Bank of the West 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

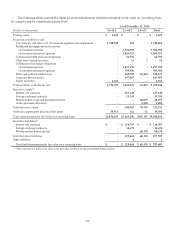

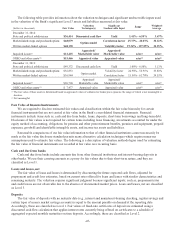

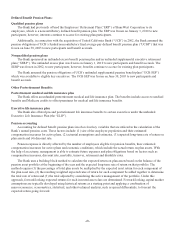

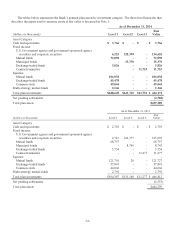

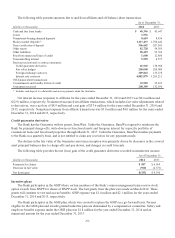

The following table shows the amounts within AOCI expected to be recognized as components of net periodic costs

during 2015:

Pension Benefits Other Benefits

(dollars in thousands) Qualified Plans Non-Qualified Plans

Amortization of net loss $16,030 $4,384 $ -

Amortization of net prior service cost (credit) - 34 (160)

Total $16,030 $4,418 $(160)

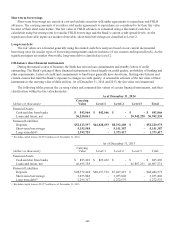

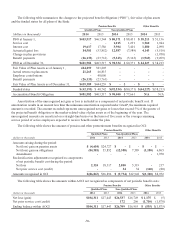

The following table sets forth the components of the net periodic benefit cost:

Pension Benefits Other Benefits

Qualified Plans Non-Qualified Plans

(dollars in thousands) 2014 2013 2014 2013 2014 2013

Service cost $-$-$1,015 $ 1,291 $1,960 $1,944

Interest cost 19,617 17,586 3,904 3,401 1,880 2,098

Expected return on plan assets (25,874) (22,087) ----

Amortization of prior service cost (credit) --34 34 (160) (80)

Recognized net actuarial loss 2,324 18,317 2,800 5,319 3,273 676

Total periodic benefit cost $ (3,933) $ 13,816 $7,753 $10,045 $6,953 $4,638

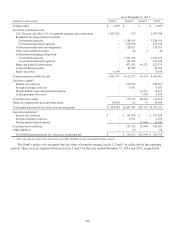

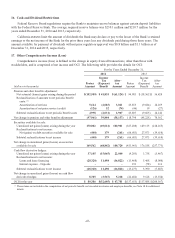

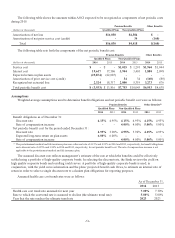

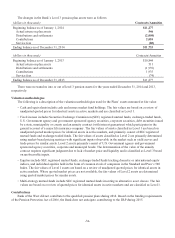

Assumptions

Weighted-average assumptions used to determine benefit obligations and net periodic benefit cost were as follows:

Pension Benefits Other Benefits(1)

Qualified Plans Non-Qualified Plans

2014 2013 2014 2013 2014 2013

Benefit obligations as of December 31:

Discount rate 4.15% 4.95% 4.15% 4.95% 4.15% 4.95%

Rate of compensation increase --4.00% 4.00% 5.00% 5.00%

Net periodic benefit cost for the period ended December 31:

Discount rate 4.95% 3.90% 4.95% 3.90% 4.15% 4.95%

Expected long-term return on plan assets 6.00% 6.00% ----

Rate of compensation increase --4.00% 4.00% 5.00% 5.00%

(1) The postretirement medical and life insurance plan uses a discount rate of 4.15% and 4.95% in 2014 and 2013, respectively, for benefit obligations

and a discount rate of 4.95% and 3.90% in 2014 and 2013, respectively, for net periodic benefit cost. The rate of compensation increase is not

applicable to the postretirement medical and life insurance plan.

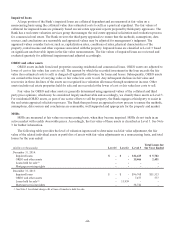

The assumed discount rate reflects management’s estimate of the rate at which the benefits could be effectively

settled using a portfolio of high-quality corporate bonds. In selecting the discount rate, the Bank reviews the yield on

high quality corporate bonds and resulting yield curves. A portfolio of high-quality corporate bonds is used; in

conjunction, with the yield curve information and the plans’ projected benefit cash flows, to estimate an internal rate of

return in order to select a single discount rate to calculate plan obligations for reporting purposes.

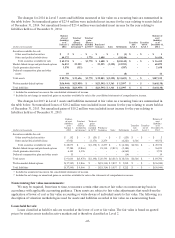

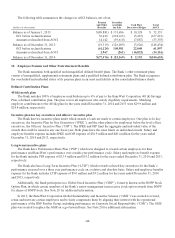

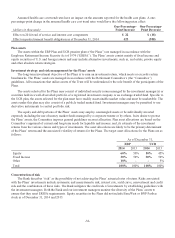

Assumed health care cost trend rates were as follows:

As of December 31,

2014 2013

Health care cost trend rate assumed for next year 7.00% 7.30%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) 5.00% 5.00%

Year that the rate reaches the ultimate trend rate 2023 2023

-51-