Bank of the West 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

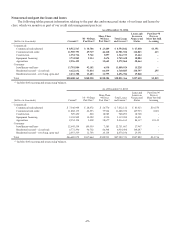

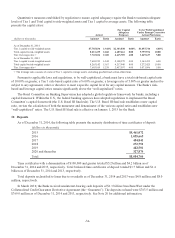

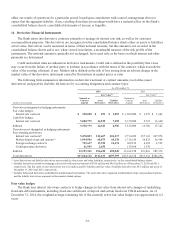

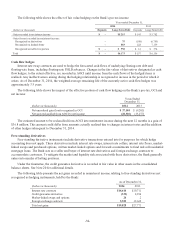

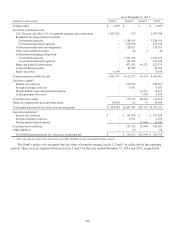

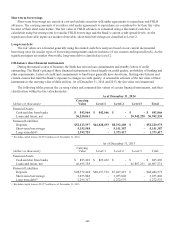

Offsetting assets and liabilities

The Bank primarily enters into derivative contracts with counterparties utilizing a standard International Swaps and

Derivatives Association master netting agreement (“ISDA”) and Collateral Support Annex (“CSA”) agreements to

reduce its exposure to credit risk. The ISDA agreement allows for the right of setoff in the event of either a default or an

additional termination event. CSA agreements govern the terms of daily collateral posting practices. Collateral practices

mitigate the potential loss impact to affected parties by requiring liquid collateral to be posted on a scheduled basis to

secure the aggregate net unsecured exposure.

The Bank has elected to present assets and liabilities related to derivatives on a gross basis in the consolidated

balance sheets. The following table provides details for which netting is permissible as of:

Gross Amounts Not Offset

in the Balance Sheet

(dollars in thousands)

Gross Amounts

of Recognized

Assets/

Liabilities

Gross

Amounts

Offset in the

Balance Sheet

Net Amounts

Presented in

the Balance

Sheet

Financial

Instruments

Cash

Collateral

Received/

Pledged

Net

Amount

December 31, 2014

Derivatives Assets $311,231 $ - $311,231 $ (83,033) $ - $228,198

Derivative Liabilities 297,599 - 297,599 (150,788) (1,634) 145,177

December 31, 2013

Derivatives Assets 315,518 - 315,518 (89,517) - 226,001

Derivative Liabilities 306,696 - 306,696 (224,257) (2,300) 80,139

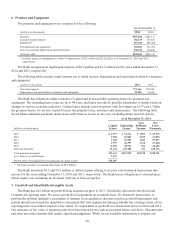

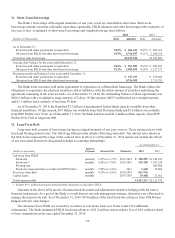

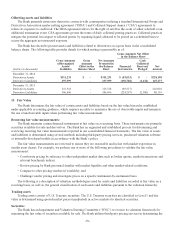

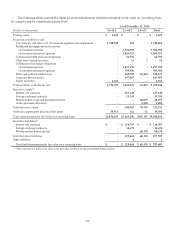

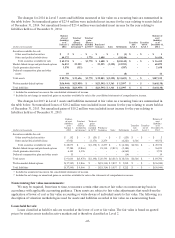

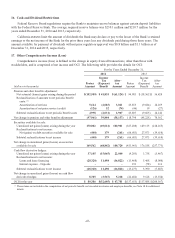

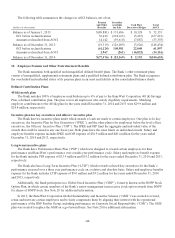

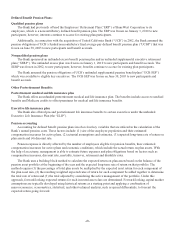

15. Fair Value

The Bank determines the fair value of certain assets and liabilities based on the fair value hierarchy established

under applicable accounting guidance, which requires an entity to maximize the use of observable inputs and minimize

the use of unobservable inputs when performing fair value measurement.

Recurring fair value measurements:

The Bank measures certain financial instruments at fair value on a recurring basis. These instruments are primarily

securities available for sale and derivatives. The Bank has an organized and established process for determining and

reviewing recurring fair value measurements reported in our consolidated financial statements. The fair value of assets

and liabilities is determined using several methods including third-party pricing services, purchased valuation software

or internally-developed models in accordance with the Bank’s policy.

The fair value measurements are reviewed to ensure they are reasonable and in line with market experience in

similar asset classes. For example, we perform one or more of the following procedures to validate the fair value

measurement:

• Corroborate pricing by reference to other independent market data such as broker quotes, market transactions and

relevant benchmark indices;

• Review pricing by Bank personnel familiar with market liquidity and other market-related conditions;

• Compare to other pricing vendors (if available); and

• Challenge vendor pricing and investigate prices on a specific instrument-by-instrument basis

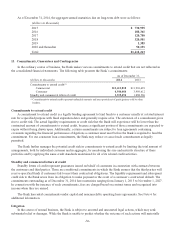

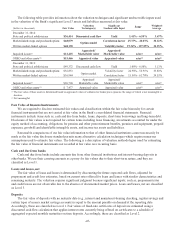

The following is a description of valuation methodologies used for assets and liabilities recorded at fair value on a

recurring basis; as well as, the general classification of such assets and liabilities pursuant to the valuation hierarchy:

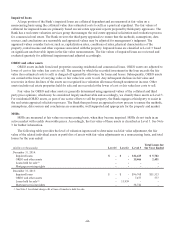

Trading assets

Trading assets consist of U.S. Treasury securities. The U.S. Treasury securities are classified as Level 1 and fair

value is determined using quoted market prices (unadjusted) in active markets for identical securities.

Securities

The Bank has an Impairment and Valuation Steering Committee (“IVSC”) to oversee its valuation framework for

measuring the fair value of securities available for sale. The Bank utilizes third-party pricing services in determining the

-39-