Bank of the West 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

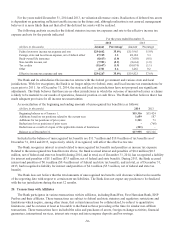

For the years ended December 31, 2014 and 2013, no valuation allowance exists. Realization of deferred tax assets

is dependent on generating sufficient taxable income in the future and, although realization is not assured, management

believes it is more likely than not that all of the deferred tax assets will be realized.

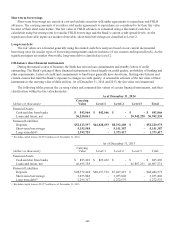

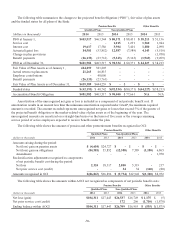

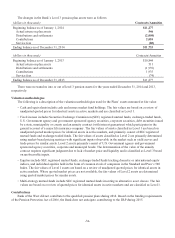

The following analysis reconciles the federal statutory income tax expenses and rate to the effective income tax

expense and rate for the periods indicated:

For the years ended December 31,

2014 2013

(dollars in thousands) Amount Percentage Amount Pecentage

Federal statutory income tax expense and rate $294,642 35.0% $315,965 35.0%

Foreign, state and local taxes expense, net of federal effect 27,125 3.2 48,184 5.3

Bank-owned life insurance (8,613) (1.0) (7,050) (0.8)

Non-taxable income, net (7,981) (0.9) (8,664) (1.0)

Tax credits (15,647) (1.9) (10,074) (1.1)

Other 4,741 0.6 1,462 0.2

Effective income tax expense and rate $294,267 35.0% $339,823 37.6%

The Bank and its subsidiaries file income tax returns with the federal government and various state and local

jurisdictions. With few exceptions, the Bank is no longer subject to federal, state, and local income tax examinations for

years prior to 2011. As of December 31, 2014, the state and local tax jurisdictions have not proposed any significant

adjustments. The Bank believes that there are no other jurisdictions in which the outcome of unresolved issues or claims

is likely to be material to our results of operations, financial position or cash flows. The Bank further believes that it has

made adequate provision for all income tax uncertainties.

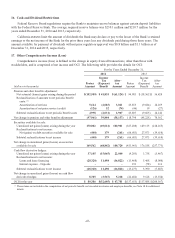

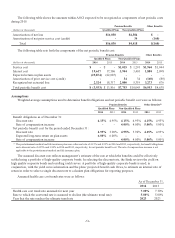

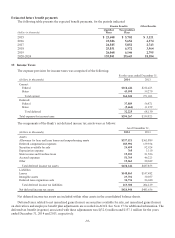

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows:

(dollars in thousands) 2014 2013

Beginning balance as of January 1, $15,316 $15,424

Additions based on tax positions related to the current year 1,659 587

Additions for tax positions of prior years 1,221 73

Reductions for tax positions of prior years -(768)

Reductions as a result of a lapse of the applicable statute of limitations (241) -

Balance as of December 31, $17,955 $15,316

Included in the balance of unrecognized tax benefits are $11.7 million and $10.0 million of tax benefits as of

December 31, 2014 and 2013, respectively which, if recognized, will affect the effective tax rate.

The Bank recognizes interest accrued related to unrecognized tax benefits and penalties as income tax expense.

Related to the unrecognized tax benefits notes above, the Bank accrued interest and penalties of $0.4 million ($0.3

million, net of federal and state tax benefit) during 2014, and in total, as of December 31, 2014, has recognized a liability

for interest and penalties of $5.1 million ($3.5 million, net of federal and state benefit). During 2013, the Bank accrued

interest and penalties of $0.6 million ($0.4 million net of federal and state tax benefit), and in total, as of December 31,

2013, had recognized a liability for interest and penalties of $4.6 million ($3.5 million, net of federal and state tax

benefit).

The Bank does not believe that the total amounts of unrecognized tax benefits will decrease within twelve months

of the reporting date with respect to certain state tax liabilities. The Bank does not expect any positions to be finalized

with the tax jurisdictions during the next 12 months.

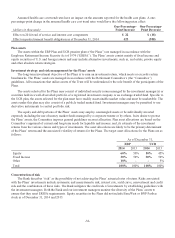

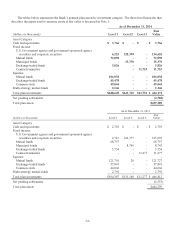

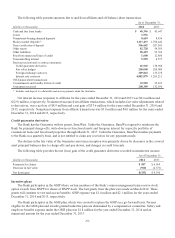

20. Transactions with Affiliates

The Bank participates in various transactions with its affiliates, including BancWest, First Hawaiian Bank, BNP

Paribas and their affiliates. These transactions are subject to federal and state statutory and regulatory restrictions and

limitations which require, among other items, that certain transactions be collateralized, be subject to quantitative

limitations, and be on terms at least as favorable to the Bank as those prevailing at the time for similar non-affiliate

transactions. These transactions have included the sales and purchases of assets, foreign exchange activities, financial

guarantees, international services, interest rate swaps and intercompany deposits and borrowings.

-56-