Bank of the West 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

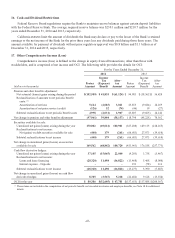

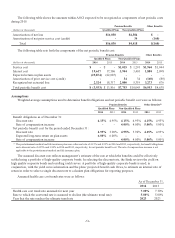

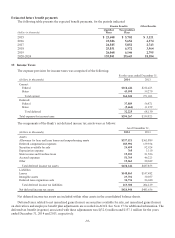

The following table presents amounts due to and from affiliates and off-balance sheet transactions:

As of December 31,

(dollars in thousands) 2014 2013

Cash and due from banks $ 40,396 $ 45,647

Loans 1,936 -

Noninterest-bearing demand deposits 8,619 8,434

Money market deposits(1) 1,117,437 1,706,442

Time certificates of deposit 306,642 207,505

Other assets 82,728 54,305

Other liabilities 98,419 95,760

Fixed-rate unsecured lines of credit 1,600 12,800

Noncontrolling interest 5,595 4,575

Derivatives (notional or contract amounts):

Credit guarantee derivative 61,945 130,960

Fair value hedges 200,000 200,000

Foreign exchange contracts 209,843 135,278

Interest rate contracts 4,882,879 3,205,211

Off-balance sheet transactions:

Commitments and standby letters of credit 43,925 25,435

Guarantees received 208,309 132,690

(1) Includes cash deposit to collateralize and secure payments under the Guarantee.

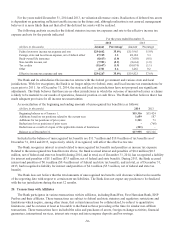

Net interest income (expense) to affiliates for the years ended December 31, 2014 and 2013 was $0.6 million and

$(2.9) million, respectively. Noninterest income from affiliate transactions, which includes fair value adjustments related

to derivatives, was a net loss of $8.9 million and a net gain of $33.6 million for the years ended December 31, 2014 and

2013, respectively. Noninterest expense from affiliate transactions was $3.0 million and $4.0 million for the years ended

December 31, 2014 and 2013, respectively.

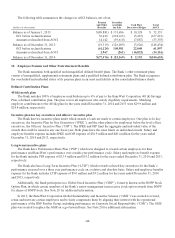

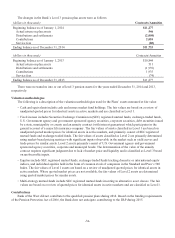

Credit guarantee derivative

The Bank has the Guarantee with its parent, BancWest. Under the Guarantee, BancWest agreed to reimburse the

Bank for principal charge-offs, write-downs on foreclosed assets and foregone interest for a specific portfolio of

commercial loans and foreclosed properties through March 31, 2017. Under the Guarantee, BancWest makes payments

to the Bank on a quarterly basis, and is not entitled to claim any recoveries for any payments made.

The decline in the fair value of the Guarantee asset since inception was primarily driven by decreases in the covered

asset principal balances due to charge-offs and pay downs, and changes in credit forecasts.

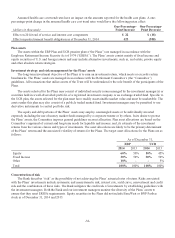

The following table provides the net (loss) gain of the credit guarantee derivative recorded in noninterest income:

As of December 31,

(dollars in thousands) 2014 2013

Payments for claims $ 587 $ 6,969

Decrease in fair value (920) (2,573)

Net (loss) gain $(333) $ 4,396

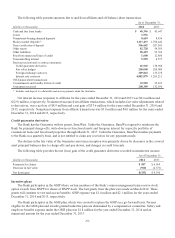

Incentive plans

The Bank participates in the GSIP where certain members of the Bank’s senior management team receive stock

option awards from BNPP for shares of BNPP stock. The last grants from the plan were made in March 2012. These

grants will continue to vest and accrue benefits. GSIP expense was $1.4 million and $2.1 million for the years ended

December 31, 2014 and 2013, respectively.

The Bank participates in the GSIS plan, which was created to replace the GSIP on a go-forward basis. Persons

eligible for the GSIS plan and awards granted under the plan are determined by a compensation committee. Salary and

employee benefits expense under the GSIS plan was $1.8 million for the year ended December 31, 2014 and an

immaterial amount for the year ended December 31, 2013.

-57-