Bank of the West 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

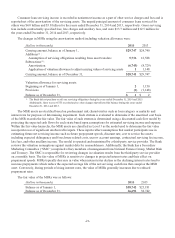

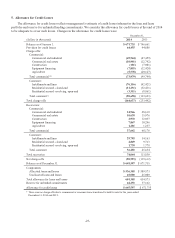

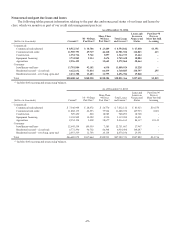

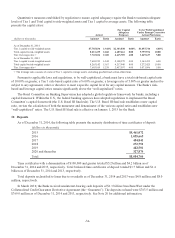

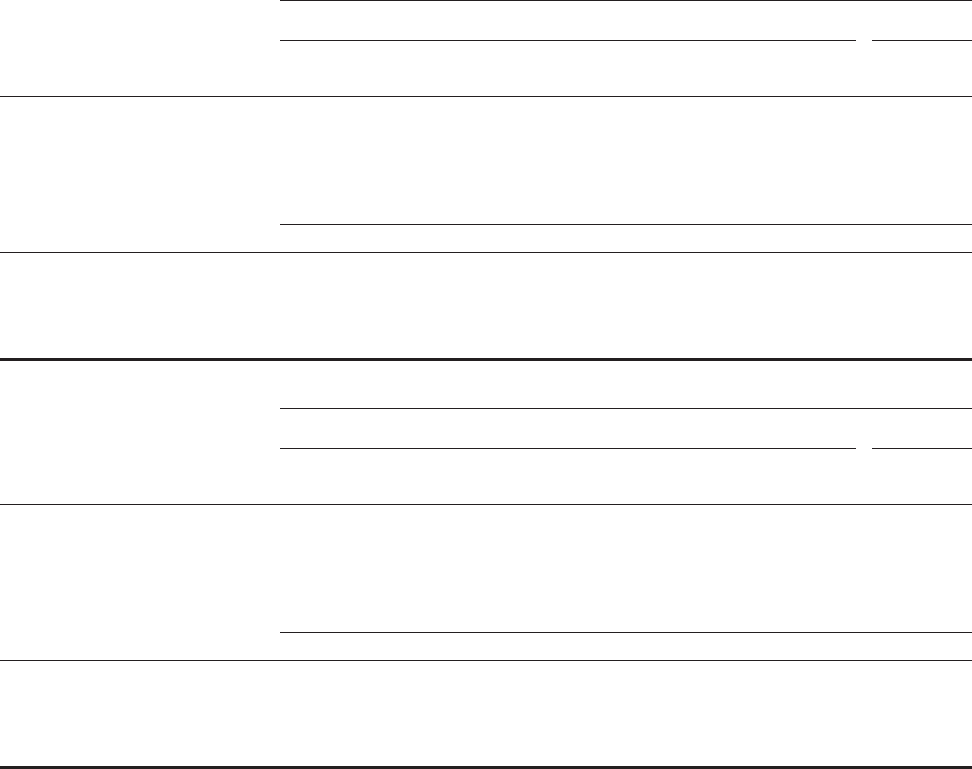

Impaired loans and leases

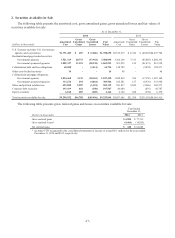

The following tables present information related to impaired loans and leases that are individually evaluated:

As of December 31, 2014

Commercial Product

Consumer

Product

(dollars in thousands)

Commercial

& Industrial

Commercial

Real Estate Construction

Equipment

Financing Agriculture Total

Residential

Secured—

Closed-End

Recorded investment in impaired loans

and leases:

Impaired loans and leases with related

allowance $ 6,040 $ 26,869 $30,035 $ - $ - $ 62,944 $188,220

Impaired loans and leases with no

related allowance 7,441 36,281 47,432 - 13,181 104,335 141,477

Total impaired loans and leases $ 13,481 $ 63,150 $77,467 $ - $ 13,181 $167,279 $329,697

