Bank of the West 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

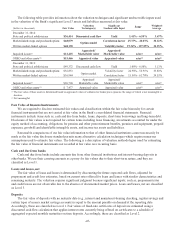

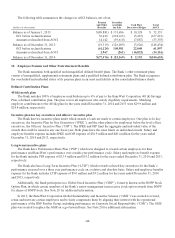

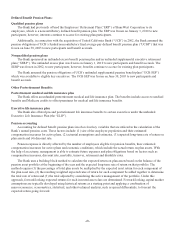

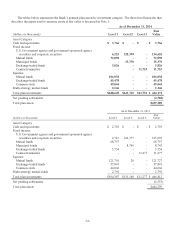

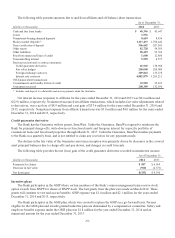

Estimated future benefit payments

The following table presents the expected benefit payments, for the periods indicated:

Pension Benefits Other Benefits

(dollars in thousands)

Qualified

Plans

Non-Qualified

Plans

2015 $ 23,608 $ 5,702 $ 3,121

2016 23,586 5,654 4,374

2017 24,385 5,852 2,743

2018 25,851 6,372 3,964

2019 26,068 6,146 2,795

2020-2024 155,801 29,643 18,184

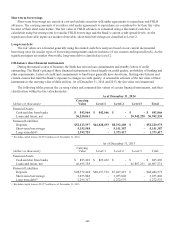

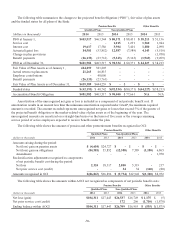

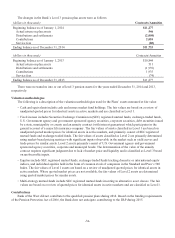

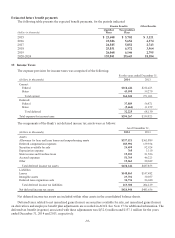

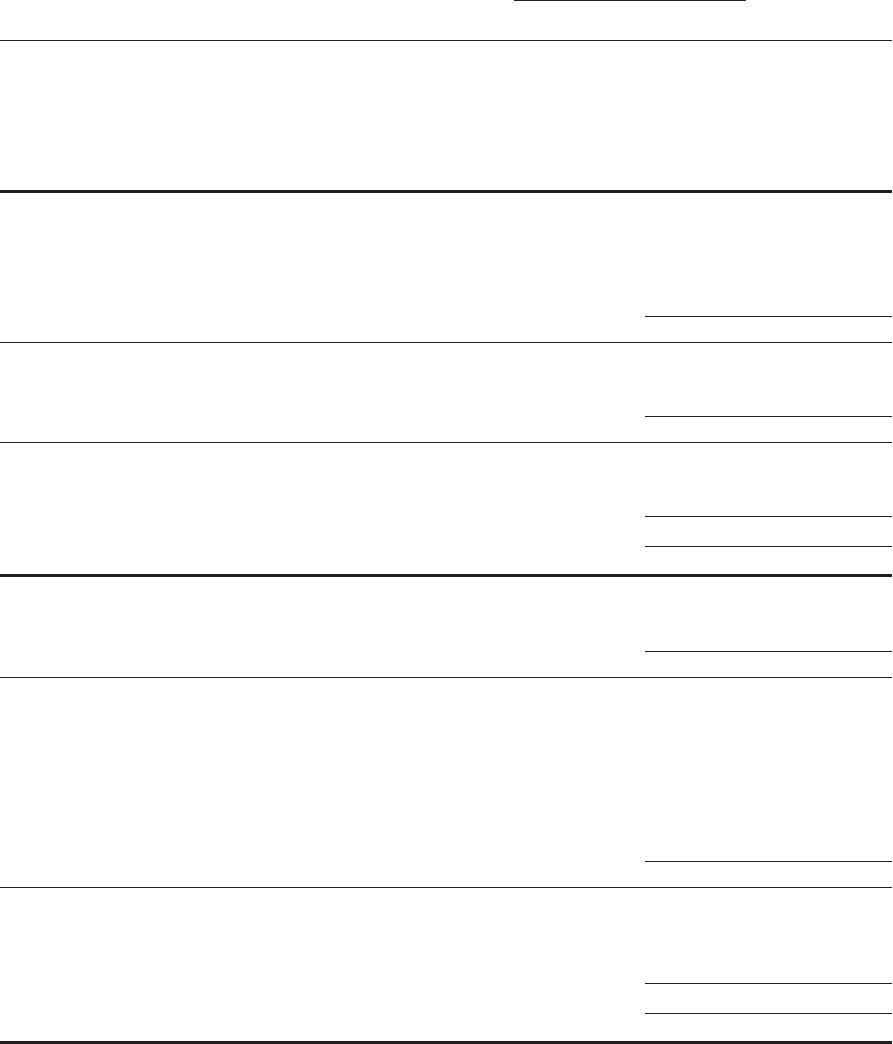

19. Income Taxes

The expense provision for income taxes was comprised of the following:

For the years ended December 31,

(dollars in thousands) 2014 2013

Current:

Federal $218,444 $212,423

States 43,598 59,270

Total current 262,042 271,693

Deferred:

Federal 37,889 56,871

States (5,664) 11,259

Total deferred 32,225 68,130

Total expense for income taxes $294,267 $339,823

The components of the Bank’s net deferred income tax assets were as follows:

As of December 31,

(dollars in thousands) 2014 2013

Assets

Allowance for loan and lease losses and nonperforming assets $337,521 $363,889

Deferred compensation expenses 185,594 139,934

Securities available for sale 24,499 92,924

Depreciation expense 765 3,310

State income and franchise taxes 19,033 21,526

Accrued expenses 51,769 46,223

Other 19,063 20,049

Total deferred income tax assets $638,244 $687,855

Liabilities

Leases $148,863 $147,482

Intangible assets 29,701 30,057

Deferred loan origination costs 34,736 26,680

Total deferred income tax liabilities 213,300 204,219

Net deferred income tax assets $424,944 $483,636

Net deferred income tax assets are included within other assets in the consolidated balance sheets.

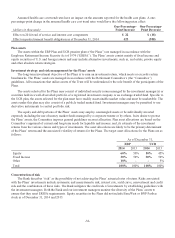

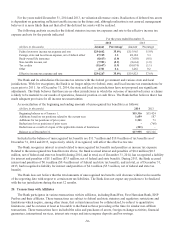

Deferred taxes related to net unrealized gains (losses) on securities available for sale, net unrealized gains (losses)

on derivatives and employee benefit plan adjustments are recorded in AOCI. See Note 17 for additional information. The

deferred tax benefit (expense) associated with these adjustments was $(32.6) million and $137.1 million for the years

ended December 31, 2014 and 2013, respectively.

-55-