Bank of the West 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

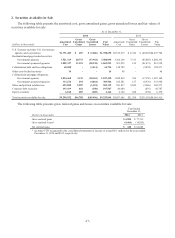

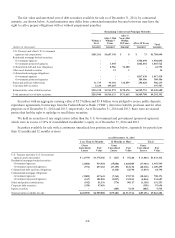

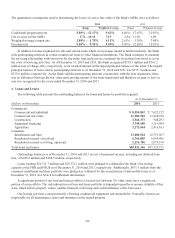

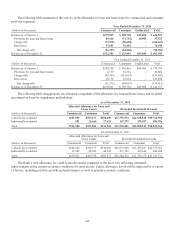

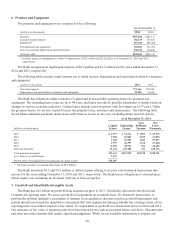

The following tables present the credit quality of each class of commercial loans and leases based on our internal

risk grading system:

As of December 31, 2014

(dollars in thousands) Pass Special Mention Classified Total

Commercial and industrial $ 8,317,786 $123,722 $113,334 $ 8,554,842

Commercial real estate 11,364,971 303,241 313,710 11,981,922

Construction 1,264,856 35,963 63,554 1,364,373

Equipment financing 3,700,818 24,201 24,631 3,749,650

Agriculture 2,080,922 156,760 34,382 2,272,064

Total commercial $26,729,353 $643,887 $549,611 $27,922,851

As of December 31, 2013

(dollars in thousands) Pass Special Mention Classified Total

Commercial and industrial $ 7,272,593 $167,313 $192,246 $ 7,632,152

Commercial real estate 10,584,371 414,192 430,107 11,428,670

Construction 865,457 51,786 31,050 948,293

Equipment financing 3,064,967 20,378 33,749 3,119,094

Agriculture 2,153,338 124,819 138,006 2,416,163

Total commercial $23,940,726 $778,488 $825,158 $25,544,372

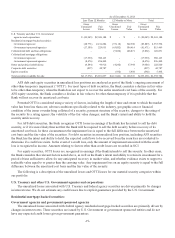

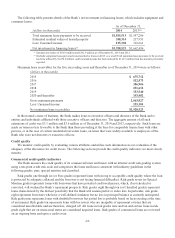

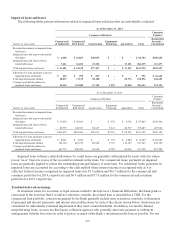

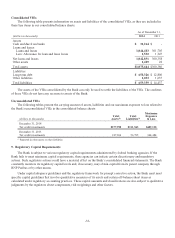

Consumer credit quality indicators

Consumer loans are assessed for credit quality by delinquency status and are placed into one of two categories. The

“Current” category, includes borrowers who are current in their payments in accordance with their contractual terms and

the “Past Due” category, includes borrowers who have missed one or more payments and are past due 30 days or more.

The following table represents the credit quality of each class of consumer loans and leases based on the delinquency

status:

(dollars in thousands)

Residential

Secured–Closed-End

Residential

Secured–Revolving,

Open-End

Installments

and Lines Total

As of December 31, 2014:

Current(1) $6,622,632 $2,231,308 $13,781,884 $22,635,824

Past due 138,253 25,398 99,040 262,691

Total 6,760,885 2,256,706 13,880,924 22,898,515

As of December 31, 2013:

Current(1) 6,771,396 2,057,359 12,643,554 21,472,309

Past due 183,100 21,837 108,113 313,050

Total $6,954,496 $2,079,196 $12,751,667 $21,785,359

(1) Includes loans that are contractually current but on nonaccrual status.

-24-