Bank of the West 2014 Annual Report Download - page 16

Download and view the complete annual report

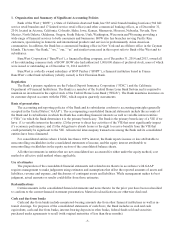

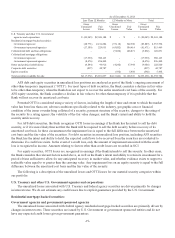

Please find page 16 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly or indirectly. Level 2 inputs include quoted prices for similar assets or liabilities in active

markets, quoted prices for identical or similar assets or liabilities in markets that are not active and inputs that are

corroborated by observable market data.

• Level 3 inputs are unobservable inputs for the asset or liability for which there is limited or no market activity at

the measurement date.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is

significant to the fair value measurement. See Note 15 for more information regarding fair value measurements.

Foreign currency translation

Monetary assets and liabilities denominated in foreign currencies are translated to the United States (“U.S.”) dollar

equivalent at the rate of exchange at the balance sheet dates. Transactions in foreign currencies are translated to the U.S.

dollar equivalent at the rate of exchange in effect at the time of the transaction. Foreign currency gains and losses are

included in the consolidated statements of income within other noninterest income in the period in which they occur.

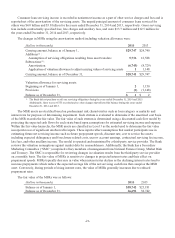

Income taxes

The Bank’s income tax filing is included in the consolidated federal income tax return filed by BancWest. The

Bank also files various combined and separate company state returns according to the laws of the particular state.

Federal and state income taxes are generally allocated to individual subsidiaries as if each had filed a separate return.

Amounts equal to income tax benefits of those subsidiaries having taxable losses or credits are reimbursed by other

subsidiaries that would have incurred current income tax liabilities.

The Bank recognizes current income tax expense in an amount which approximates the tax to be paid or refunded

for the current period. The Bank recognizes deferred income tax liabilities and assets for the expected future tax

consequences of events that the Bank includes in the consolidated financial statements or tax returns based on the

difference between the book and tax bases of assets and liabilities using enacted tax rates in effect for the years in which

the differences are expected to reverse. Deferred tax assets are recognized if it is more likely than not that they will be

realized. Realization is dependent on generating sufficient taxable income prior to expiration of any loss carry forward

balance. The Bank’s net tax asset is presented as a component of other assets.

Tax benefits are recognized and measured based upon a two-step model: (1) a tax position must be more likely than

not to be sustained based solely on its technical merits in order to be recognized, and (2) the benefit is measured as the

largest dollar amount of that position that is more likely than not to be sustained upon settlement. The difference

between the benefit recognized and the tax benefit claimed on the return is referred to as an unrecognized tax benefit.

Foreign taxes paid are generally applied as credits to reduce federal income taxes payable. Tax-related interest is

recognized as a component of income tax expense. Substantially all penalties are recognized as a component of other

noninterest expense. The Bank recognizes interest and penalties related to unrecognized tax benefits within the income

tax expense line in the accompanying consolidated statements of income.

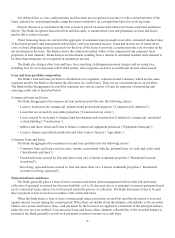

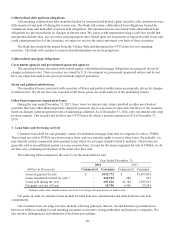

Derivative instruments and hedging activities

Derivatives are recognized on the consolidated balance sheets as other assets or other liabilities at fair value and are

either designated as (1) a hedge of the fair value of a recognized asset or liability or of an unrecognized firm

commitment (“fair value” hedge), (2) a hedge of a forecasted transaction or the variability of cash flows to be received

or paid related to a recognized asset or liability (“cash flow” hedge) or (3) held for trading, customer accommodation or

not designated for hedge accounting (“free-standing derivative instrument”).

The Bank formally documents the relationship between hedging instruments and hedged items, as well as the risk

management objective and strategy for undertaking various hedge transactions. The Bank also formally assesses both at

the inception of the hedge and on a quarterly basis, whether the derivative instruments are considered effective in

offsetting changes in fair values of or cash flows related to hedged items.

For derivatives designated as fair value hedges, changes in the fair value of the derivative instrument and changes

in the fair value of the related hedged asset or liability or of an unrecognized firm commitment attributable to the hedged

risk are recorded in noninterest income.

-14-