Bank of the West 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

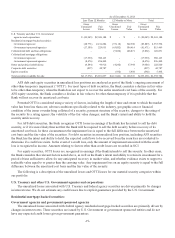

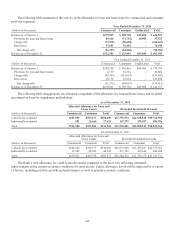

Collateralized debt and loan obligations

All remaining collateralized debt securities backed by trust preferred hybrid capital issued by other institutions were

fully amortized and paid off during the current year. The Bank still retains collateralized loan obligations backed by

commercial loans and individual corporate debt obligations. The unrealized losses associated with collateralized loan

obligations are driven primarily by changes in interest rates. We assess credit impairment using a cash flow model that

incorporates default rates, loss severities and prepayment rates. Based upon our assessment of expected credit losses and

credit enhancement level of the securities, we expect to recover the entire amortized cost basis of these securities.

The Bank has assessed the impact from the Volcker Rule and determined no OTTI exists for our remaining

securities. The Bank will continue to reassess this determination on an on-going basis.

Collateralized mortgage obligations:

Government agencies and government sponsored agencies

The unrealized losses associated with federal agency collateralized mortgage obligations are primarily driven by

changes in interest rates. These securities are issued by U.S. Government or government sponsored entities and do not

have any expected credit losses given government implicit guarantees.

States and political subdivisions

The unrealized losses associated with securities of States and political subdivisions are primarily driven by changes

in interest rates. We do not have any expected credit losses given our credit analysis of the underlying issuers.

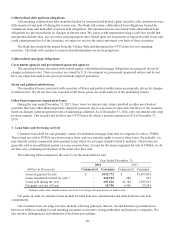

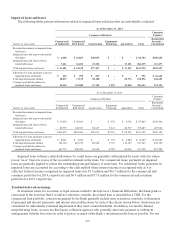

Other-than-temporary impairment losses

During the year ended December 31, 2013, there were two interest-only strips classified as other asset-backed

securities that were other-than-temporarily impaired, primarily due to a decrease in expected cash flows of the securities

based on changes in the prepayment rates of underlying collateral. As of December 31, 2014, only one interest-only strip

position remains. This security did not have any OTTI losses for which a portion remained in OCI at December 31,

2014.

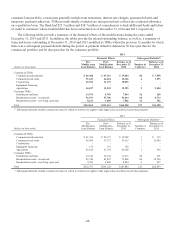

3. Loan Sales and Servicing Activity

Consumer loans held for sale primarily consist of residential mortgage loans that we originate for sale to FNMA.

These loans are sold to FNMA on a non-recourse basis, and we retain the rights to service these loans. Periodically, we

may identify certain commercial and consumer loans which we no longer intend to hold to maturity. These loans are

generally sold to non-affiliated parties on a non-recourse basis. Except for the loans originated for sale to FNMA, we do

not have any continuing involvement in the loans after their sale.

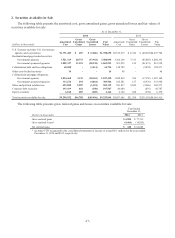

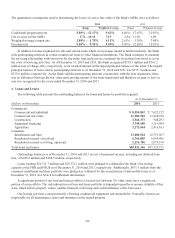

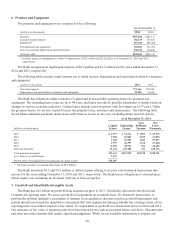

The following table summarizes the activity for the loans held for sale:

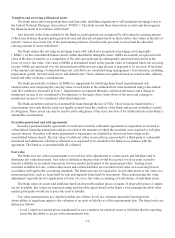

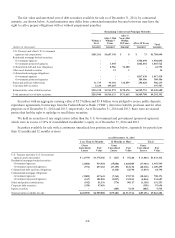

Year Ended December 31,

2014 2013

(dollars in thousands) Commercial Consumer Commercial Consumer

Loans originated for sale $ - $432,772 $ - $1,097,834

Loans transferred to held for sale(1) - 220,904 288 601

Loans sold during the year - 603,626 42,184 1,285,691

Net gains on sales of loans - 18,750 6,506 23,941

(1) Balances reflect after-transferred basis. See Note 5 for charge-offs upon transfer to held for sale.

Net gains on sales of consumer loans include forward loan sale commitments and related interest rate lock

commitments.

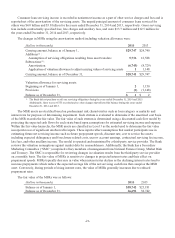

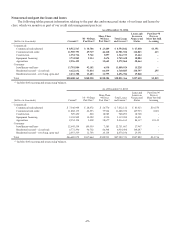

Our consumer loan servicing activities include collecting principal, interest, tax and insurance payments from

borrowers while accounting for and remitting payments to investors, taxing authorities and insurance companies. We

also monitor delinquencies and administer foreclosure proceedings.

-20-