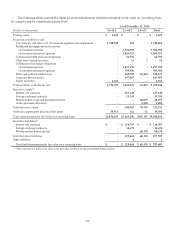

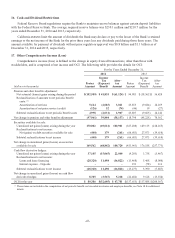

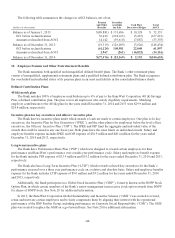

The following tables present the financial assets and financial liabilities measured at fair value on a recurring basis

by category and by valuation hierarchy level:

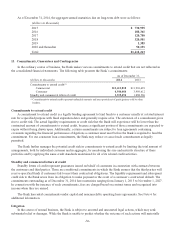

As of December 31, 2014

(dollars in thousands) Level 1 Level 2 Level 3 Total

Trading assets $ 6,499 $ - $ - $ 6,499

Securities available for sale:

U.S. Treasury and other U.S. Government agencies and corporations 1,788,589 101 - 1,788,690

Residential mortgage-backed securities:

Government agencies - 3,504,098 - 3,504,098

Government sponsored agencies - 1,865,522 - 1,865,522

Collateralized debt and loan obligations - 64,794 - 64,794

Other asset-backed securities -13114

Collateralized mortgage obligations:

Government agencies - 1,017,430 - 1,017,430

Government sponsored agencies - 309,506 - 309,506

States and political subdivisions - 465,705 36,414 502,119

Corporate debt securities - 197,507 - 197,507

Equity securities 6,164 - - 6,164

Total securities available for sale 1,794,753 7,424,676 36,415 9,255,844

Derivative assets(1):

Interest rate contracts - 227,148 - 227,148

Foreign exchange contracts - 13,354 - 13,354

Market-linked swaps and purchased options - - 68,079 68,079

Credit guarantee derivative - - 2,650 2,650

Total derivative assets - 240,502 70,729 311,231

Deferred compensation plan and other assets 34,913 112 11 35,036

Total assets measured at fair value on a recurring basis $1,836,165 $7,665,290 $107,155 $9,608,610

Derivative liabilities(1)

Interest rate contracts $ - $ 214,787 $ - $ 214,787

Foreign exchange contracts - 14,674 - 14,674

Written market-linked options - - 68,138 68,138

Total derivative liabilities - 229,461 68,138 297,599

Other liabilities -4-4

Total liabilities measured at fair value on a recurring basis $ - $ 229,465 $ 68,138 $ 297,603

(1) These amounts are reflected in other assets and other liabilities on the consolidated balance sheets.

-41-