Bank of the West 2014 Annual Report Download - page 13

Download and view the complete annual report

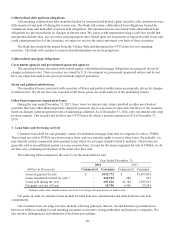

Please find page 13 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Bank also maintains a reserve for losses on unfunded loan commitments and letters of credit, which is recorded

within other liabilities. The Bank measures the amount of reserve based on estimates of the probability of the ultimate

funding and losses related to credit exposures that exist at the balance sheet date, similar to the methodology used for the

loans and leases portfolio.

While the Bank has a formal methodology to determine the adequate and appropriate level of the allowance for

credit losses, estimates of inherent loan, lease and unfunded loan commitment losses involve judgment and assumptions

as to various factors, including current economic conditions. Management’s determination of adequacy of the total

allowance for credit losses is based on quarterly evaluations of the above factors. Accordingly, the provision for credit

losses will vary from period to period based on management’s ongoing assessment of the adequacy of the Allowance.

See Note 5 for information on how the Bank’s experience and current economic conditions have influenced

management’s determination of the Allowance.

Charge-off and recovery policies for loans and leases

The Bank’s policy is to fully charge-off or partially charge down to net realizable value when a loan or lease is

deemed to be uncollectible and all commercially reasonable means of recovering those payments have been exhausted.

A commercial loan or lease that is considered to be individually impaired is charged off, partially or fully, when

potential recovery of the recorded loan balance is unlikely as a result of a shortfall in collateral value or the borrower’s

financial difficulty. Consumer installment loans and leases are generally charged off, partially or fully, upon reaching a

predetermined delinquency status that ranges from 120 to 180 days depending on the type of consumer installment loans

and leases.

Recoveries of amounts on nonaccrual loans that have previously been charged off are credited to the Allowance and

are generally recorded only to the extent that cash or other assets are received.

Troubled debt restructurings

In situations where for economic or legal reasons related to the borrower’s financial difficulties, the Bank grants a

concession to the borrower that it would not otherwise consider, the related loan is classified as a troubled debt

restructuring (“TDR”). Concessions generally include modifications to the loan’s terms, including but not limited to

interest rate modifications and reductions, principal and interest forgiveness, term extensions or renewals, or any other

actions that may minimize the potential economic loss to the Bank.

Generally, all loans modified in a TDR (including consumer loans that have been discharged in a Chapter 7

Bankruptcy) are placed or remain on nonaccrual status at the time of the restructuring. However, certain accruing loans

modified in a TDR that are current at the time of restructuring may remain on accrual status if payment in full under the

restructured terms is expected.

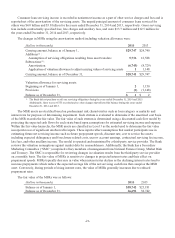

Premises and equipment

Premises and equipment, including leasehold improvements, are stated at cost less accumulated depreciation and

amortization. Depreciation and amortization are computed on a straight-line basis over the estimated useful lives as

follows:

Premises 10-39 years

Furniture and equipment 3-20 years

Leasehold improvements Shorter of the lease term or estimated remaining life

We periodically evaluate our long-lived assets for impairment. We perform these evaluations whenever events or

changes in circumstances suggest that the carrying amount of an asset or group of assets is not recoverable. If

impairment recognition criteria are met, an impairment charge is reported in noninterest expense.

Lease commitments

Lease commitments are transactions entered into by the Bank where the Bank is the lessee. Leases are classified as

either a capital or an operating lease depending on the terms and conditions of the contracts. For assets accounted for as

capital leases, depreciation is recorded on a straight-line basis over the period of the lease term or the estimated useful

life of the asset, depending on the nature of the transaction. Lease obligations recorded under capital leases are reduced

by lease payments net of imputed interest. Operating leases are contracts that do not transfer substantially all of the

-11-