Bank of the West 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

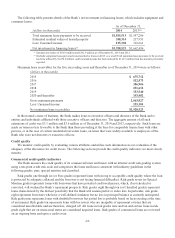

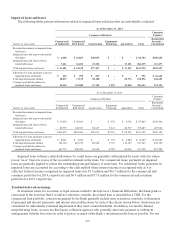

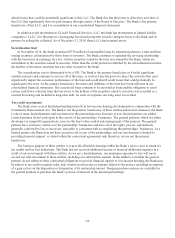

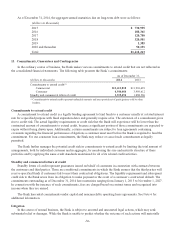

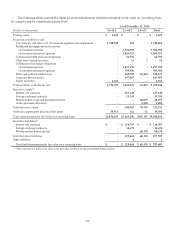

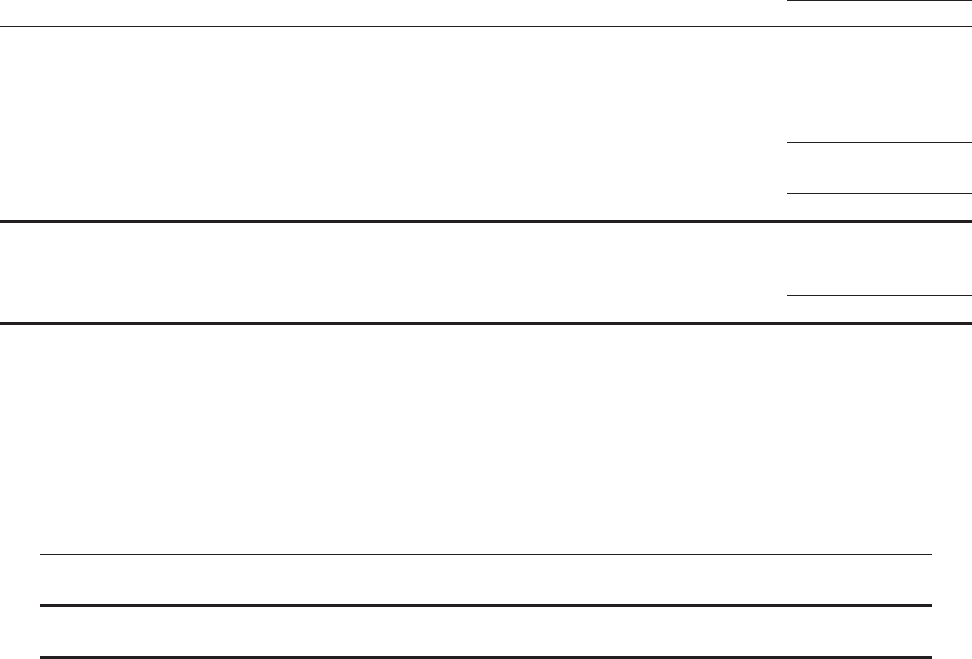

Consolidated VIEs

The following table presents information on assets and liabilities of the consolidated VIEs, as they are included in

these line items in our consolidated balance sheets:

As of December 31,

(dollars in thousands) 2014 2013

Assets

Cash and due from banks $ 31,264 $-

Loans and leases:

Loans and leases 1,044,483 301,705

Less: Allowance for loan and lease losses 1,592 1,347

Net loans and leases 1,042,891 300,358

Other assets 1,489 22

Total assets $1,075,644 $300,380

Liabilities

Long-term debt $ 658,326 $ 12,800

Other liabilities 1,033 1,637

Total liabilities $ 659,359 $ 14,437

The assets of the VIEs consolidated by the Bank can only be used to settle the liabilities of the VIEs. The creditors

of these VIEs do not have any recourse to assets of the Bank.

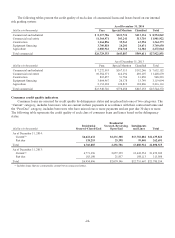

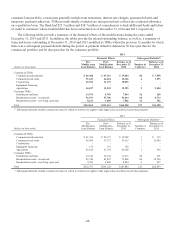

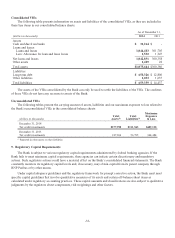

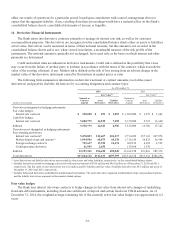

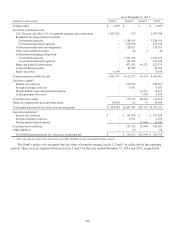

Unconsolidated VIEs

The following tables present the carrying amount of assets, liabilities and our maximum exposure to loss related to

the Bank’s unconsolidated VIEs in the consolidated balance sheets:

(dollars in thousands)

Total

Assets(1)

Total

Liabilities(1)

Maximum

Exposure

to Loss

December 31, 2014

Tax credit investments $277,998 $111,543 $489,110

December 31, 2013

Tax credit investments 187,966 56,795 364,484

(1) Reported in other assets or other liabilities.

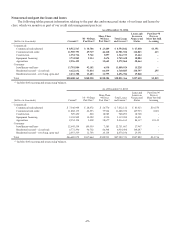

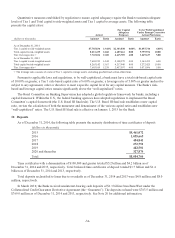

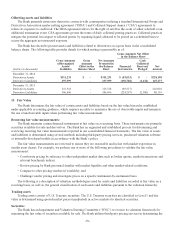

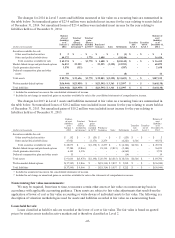

9. Regulatory Capital Requirements

The Bank is subject to various regulatory capital requirements administered by federal banking agencies. If the

Bank fails to meet minimum capital requirements, these agencies can initiate certain discretionary and mandatory

actions. Such regulatory actions could have a material effect on the Bank’s consolidated financial statements. The Bank

constantly monitors its regulatory capital levels and, if necessary, may obtain capital from its parent company through

BNP Paribas or by other means.

Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet

specific capital guidelines that involve quantitative measures of its assets and certain off-balance sheet items as

calculated under regulatory accounting practices. These capital amounts and classifications are also subject to qualitative

judgments by the regulators about components, risk weightings and other factors.

-33-