Bank of the West 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

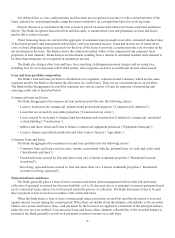

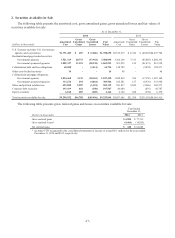

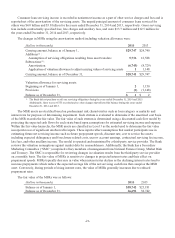

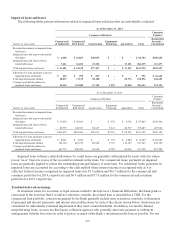

The fair value and amortized cost of debt securities available for sale as of December 31, 2014, by contractual

maturity, are shown below. Actual maturities may differ from contractual maturities because borrowers may have the

right to call or prepay obligations with or without prepayment penalties.

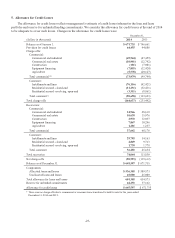

Remaining Contractual Principal Maturity

Within 1

Year

After 1 But

Within 5

Years

After 5

Years But

Within

10 Years After 10 Years Total

Amount(dollars in thousands) Amount Amount Amount Amount

U.S. Treasury and other U.S. Government

agencies and corporations $181,261 $1,607,348 $ 8 $ 73 $1,788,690

Residential mortgage-backed securities:

Government agencies - - - 3,504,098 3,504,098

Government sponsored agencies - 3,458 - 1,862,064 1,865,522

Collateralized debt and loan obligations - 8,586 56,208 - 64,794

Other asset-backed securities -131 - 14

Collateralized mortgage obligations:

Government agencies - - - 1,017,430 1,017,430

Government sponsored agencies - - - 309,506 309,506

States and political subdivisions 31,739 99,301 114,459 256,620 502,119

Corporate debt securities 2,238 195,269 - - 197,507

Estimated fair value of debt securities $215,238 $1,913,975 $170,676 $6,949,791 $9,249,680

Total amortized cost of debt securities $214,944 $1,916,133 $171,615 $6,989,700 $9,292,392

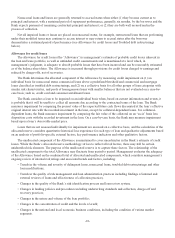

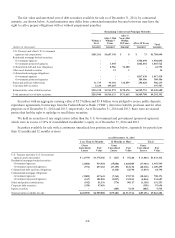

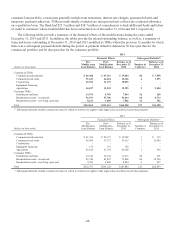

Securities with an aggregate carrying value of $5.5 billion and $5.8 billion were pledged to secure public deposits,

repurchase agreements, borrowings from the Federal Reserve Bank (“FRB”), derivative liability positions and for other

purposes as of December 31, 2014 and 2013, respectively. As of December 31, 2014 and 2013, there were no secured

parties that had the right to repledge or resell these securities.

We held no securities of any single issuer (other than the U.S. Government and government sponsored agencies)

which were in excess of 10% of consolidated stockholder’s equity as of December 31, 2014 and 2013.

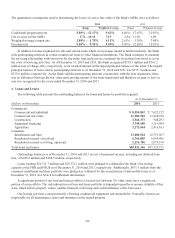

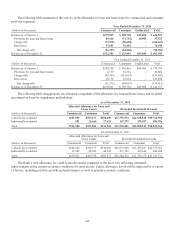

Securities available for sale with a continuous unrealized loss position are shown below, separately for periods less

than 12 months and 12 months or more:

As of December 31, 2014

Less Than 12 Months 12 Months or More Total

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fair

Value

U.S. Treasury and other U.S. Government

agencies and corporations $ (2,979) $1,378,186 $ (427) $ 55,246 $ (3,406) $1,433,432

Residential mortgage-backed securities:

Government agencies (2,084) 535,510 (35,880) 1,420,085 (37,964) 1,955,595

Government sponsored agencies (971) 297,103 (27,159) 812,196 (28,130) 1,109,299

Collateralized debt and loan obligations - - (3,414) 64,794 (3,414) 64,794

Collateralized mortgage obligations:

Government agencies (3,002) 417,641 (7,363) 372,732 (10,365) 790,373

Government sponsored agencies (167) 101,856 (3,897) 132,831 (4,064) 234,687

States and political subdivisions (542) 81,136 (776) 50,117 (1,318) 131,253

Corporate debt securities (350) 97,656 - - (350) 97,656

Equity securities - - (485) 5,515 (485) 5,515

Total securities available for sale $(10,095) $2,909,088 $(79,401) $2,913,516 $(89,496) $5,822,604

-18-