Bank of the West 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

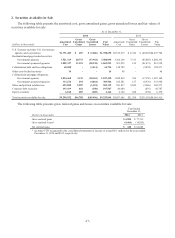

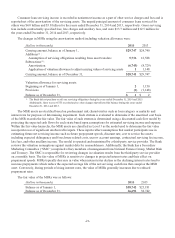

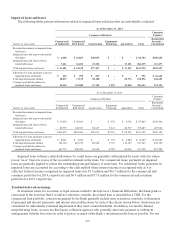

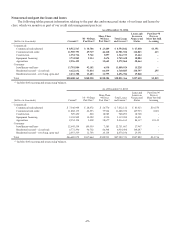

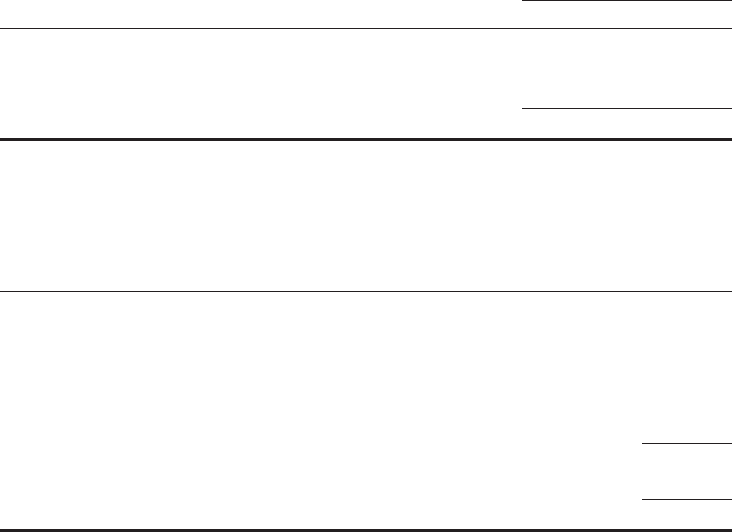

The following table presents details of the Bank’s net investment in financing leases, which includes equipment and

consumer leases:

As of December 31,

(dollars in thousands) 2014 2013(2)

Total minimum lease payments to be received $1,815,513 $1,557,206

Estimated residual values of leased property 248,314 217,951

Less: Unearned income 135,304 112,661

Net investment in financing leases(1) $1,928,523 $1,662,496

(1) Includes auto leases of $100.0 million and $101.0 million as of December 31, 2014 and 2013.

(2) Excludes equipment loans previously misclassified as leases in 2013, as a result Total minimum lease payments to be received

has been reduced by $1,674.0 million, and Unearned income has been reduced by $116.7 million from the amounts previously

reported.

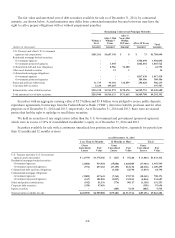

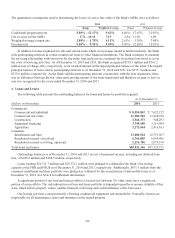

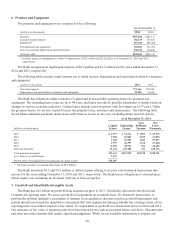

Minimum lease receivables for the five succeeding years and thereafter as of December 31, 2014 were as follows:

(dollars in thousands)

2015 $ 675,712

2016 512,573

2017 356,906

2018 231,614

2019 133,540

2020 and thereafter 153,482

Gross minimum payments 2,063,827

Less: Unearned income 135,304

Net minimum lease receivables $1,928,523

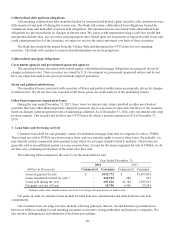

In the normal course of business, the Bank makes loans to executive officers and directors of the Bank and to

entities and individuals affiliated with those executive officers and directors. The aggregate amount of all such

extensions of credit was $3.1 million and $3.6 million as of December 31, 2014 and 2013, respectively. Such loans are

made on terms no less favorable to the Bank than those prevailing at the time for comparable transactions with other

persons, or in the case of certain residential real estate loans, on terms that were widely available to employees of the

Bank who were not directors or executive officers.

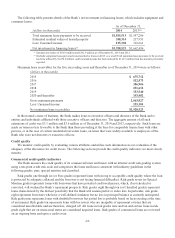

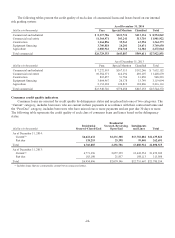

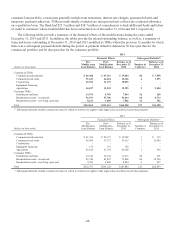

Credit quality

We monitor credit quality by evaluating various attributes and utilize such information in our evaluation of the

adequacy of the allowance for credit losses. The following sections provide the credit quality indicators we most closely

monitor.

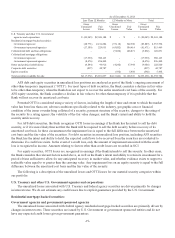

Commercial credit quality indicators

The Bank assesses the credit quality of its commercial loans and leases with an internal credit risk grading system

using a ten-point credit risk scale and categorizes the loans and leases consistent with industry guidelines in the

following grades: pass, special mention and classified.

Risk grades one through six (or Pass grades) represent loans with strong to acceptable credit quality where the loan

is protected by adequate collateral and the borrower is not facing financial difficulties. Risk grade seven (or Special

Mention grade) represents loans with borrowers that have potential credit weaknesses, which, if not checked or

corrected, will weaken the Bank’s repayment prospects. Risk grades eight through ten (or Classified grades) represent

loans characterized by the distinct possibility that the Bank will sustain partial or entire loss. In particular, risk grade

eight represents borrowers who have a well-defined weakness but no loss in principal balance is currently anticipated.

Risk grade nine represents loans with doubtful borrowers but partial loss is probable based on facts existing at the time

of assessment. Risk grade ten represents loans with borrowers who are incapable of repayment or loans that are

considered uncollectable and are therefore, charged off. All loans in risk grades nine and ten and certain loans in risk

grade eight that are on nonaccrual status are considered impaired loans. Risk grades of commercial loans are reviewed

on an ongoing basis and upon a credit event.

-23-