Bank of the West 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

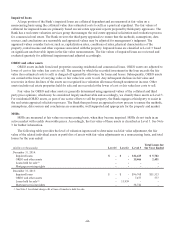

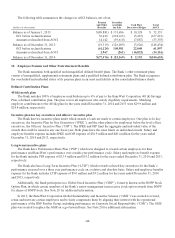

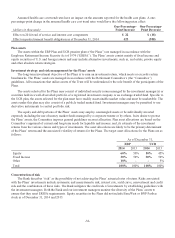

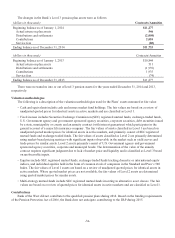

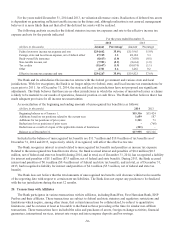

The changes in the Bank’s Level 3 pension plan assets were as follows:

(dollars in thousands) Contracts/Annuities

Beginning balance as of January 1, 2014 $11,277

Actual return on plan assets 546

Distributions and settlements (2,000)

Contributions 2,010

Service fees (80)

Ending balance as of December 31, 2014 $11,753

(dollars in thousands) Contracts/Annuities

Beginning balance as of January 1, 2013 $10,844

Actual return on plan assets 511

Distributions and settlements (1,939)

Contributions 1,935

Service fees (74)

Ending balance as of December 31, 2013 $11,277

There were no transfers into or out of level 3 pension assets for the years ended December 31, 2014 and 2013,

respectively.

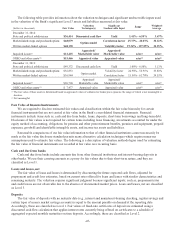

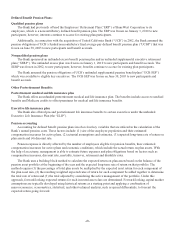

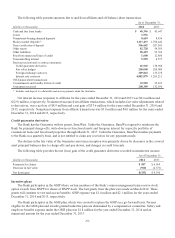

Valuation methodologies

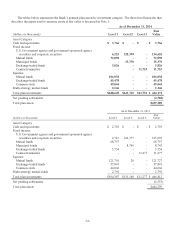

The following is a description of the valuation methodologies used for the Plans’ assets measured at fair value:

• Cash and equivalents include cash and money market fund holdings. The fair values are based on a review of

unadjusted quoted prices for identical assets in active markets and are classified as Level 1.

• Fixed income includes Securities Exchange Commission (SEC) registered mutual funds, exchange-traded funds,

U.S. Government agency and government sponsored agency securities, corporate securities, debt securities issued

by a state, municipality or county and an annuity contract (with interest guarantees) which participates in the

general account of a major life insurance company. The fair values of assets classified as Level 1 are based on

unadjusted quoted market prices for identical assets in active markets, and primarily consist of SEC registered

mutual funds and exchange-traded funds. The fair values of assets classified as Level 2 are primarily determined

using market-based pricing matrices with significant inputs observable in the market such as yield curves and

trade prices for similar assets. Level 2 assets primarily consist of U.S. Government agency and government

sponsored agency securities, corporate and municipal bonds. The determination of the value of the annuity

contract requires significant judgment due to lack of market price and liquidity and is classified as Level 3 based

on unobservable inputs.

• Equities include SEC registered mutual funds, exchange-traded funds tracking domestic or international equity

indices, and individual equities held in the form of common stock of companies in the Standard and Poor’s 500

Index. The fair values of Level 1 assets are based on a review of unadjusted quoted prices for identical assets in

active markets. Where quoted market prices are not available, the fair values of Level 2 assets are determined

using quoted market prices for similar assets.

• Multi-strategy mutual funds include SEC registered mutual funds investing in alternative asset classes. The fair

values are based on a review of quoted prices for identical assets in active markets and are classified as Level 1.

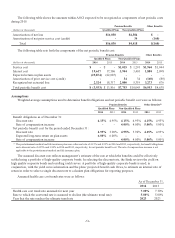

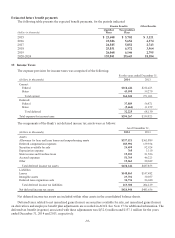

Contributions

Bank of the West did not contribute to the qualified pension plans during 2014. Based on the funding requirements

of the Pension Protection Act of 2006, the Bank does not anticipate contributing to the ERP during 2015.

-54-