Bank of the West 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net deferred fees or costs, and premiums and discounts are recognized in income over the contractual term of the

loans, adjusted for actual prepayments, using the interest method or on a straight-line basis for revolving loans.

Interest income is accrued unless the loan or lease is placed on nonaccrual status (see Nonaccrual loans and leases

below). The Bank recognizes unaccreted fees and discounts, or unamortized costs and premiums on loans and leases

paid in full as interest income.

Direct financing leases are carried at the aggregate of minimum lease payments receivable, estimated residual value

of the leased property and unamortized initial direct costs less unearned income. Unearned income net of initial direct

costs on direct financing leases is accreted over the lives of the leases to provide a constant periodic rate of return on the

net investment in the lease. The Bank reviews the estimated residual values of the commercial and consumer lease

properties at least annually. Reductions in net investment resulting from a decline in estimated residual value deemed to

be other-than-temporary are recognized in noninterest income.

The Bank also charges other loan and lease fees consisting of delinquent payment charges and servicing fees,

including fees for servicing loans sold to third parties, and recognizes such fees as noninterest income when earned.

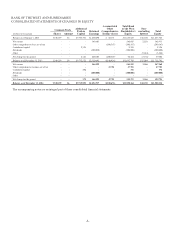

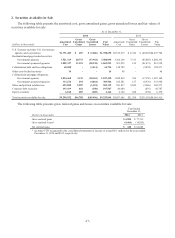

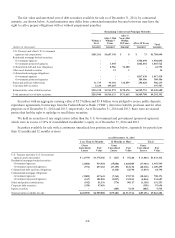

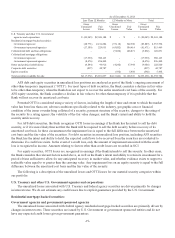

Loan and lease portfolio composition

The Bank’s loan and lease portfolio is divided into two segments, commercial and consumer, which are the same

segments used by the Bank to determine the allowance for credit losses. There are no concentrations in our portfolio.

The Bank further disaggregates its portfolio segments into various classes of loans for purposes of monitoring and

assessing credit risk as described below.

Commercial loans and leases

The Bank disaggregates the commercial loan and lease portfolio into the following classes:

• Loans to businesses for commercial, industrial and professional purposes (“Commercial & industrial”);

• Loans that are secured by real estate properties (“Commercial real estate”);

• Loans secured by real estate to finance land development and construction of industrial, commercial, residential

or farm building (“Construction”);

• Indirect and direct leases and loans to finance commercial equipment purchases (“Equipment financing”);

• Loans to finance agricultural production and other loans to farmers (“Agriculture”).

Consumer loans and leases

The Bank disaggregates the consumer loan and lease portfolio into the following classes:

• Consumer loans and leases such as autos, marine, recreational vehicles, personal lines of credit and credit cards

(“Installments and lines”);

• Closed-end loans secured by first and junior liens on 1-4 family residential properties (“Residential secured–

closed-end”);

• Revolving, open-end loans secured by first and junior liens on 1-4 family residential properties (“Residential

secured–revolving, open-end”).

Nonaccrual loans and leases

The Bank generally places a loan or lease on nonaccrual status when management believes that full and timely

collection of principal or interest has become doubtful; or it is 90 days past due as to principal or interest payments based

on its contractual terms, unless it is well secured and in the process of collection. The Bank determines loans to be past

due if payment is not received in accordance with contractual terms.

When the Bank places a loan or lease on nonaccrual status, previously accrued but uncollected interest is reversed

against interest income during the current period. When there are doubts about the ultimate collectability of the recorded

balance on a nonaccrual loan or lease, cash payments by the borrower are applied as a reduction of the principal balance,

under the cost recovery method. For nonaccrual loans and leases where ultimate collectability of the recorded balance is

presumed, the Bank generally records such payments as interest income on a cash basis.

-9-