Allowance for loan and lease losses on

impaired loans and leases $ 226 $ 290 $ 435 $ - $ - $ 951 $ 26,664

Total unpaid principal balance 20,219 71,135 90,188 - 28,754 210,296 366,683

Average recorded investment in

impaired loans and leases 52,665 132,608 67,169 1,525 52,496 306,463 332,154

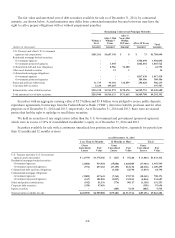

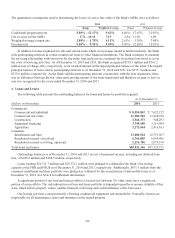

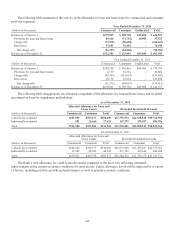

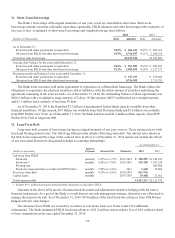

As of December 31, 2013

Commercial Product

Consumer

Product

(dollars in thousands)

Commercial

& Industrial

Commercial

Real Estate Construction

Equipment

Financing Agriculture Total

Residential

Secured—

Closed-End

Recorded investment in impaired loans

and leases:

Impaired loans and leases with related

allowance $ 17,656 $ 70,099 $ - $ 372 $ 9,738 $ 97,865 $199,396

Impaired loans and leases with no

related allowance 83,999 142,765 58,615 3,341 84,767 373,487 129,946

Total impaired loans and leases $101,655 $212,864 $58,615 $3,713 $ 94,505 $471,352 $329,342

Allowance for loan and lease losses on

impaired loans and leases $ 8,061 $ 4,045 $ - $ 159 $ 3,284 $ 15,549 $ 28,983

Total unpaid principal balance 123,164 225,933 80,608 3,713 114,127 547,545 364,765

Average recorded investment in

impaired loans and leases 105,775 208,454 83,634 4,789 68,906 471,558 327,389

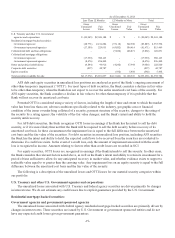

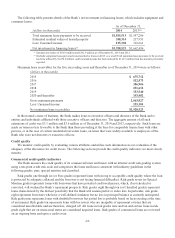

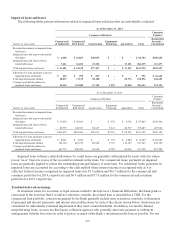

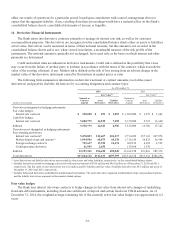

Impaired loans without a related allowance for credit losses are generally collateralized by assets with fair values

(on an “as-is” basis) in excess of the recorded investment in the loans. For commercial loans, payments on impaired

loans are generally applied to reduce the outstanding principal balance of such loans. For residential loans, payments on

impaired loans are accounted for according to the cash method where interest income is recognized only as it is

collected. Interest income recognized on impaired loans was $1.3 million and $16.7 million for the commercial and

consumer portfolios for 2014, respectively and $0.9 million and $17.0 million for the commercial and consumer

portfolios for 2013, respectively.

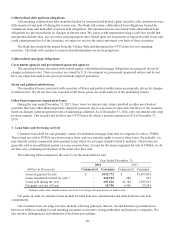

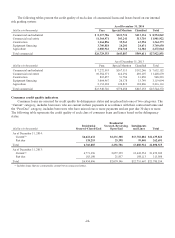

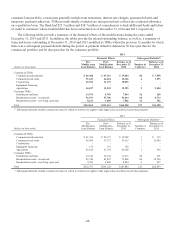

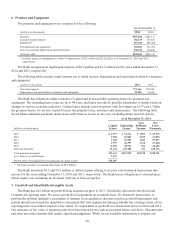

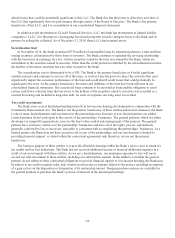

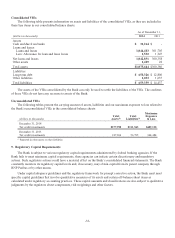

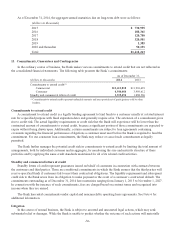

Troubled debt restructurings

In situations where for economic or legal reasons related to the borrower’s financial difficulties, the Bank grants a

concession to the borrower that it would not otherwise consider, the related loan is classified as a TDR. For the

commercial loan portfolio, concessions granted by the Bank generally include term extensions, renewals, forbearances

of principal and interest payments, and interest rate modifications for each of the classes shown below. Such loans are

considered for individually evaluated impairment if they meet certain thresholds. In addition, for smaller balance

nonperforming loans, we may use third-party collection agencies who generally enter into payment or settlement

arrangements with the borrowers in order to protect as much of the Bank’s investment in the loan as possible. For our

-27-